Simplify your construction accounting software

Run your construction business with more automation, better tracking, and deeper insights from QuickBooks.

Sync your contruction accounting with apps that streamline how you track leads, schedule projects, enter expenses, and manage field service.

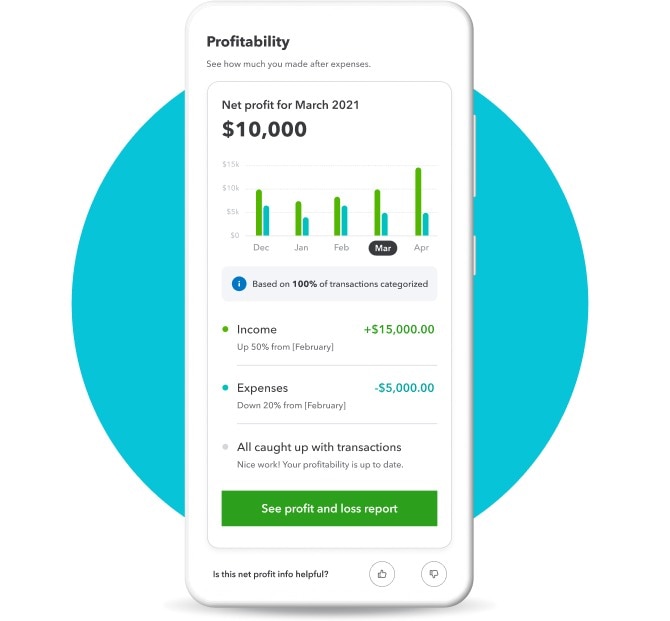

MOBILE APP

Always have your construction accounting software in reach. Track money in and out, get alerts, and run business from any device.

Plans that work for construction and contractors

Buy now and get Live Expert Assisted FREE for 30 days*

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

Call 1-800-816-4611 to get 50% off Live Expert Assisted for 3 months.*

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

Ready to get started?

Or call 1-800-365-9606

Find more of what you need with these tools, resources, and solutions.

Construction companies that track job costing manually struggle to stay profitable in this in-depth survey, jointly commissioned by QuickBooks and QuickBooks Time, (formerly TSheets).

Being a small business owner includes plenty of drudgery, especially when it comes to keeping track of the books. That’s where virtual bookkeeping comes in.