Restaurant accounting software that lets you focus on the food

QuickBooks simplifies accounting for restaurants, so there’s more time for what you love.

Sync your restaurant accounting software with apps that organize sales, employees, and back of house with less manual data entry.

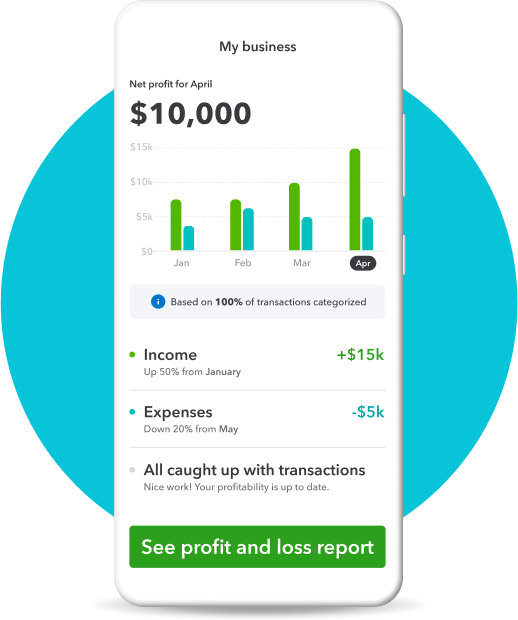

MOBILE APP

Run the financial side of your restaurant from the convenience of your phone, and automatically stay organized for tax time.

Popular plans for restaurants

Find more of what you need with these tools, resources, and solutions.

The hustle and bustle of a restaurant can make running payroll difficult. But before you get overwhelmed, let’s break down how to do payroll into a few key aspects.

Owning a restaurant can be an extremely fulfilling experience. But it also brings its own set of challenges—which is why we’ve created this guide to get you started on the right foot.