- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Taxes

Let's find out why the 1099 Vendor report is blank, DMV0808.

You'll want to make sure that you've properly set up your vendor profile so that the names will show on your report.

- Go to Vendors, then open the Vendor Center.

- Select and open the vendor's profile.

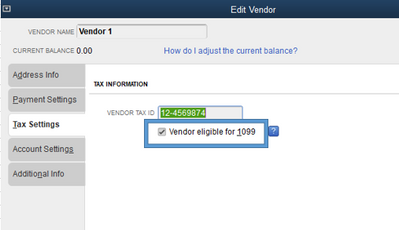

- Go to Tax settings.

- Tick the Vendor eligible for 1099 box.

- Enter their tax ID.

- Ensure other information is correct by checking it in the tabs.

- Once done, click OK.

Then, make sure to run the 1099 Wizard to verify the data, map the accounts, and prepare the form for filing. Here's how:

- Go to Vendors, then hover your mouse on Print/E-file 1099s.

- Choose 1099 Wizard.

- On the pop-up window, click the Get Started button.

- Choose your 1099 vendors, then click Continue.

- Verify their information and other details, then proceed with Continue.

- Map the accounts for 1099.

- Review the payments on the next page.

- Confirm the entries, then finalize the form by either printing or e-filing it.

However, if the report is still blank you can use the verify and rebuild data tool to fix any data issues.

Also, there are tasks you need to complete to start using the Tax 1099 E-file Service, Please read this article for your reference: 1099 E-File: QuickBooks Desktop Setup, Troubleshooting, & FAQs.

Post a comment on this thread if you have any other questions with 1099. We're always right here to help you.