Customers log on average $7,393 in mileage deductions per year with QuickBooks Self-Employed.#

Flexible plans for independent contractors and freelancers

Self-Employed

Self-Employed Tax Bundle

Explore the features

Your mileage on autopilot

Track mileage automatically with your smartphone’s GPS, then categorize trips with just a swipe. Now your business miles are in order and ready for tax time.**

Keep business and personal separate

Business and personal expenses are automatically sorted into categories, so you can track your spending and maximize tax deductions.

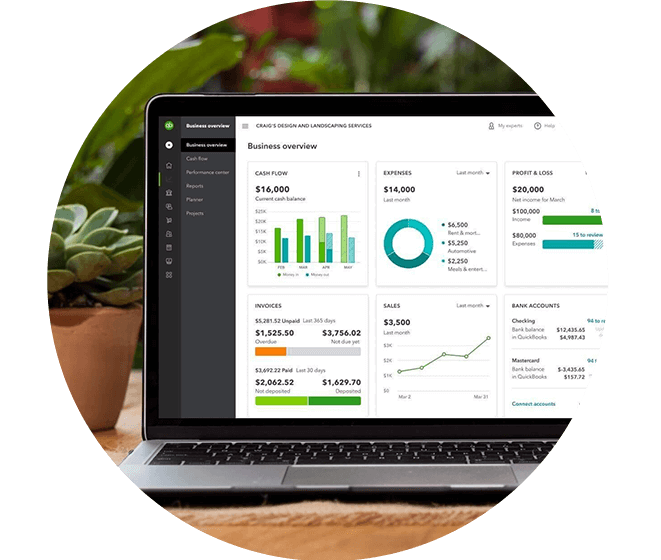

Your finances, your taxes. All in one place.

Exclusively for Schedule C filers—save time and effort by seamlessly moving from books to taxes in QuickBooks. Prepare your current tax year return with unlimited help from live tax experts, powered by TurboTax. Pay only when you file.**

Run your business anytime, anywhere

Easily track business mileage, send invoices and estimates on the go, view reports, and more—all with the QuickBooks Mobile app.**

Get setup for success – faster

Speed up your initial setup by automatically importing your spreadsheet data for instant business insights and simple bank connections.

Create goals. Then take action.

Set up business goals with target dates. We’ll suggest actions to achieve them. Then track your progress from your dashboard.

Driving for your business pays off when you log your mileage

Uber is not responsible for third party offers, products and/or service and does not provide tax advice.

Uber recommends that you seek guidance from a qualified tax service for answers to tax questions.

We have you covered with TurboTax and QuickBooks.

#Claims

- 88% of customers say QuickBooks makes it easier to run their business claim: Based on survey of existing small businesses using QuickBooks Online in U.S. conducted October 2021.

- Users find an average of $7,393 in potential mileage deductions per year claim: Mileage deductions claim: Based on TY17 US mobile subscribers that have identified >$0 in income and >$0 in business expenses.

- #1 accounting software claim: QuickBooks Online is the #1 accounting software for small business based on PCMag, as of December 2021.

- Save over 30 hours per month on average by using QuickBooks claim: Based on survey of small businesses using QuickBooks Online in U.S. conducted March 2023 who stated average savings compared with their prior solution.

- Over 100,000 5-star review claim: Based on information collected in November 2022 from the Apple App Store, Google Play Store, Capterra, Software Advice, G2.com, Inc. and QB Apps.com, in which a total of 104,570 ratings out of 143,320 were 5 stars.

- Save an average of 4% on payroll costs claim: Based on a survey of 595 QuickBooks Time and QuickBooks Payroll customers in the U.S. in January 2023. On average, businesses that report gross payroll cost savings save 4.50%.

**Product Information and Features

24/7 expert product support: 24/7 customer support is included with your paid subscription to QuickBooks Online Payroll Elite. Chat support available 24/7. U.S. based phone support is available Monday through Friday 6 AM to 6 PM PT and Saturday 6 AM to 3 PM PT. Non-US based phone support is available Monday through Friday 6 PM to 6 AM PT, on Saturday 3 PM to 6 AM PT and on Sundays. Your subscription must be current. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service, and support are subject to change without notice.

Account team benefits for Priority Circle: Only available with a paid subscription. Trial customers have access to QuickBooks Online Advanced product experts.

Annual Percentage yield: The annual percentage yield ("APY") is accurate as of November 17, 2022 and may change at our discretion at any time. The APY is applied to deposit balances within your individual Envelopes. We use the average daily balance method to calculate interest on all balances held in Envelopes. Balances held in your primary QuickBooks Checking account that are not in an Envelope will not earn interest. See Deposit Account Agreement for terms and conditions.

Auto Payroll: Available if setup for the company is complete. At least one employee has completed setup and has consistent payroll that qualifies for automation (i.e. salaried or hourly with default). Company must complete bank verification if an employee has direct deposit as the payment method, and the first payroll must run successfully. The account must not have a hold.

Automated 1099 e-file & delivery: Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Automated payroll tax payments and filings: Automated tax payments and filing available only for state and federal taxes. Enrollment in e-services is required. Local taxes require the user to print the forms and upload it to the necessary local sites. QuickBooks Online Payroll Core does not offer local tax payments and filings. Automatic filings for state new hire paperwork available in QuickBooks Online Payroll Premium and Elite only.

Automatic data backup and recovery: QuickBooks Online uses technical and administrative security measures such as, but not limited to, firewalls, encryption techniques, and authentication procedures, among others, to work to maintain the security of your online session and information.

Collaborate with your accountant: You can connect up to the following for each product: 1 billable user and 2 accounting firms for QuickBooks Online Simple Start, 3 billable users and 2 accounting firms for QuickBooks Online Essentials, 5 billable users and 2 accounting firms for QuickBooks Online Plus, 25 billable users and 3 accounting firms for QuickBooks Online Advanced. Accounting firms must connect using QuickBooks Online Accountant.

CPAs when you need to talk: 100% of TurboTax Live experts are CPAs, EAs, or Tax Attorneys.

Envelopes: You can create up to 9 Envelopes within your primary QuickBooks Checking account. Money in Envelopes must be moved to the available balance in your primary QuickBooks Checking account before it can be used. Envelopes within your primary QuickBooks Checking account will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be credited to each Envelope in proportion to the average daily balance of each Envelope.

Expert setup: Available to QuickBooks Online Payroll Elite users only.

Guideline 401(k): 401(k) offerings are provided and administered by Guideline, an independent third party and not provided by Intuit. Intuit is not a 401(k) plan administrator, fiduciary or other provider. Requires acceptance of Guideline's Client Relationship Summary and Privacy Policy. Additional 401(k) plan fees will apply. Employees may manage their contributions directly with Guideline. Admin and payroll access required to sign up for a 401(k) plan with Guideline.

Health benefits: Health Insurance benefits are provided by Intuit Insurance Services Inc., a licensed insurance broker, through a partnership with Allstate Health Solutions. Requires acceptance of Allstate's Terms of use and privacy policy. Intuit Insurance Services is owned and operated by Intuit Inc. and is paid a percentage fee of insurance policy premiums by Allstate Health Solutions in connection with the services described on this page.

HR services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service . HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Mobile signatures: Requires QuickBooks Online mobile application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses

Overtime alerts: Automated overtime identifies potentially incorrect overtime hours based on current laws and regulations; business owners have full control and can decline this suggestion in product. Compliance with application laws is the responsibility of the business. This feature is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

Payments Dispute Protection: Payments Dispute Protection ("PDP") is an additional service that covers you for certain payment disputes (i.e. "chargebacks") that your customer initiates through its card issuer associated with a credit or debit card transaction on the American Express, Discover, Mastercard or Visa networks and are processed by QuickBooks Payments while you are enrolled in PDP. You must be enrolled in PDP when both the customer's payment is processed and payment dispute is initiated to receive coverage. Payment disputes covered by PDP are subject to a per-payment dispute coverage limit of $10,000 with a total annual coverage limit of $25,000 for all payment disputes received on a rolling 365-day period. Payment disputes related to transactions processed by QuickBooks Payments prior to 3 PM PT on your enrollment day will not be covered if you enrolled in PDP after 3 PM PT. The PDP service fee ranges from .99% to 1.99%, based on eligibility criteria. Terms, conditions, and service fee subject to change without notice.

Priority Circle: Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A. Inc. Green Dot Bank operates under the following registered trade names: GoBank, Green Dot Bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Account funds are FDIC-insured up to the allowable limits upon verification of Cardholder’s identity. Visa is a registered trademark of Visa International Service Association. Green Dot is a registered trademark of Green Dot Corporation. ©2020 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, next-day deposit are not provided by Green Dot Bank.

QuickBooks Online System Requirements: QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). Network fees may apply.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit and application approval. Subscription to QuickBooks Online is required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Payments and QuickBooks Checking accounts: Users must apply for both QuickBooks Payments and QuickBooks Checking accounts when bundled. QuickBooks Payments’ Merchant Agreement and QuickBooks Checking account’s Deposit Account Agreement apply.

QuickBooks Self-Employed System Requirements: QuickBooks Self-Employed, Self-Employed Tax Bundle, and Self-Employed Live Tax bundle require a persistent internet connection (a high-speed connection is recommended) and a computer with a supported Internet browser or a mobile phone with a supported operating system (see System Requirements). Network fees may apply. Subscriptions will be charged to your credit card through your account. QuickBooks Online Payroll is not available with QuickBooks Self-Employed.

QuickBooks Self-Employed Tax Bundle: Bundle includes the cost for only one state and one federal tax filing. Each additional TurboTax Self-Employed federal tax filing is $119.99 and state tax filing is $44.99. Each additional TurboTax Live Self-Employed federal tax filing is $199.99 and includes live on screen tax advice from a CPA or EA, and state tax filing is $44.99.

QuickBooks Time tracking: Additional fees may apply. Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Receipt capture: Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Same-day direct deposit: Available to QuickBooks Online Payroll Premium and Elite users only. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Available only for employees, not available for contractors.

Tax penalty protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. Only QuickBooks Online Payroll Elite users are eligible to receive tax penalty protection.

Third party apps: Third party applications available on apps.com. Subject to additional terms, conditions, and fees.

Track project progress: Available in QuickBooks Time Elite only.

Project estimates vs actuals reporting: Available in QuickBooks Time Elite only.

Workers’ comp administration: Benefits are powered by NEXT Insurance and require acceptance of NEXT Insurance's Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by NEXT Insurance. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.