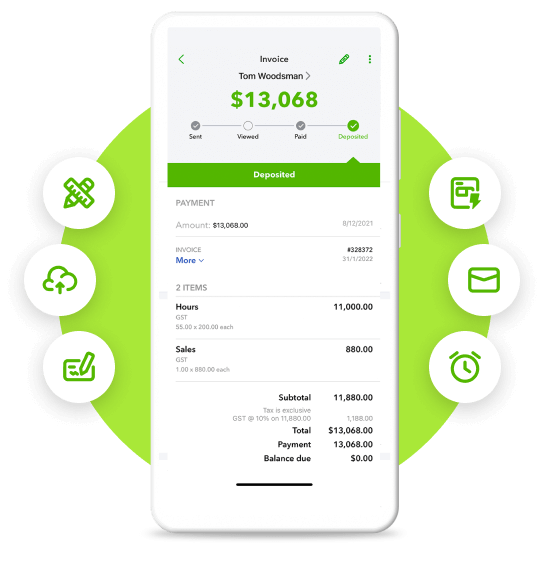

Whether you’re a freelancer or a small business owner in the United Arab Emirates (UAE), you can download a free invoice template for your specific needs. You can create and send professional invoices as a PDF, in Excel or as Google sheets, and in Microsoft Word or Google docs.

Get tips on what to include according to what you do and how to use professional Invoicing Software to get paid fast either through online payments or credit cards.