While it would be nice to know we could rely on our businesses to be flourishing money trees, there are those times when they bear no fruit. Despite our consistent efforts to produce, there are times when no money comes in. That’s why, just like a tree, a business needs to bring cash in and let cash out in order to survive and grow strong. That movement of cash coming in and going out is known as your business’ cash flow.

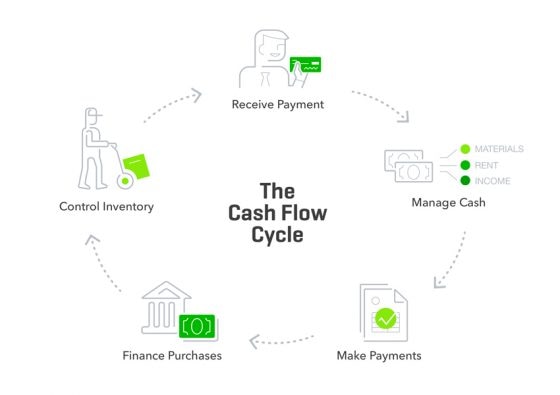

As a business owner, you will realize that cash flow is cyclical. Cash flow is one of the many factors involved that influences the results of your company. In fact, cash flow is one of the most important aspects to understand in order to sustain your business.