Whether you bill your clients daily, weekly, or monthly, invoicing can be a chore. Most small business owners spend countless hours per month on administrative tasks, like creating invoices. However, by using accounting software, you can speed up the invoicing process exponentially. On average, QuickBooks users get paid two times faster. Read more to understand how to master the art of creating an invoice (aka the art of getting paid).

How QuickBooks Invoicing Software can Save you Time and Money

Why Are Invoices Important?

The backbone of any business is capital, so getting paid on time is essential. Think of your invoice as a type of insurance policy for client payments. It doesn’t guarantee you’ll get paid, but it does establish that goods or services were delivered and your right to payment. It doesn’t happen all the time, but if a customer or client fails to pay, you can use the contract and subsequent invoice(s) as evidence your clients owe you for the items provided. On the same token, you can store invoices you’ve received from your contractors or vendors after you’ve remitted payment to show that you’ve met your obligations.

The Advantages of Invoicing Software

QuickBooks invoicing app helps you get paid fast and do a lot more.

- Are you tired of chasing clients to pay your invoices? QuickBooks invoicing software automatically sends reminders to your customers, alerting them when payment is due. You’ll also get instant notifications when customers view and pay invoices.

- Send your invoices to clients on the go—wherever you are, whenever you want. Whether you’re at the job site, the office or dinner, take care of business securely and quickly with the QuickBooks mobile app.

- Give your clients new ways to pay. The QuickBooks app allows you to accept payments via credit card right within its invoicing app, making it easier for clients to pay you.

- Stay organized for tax time. QuickBooks automatically calculate sales tax on your invoices and records the amount.

- Monitor your cash flow in one place: QuickBooks automatically tracks deposits into your account so that you can get an accurate and holistic overview of your cash flow. The app also allows tracks expenses allowing you to see how your business is performing on your dashboard instantly.

- Send professional invoices using our various invoice templates and then add your logo and accent colors to make it your own.

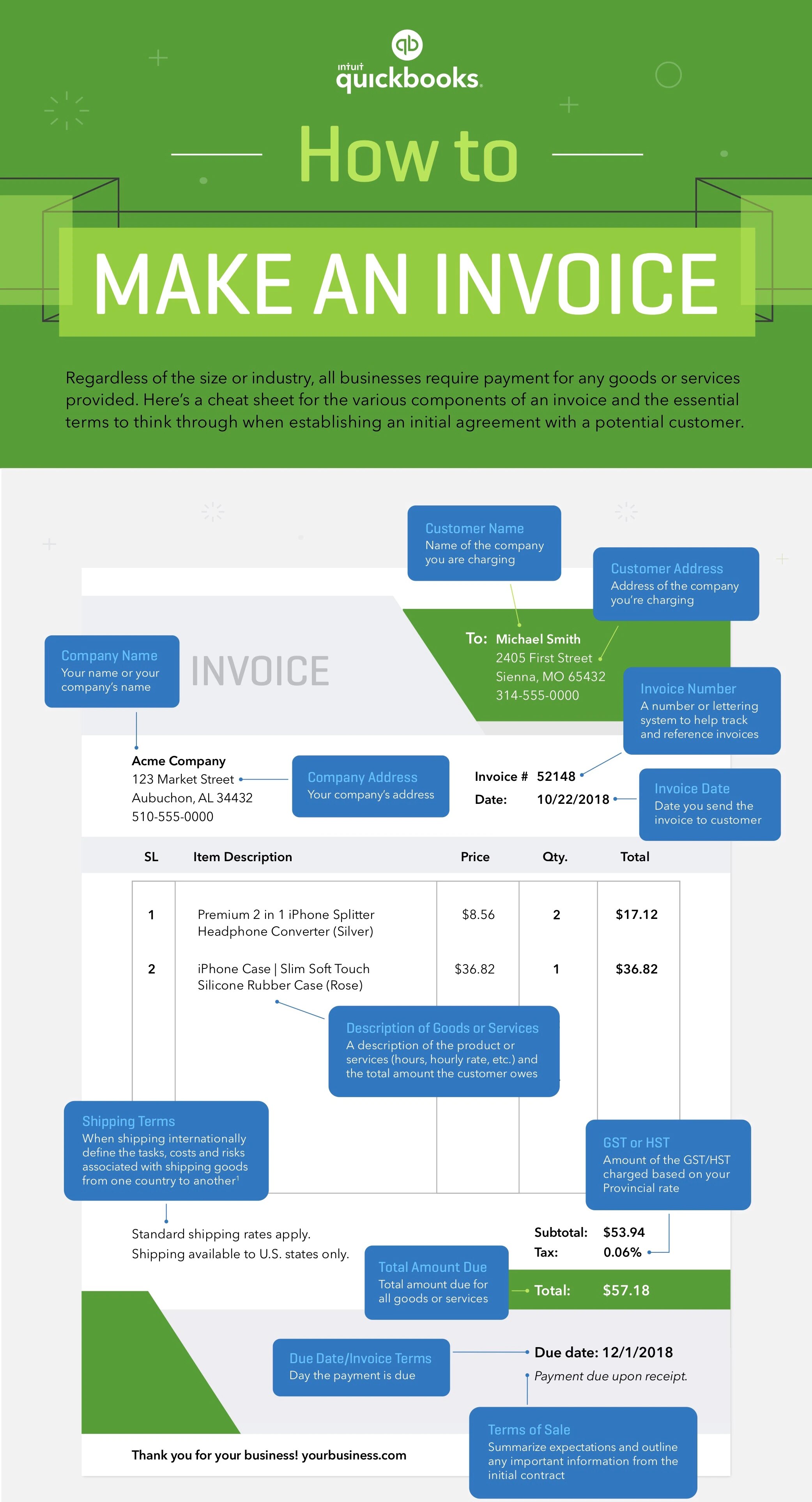

How to Make an Invoice

It’s crucial that your invoice contains accurate and thorough information as Singapore invoice templates require certain information for them to be legal. This information will come in handy if you have to collect sales tax from purchases and pay small-business taxes on your income.

Ready to create an invoice? Read our guide below to discover the information required to create an invoice.

In summary, when creating an invoice, be sure to include the following information:

- At the top, identify your business with the name, logo, and contact information.

- Below that, show the customer’s name and contact information.

- Highlight the date and invoice number for easy tracking, for both you and the customer.

- On separate lines in a grid-like pattern, itemize the goods or services rendered and pair them with a column on the right showing the charges for each.

- At the bottom, total the charges and indicate when they are due.

Should Your Business Charge Late Fees for Delinquent Invoices?

While it’s tempting to slap late fees on an invoice that’s been sitting unpaid, be careful. You can only charge late fees or interest if the original contract for products and services allows it. Make sure when you draw up your agreement that you specify the number of late fees that can be charged (usually a percentage of the outstanding balance accruing monthly), and mention the time frame governing late fees as well. Even if you’re legally allowed to charge them late fees, you may find you get paid quicker if you offer the customer incentives for paying (such as a discount if payment is received within a short time frame), rather than threatening the penalty of late fees.

Alternatives to Charging Late Fees

Charging late fees isn’t the only way to deal with delinquent accounts. By organizing your collection process and assigning an employee as a point person to reach out to late customers, you may be able to make payment arrangements. Create a script to help your collection representatives be consistent and make sure they document every contact with the customer. Invoicing software programs like QuickBooks can also send automatic reminders.

Another positive step to avoid late fees is to establish invoicing procedures ahead of time that takes into consideration the possibility of late payments. Consider offering incentives for early payment, and offer payment plans upfront. You might demand 50% of your fee before you start on a new project, invoicing for the remainder when you deliver. Be clear from the beginning about your invoicing procedures, so your customer knows exactly what’s expected.\

Assessing late fees isn’t always the best possible choice when you’re trying to get paid on a delinquent invoice. Establish payment protocols and procedures ahead of time.

Pro tip: Use QuickBook’s invoicing software to see when clients have viewed your invoice, and automatically remind customers when payment is due.

Try United Arab Emirates’s Top Invoice Generator

Invoicing doesn’t need to be a tedious task. Using invoicing software can help you send professional, smart invoices to clients in mere minutes. Join over 5.6 million small business owners on QuickBooks to get paid faster using our invoicing technology. Manage your invoices online, and more with QuickBooks. The app is available on iOS and Android.