Learn about QuickBooks PCI Compliance

by Intuit• Updated 6 months ago

Learn about the QuickBooks Payment Card Industry Data Security Standard (PCI DSS) compliance.

As a merchant accepting cards for payment, you need to have payment security throughout your local environment. This includes all applications and systems on your local network.

Frequently asked questions

Know the tools and services included in the QuickBooks PCI Service

QuickBooks PCI tools and services

| LAYERS OF PROTECTION | DATA SECURITY BENEFITS | DESCRIPTION |

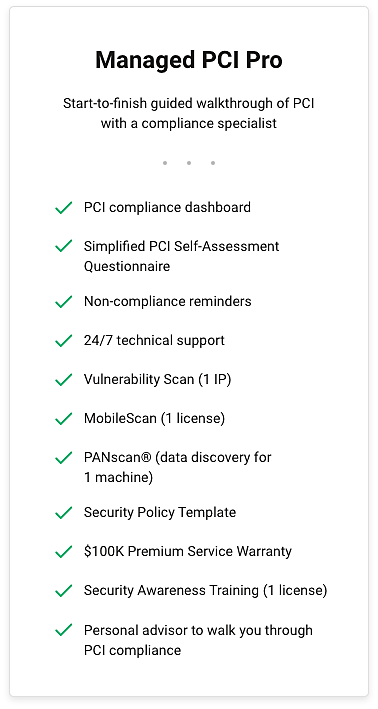

| Security Awareness Training | Educates you about common cyber threats | Intuit has partnered with SecurityMetrics to provide easy-to-understand security awareness training that will help protect your digital assets against common threats such as phishing scams and keylogging malware attacks. |

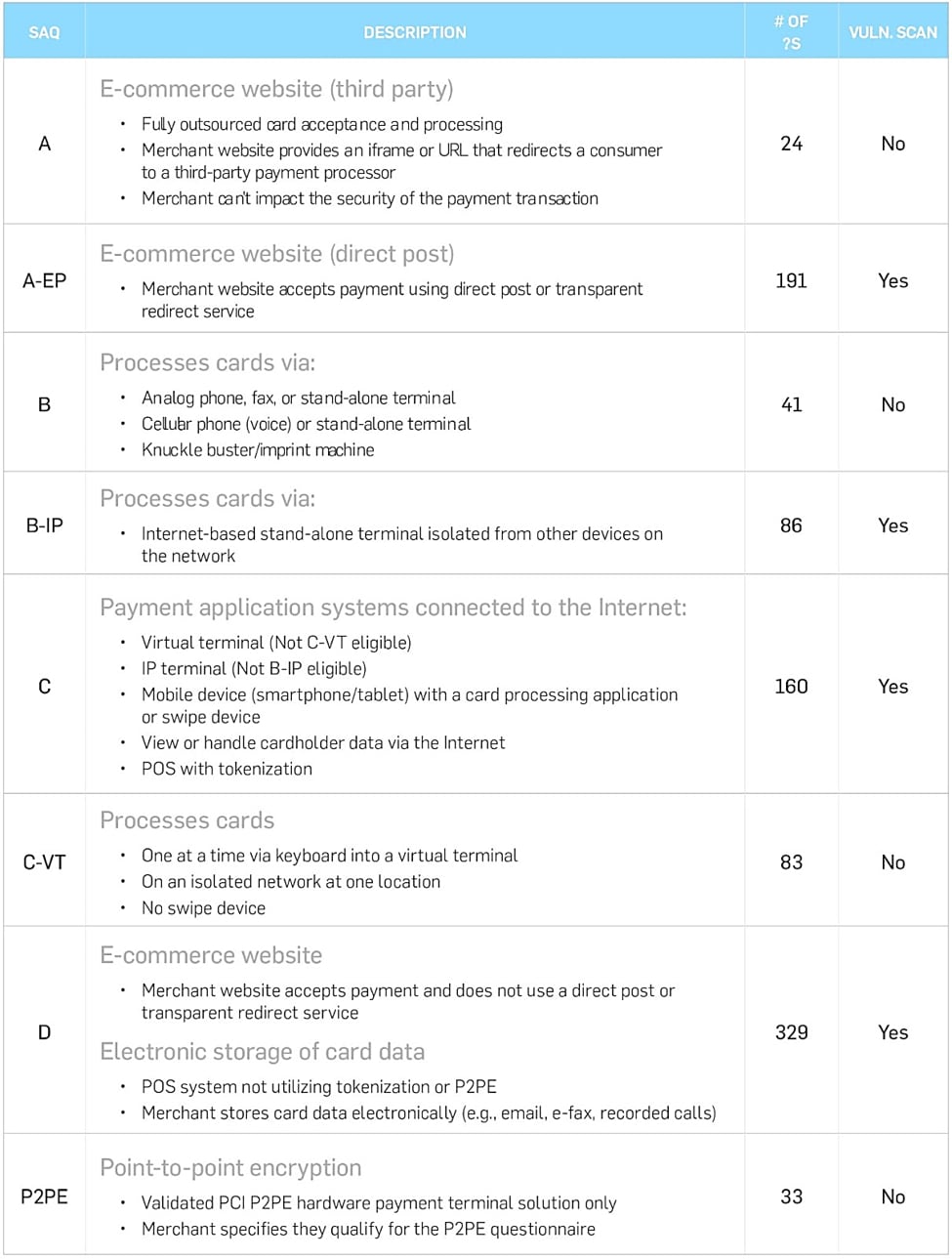

| Threat Prevention Tools | Simplifies your PCI compliance | Use threat prevention tools to simplify your PCI compliance process and better defend your customer card data. Vulnerability scans, mobile scans, and SecurityMetric PANscans make it easier to identify unencrypted card data and prevent a breach. |

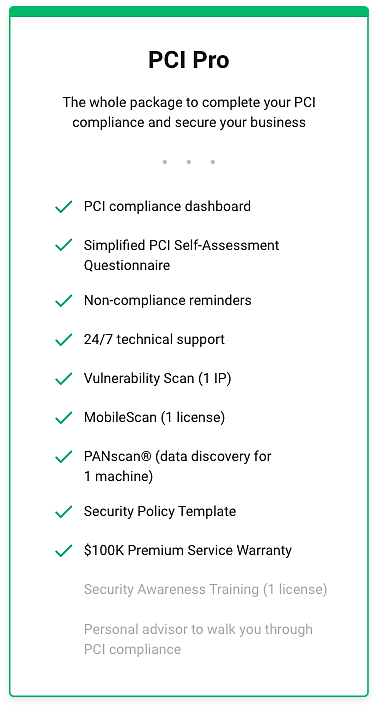

| Card Data Breach Protection | Protects you with a $100,000 Premium Service Warranty | Your PCI service provides up to $100,000 premium service warranty. To qualify for this benefit, you need to enroll in the program and be up-to-date on service fees. |

Turn on PCI Service

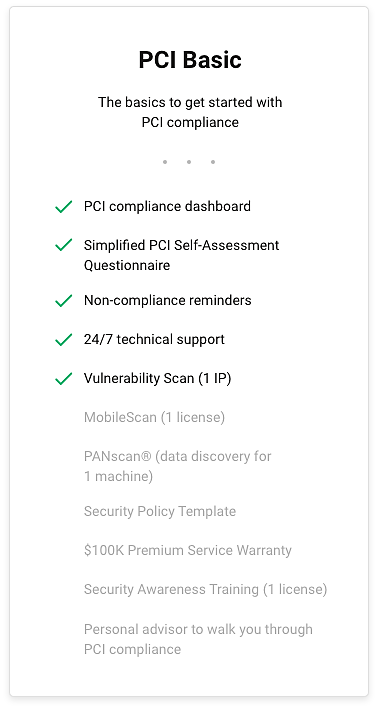

If PCI Services is unavailable on your account, upgrade your pricing plan or add it to your current plan. Create an account with SecurityMetrics and complete FastPass, then they’ll present different PCI packages to fit your financial and security needs.

Exceptions may apply to non-standard plans. Visit our website or the PCI Security Standards website for more information.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Contact QuickBooks products and services supportby QuickBooks•897•Updated 1 month ago

- Manage billing, payment, and subscription info in QuickBooks Onlineby QuickBooks•5246•Updated 1 week ago

- QuickBooks Data Services FAQby QuickBooks•202•Updated 3 weeks ago

- Learn about the PCI DSS Compliance Servicesby QuickBooks•47•Updated 6 days ago