Using the FX module in Pro Tax

by Intuit•4• Updated a day ago

Pro Tax has a FX (forms expert) module that lets you file and prepare federal information slips and summaries online. This includes:

- T4 (Remuneration Paid)

- T4A (Pension, Retirement, Annuity, and Other Income)

- T5 (Investment Income)

- NR4 (Non-Resident Tax Withholding, Remitting, and Reporting)

ProTax includes info returns, like the T3010 Information Return for Registered Charities. For a full list of available forms and slips, go here.

In this article, you'll learn about:

Table of contents:

You can review our video demonstrating the QBOA Pro Tax FX module below:

Some features of the FX module include:

- Unlimited electronic XML and paper filing

- File searchability

- The ability to import your T4 client data directly from your Excel file

- A Live auditor with all diagnostic messages built in

- Form search

- A Quick mode that saves bandwidth and speeds Pro Tax performance

- All common features available in T1, T2 and T3

Transmitter settings

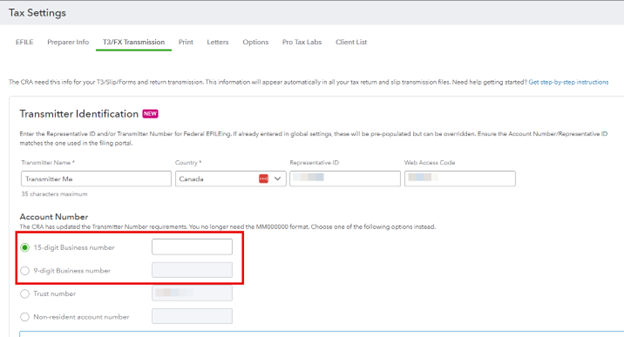

The CRA has updated transmitter requirements. You should no longer enter a transmitter number in the format of MM followed by 6 digits.

Note: You’ll need to enter filing credentials (RepID or Transmitter Number) depending on which of the three submission methods you choose (RAC, MyBA, WAC).

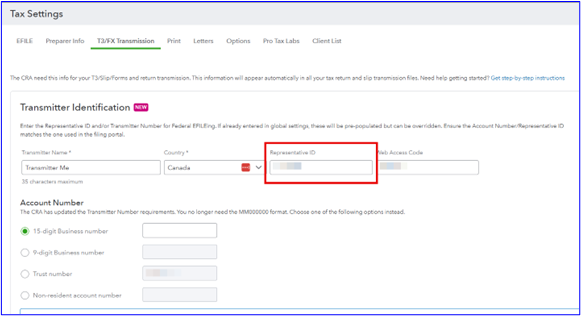

To locate these settings, follow these instructions:

- Open Pro Tax.

- Go to Tax Settings.

- Select the T3/FX Transmission tab

Note: customers can use either a WAC number to file with the above information or a RepID if they’re filing as a preparer (more explanation is available in the “Enter filing credentials” below)

Tax slips can be submitted to the CRA three different ways (RAC, MyBA, WAC).

Examples of business numbers for purposes of filing

Note: The business number used for filing should contain 9 numbers, followed by two letters (RP for Payroll Account Number, as an example), followed by four numbers, 0001 (most common), 0002, or 0003.

| Slip type | Business number |

| T4A | Payer's Account Number: Required, 15 alphanumeric, 9 digits RP 4 digits, example: 000000000RP0001 |

| T5 | Account Number: Required, 15 alphanumeric, 9 digits RZ 4 digits, example: 000000000RZ0001 |

| T4 | Payroll Account Number: Required, 15 alphanumeric, 9 digits RP 4 digits, example: 000000000RP0001 |

- If you file different types of slips, you will need to change the business number in Tax Settings when filing a different slip type than the last.

- You will need a different WAC for each business number of a client. The WAC for a RP filing (T4/T4A) will be different than the WAC for the RZ filing (T5).

Represent a Client (RAC)

When filing federal slips through your Represent a Client portal, you will only need to provide your RepID in the T3/FX Transmission tab. The XML file will omit the Transmitter BN field and contain the other required information to submit the slip successfully.

My Business Account (MyBA)

If you’re new to filing via your My Business Account, the CRA has an article on how to submit this way in the General Recommendations section of the Internet File Transfer (IFT) Reference Guide.

Under the T3/FX Transmission tab, enter either the BN15 or BN9 that'll be used to access MyBA. Depending on what type of slips you’re filing, will determine which format of Business Number you use as described below in the Examples of Business Numbers for the Purposes of Filing.

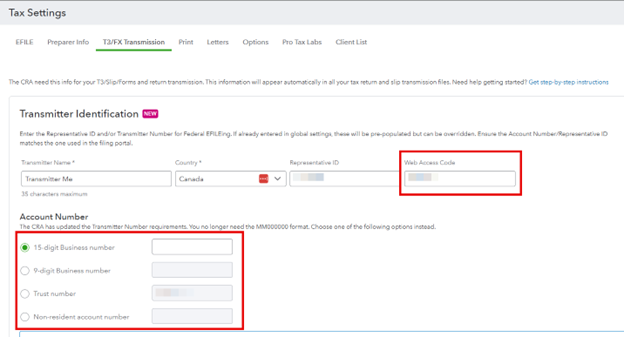

Internet file transfer using WAC

Your firm can request a WAC code. If you have a WAC code for your firm, enter your 15-digit Business Number and WAC code in the T3/FX Transmission tab. This allows you to to file for all your clients through CRA’s Internet File Transfer system.

If you are an internal accountant or have limited companies you are filing for, you can change the information in this section to be the client’s 15-digit Business Number, Trust Number, or Non-resident Account Number. The WAC code is optional in these settings and for your own records.

Creating slips

- Select Create new.

- A window opens prompting you to select which slips or forms you want to complete.

- Select your tax year.

- Select your client.

- Enter a name for your return.

Note: Carryforward is currently not possible in the FX module.

Import T4 data from Excel

- Create a new return.

- Under Actions, select Import T4.

- Choose your file.

- Map your own fields based on your Excel file. For example, you may have chosen to use Last Name instead of Surname, or vice versa. You may also leave fields empty if they don't apply to your file.

- Select Next.

- Confirm that all your slips were imported correctly.

Import returns from ProFile

- From the FX dashboard, select Import returns.

- Import the returns from ProFile.

Importing from other tax suppliers? Take advantage of our assisted onboarding to help you migrate your files to Pro Tax.

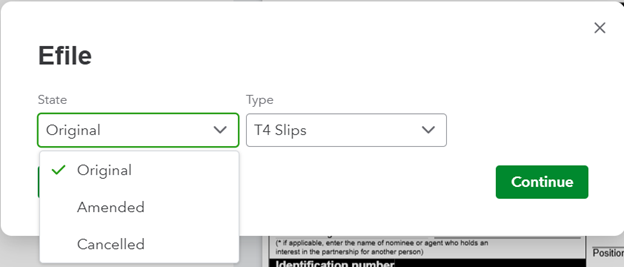

Transmit original, amended, or cancelled Federal slips

Note: Slip filing is supported in Pro Tax for 2023 onwards.

Once you have completed and reviewed your forms, you are ready to file.

- Select Transmit. If applicable, the auditor will inform you of any outstanding messages before you can submit your return.

- Select Transmit, and then select Slips.

- A window appears allowing you to select the slips you wish to transmit:

- Original: The first version of the slips sent to the CRA

- Amended: subsequent versions of the original slips with corrections

- Cancelled: Slips already sent that you no longer wish to be processed by the CRA

- Select Continue.

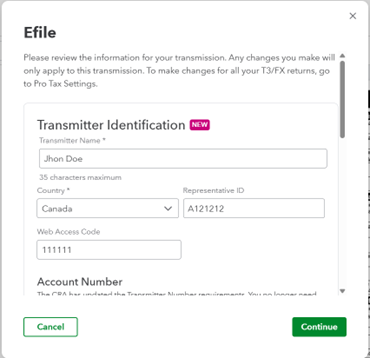

- The next window gives you a chance to review your transmitter identification. If the information is incorrect, you can make changes directly on this window or in Tax settings.

- If the changes are made directly on this window, the changes apply for one time only for this XML generation. Future XML generations will continue to use transmitter information from Tax Settings.

- Select Continue.

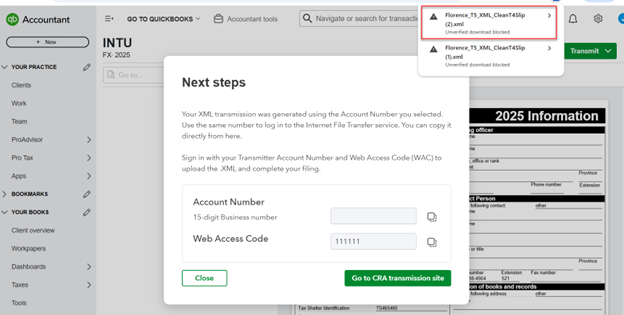

- Pro Tax builds the XML. A copy of the file is automatically downloaded to your computer

- If you have entered a 15-digit Account number and/or Web Access Code in Tax Settings, they will be displayed. You can copy it from here and use it to sign in at the CRA’s Internet File Transfer site.

- If you are submitting the XML to CRA using Represent a Client (RAC) or My Business Account (MyBA), you can close this EFILE session and continue with the XML file submission on CRA’s RAC or MyBA pages.

- Select Go to CRA transmission site.

- Follow CRA’s instructions to upload the XML.

- Review the T619 verification page, and then select Submit.

The XML file will be transmitted to the CRA. We recommend printing the confirmation you receive.

Note: The transmission isn't complete until you follow the instructions on the CRA website. Pro Tax doesn't automatically transmit forms or slips. The CRA says you must use their online portal to sign in with your information and upload the XML file that Pro Tax made.

Note: Due to changes in CRA requirements, the account number must be manually entered. It must match the number used to build the XML file in the Tax Settings

Available FX slips and forms in Pro Tax

You can review our list of slips and forms available for FX in Pro Tax.

More like this

- Introducing Pro Tax bundlesby QuickBooks

- Printing a Return or Slips in Pro Taxby QuickBooks

- Slips and forms currently available in Pro Tax FXby QuickBooks

- Pro Tax release notesby QuickBooks