QuickBooks Online Accountant Pro Tax carry forward

by Intuit•2• Updated 1 year ago

Carry forward is a service that allows existing client information from previous year’s returns to be carried forward into a new return, saving time and effort for tax preparers. The carry forward process imports personal information such as names and street addresses, plus detailed tax information such as Undepreciated Capital Cost (UCC), unused RRSP deductions, and so on.

Users can carry forward the previous year’s return or a return prepared using a competitor’s product.

- Select your module in Pro Tax.

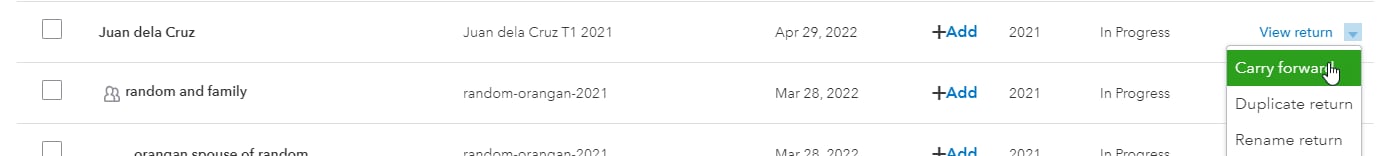

- Find the return you want to carry forward.

- Navigate to the View return dropdown in the Action column and select Carry forward:

Frequently asked questions

Is batch carry forward supported?

Yes, in Pro Tax you have the ability to select and carry forward multiple returns. ProFile and TaxCycle allow for the upload of multiple returns at once for carry forward.

When will other supplier carry forward be supported?

You can now carry forward data from more third-party tax software in Canada including Cantax, TurboTax Desktop, DT Max, and TaxPrep. Learn how.

What tax years are supported for carry forward?

Review supported tax years in this FAQ. Carry forward is only supported for these tax years.

Is a carry forward summary available in Pro Tax?

Not at this time.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this