Make adjustments when you import past Etsy transactions in QuickBooks Online

by Intuit•13• Updated a day ago

Learn what to do if you import Etsy transactions that are already in your books in QuickBooks Online.

If you set up the Sync with Etsy app and choose an import start date from the past, the app may enter Etsy transactions that are already in your books. Here we’ll step through an example of how you can make adjustments so your accounting stays accurate.

As always, if you’re not sure what to do, reach out to your accountant. If you don't have one, we can help you find a ProAdvisor.

For a better experience, open this article in QuickBooks Online. Launch side-by-side view

Example of adjusting your books

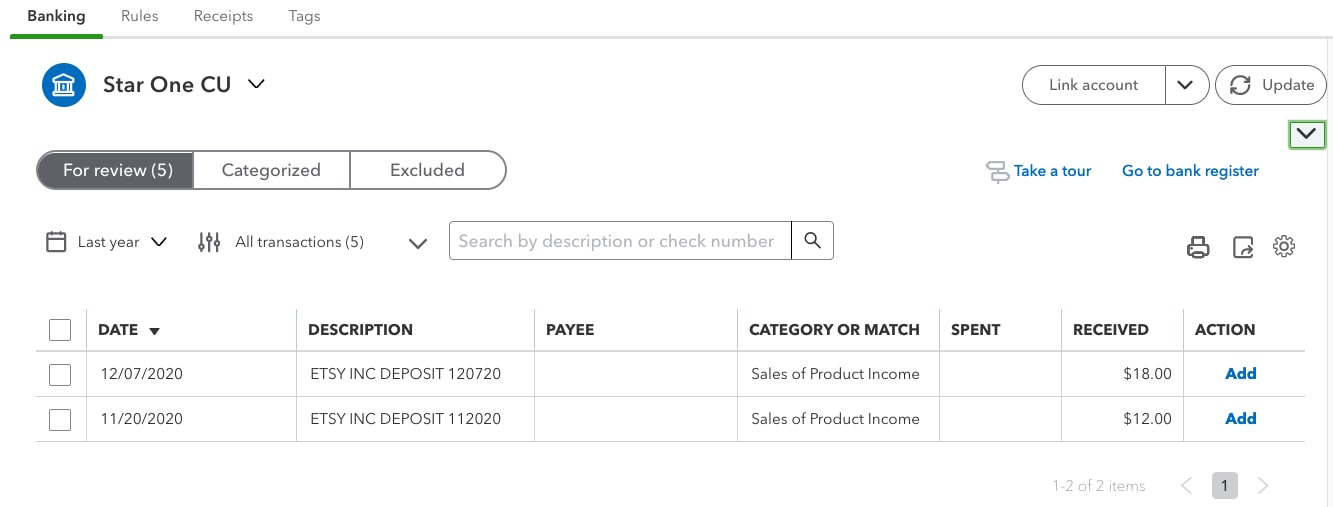

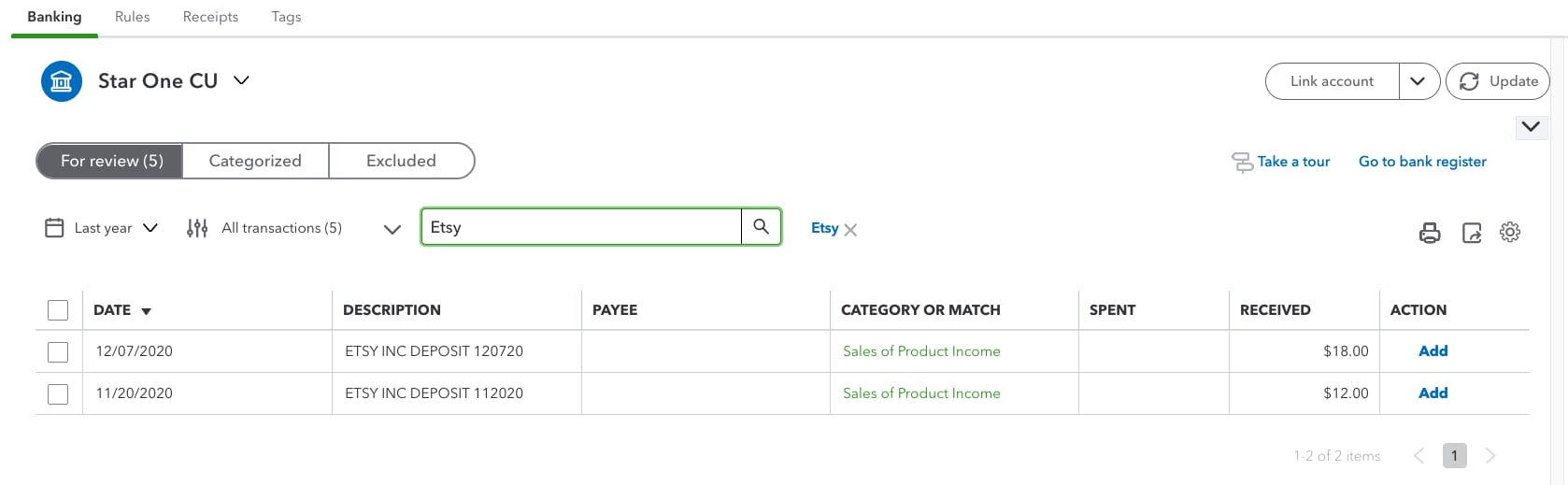

On December 14 (before you have the Sync with Etsy app), you download transactions from your bank account into QuickBooks.

In your QuickBooks bank feed, you see two deposits from Etsy for sales you made. These are net deposits after Etsy charges fees.

You add these transactions to the income account Sales of Product Income.

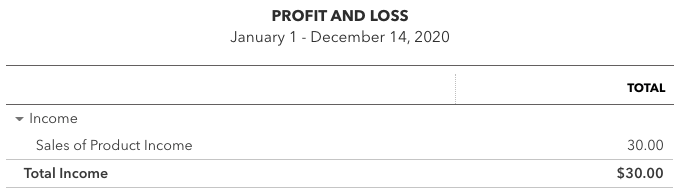

When you run your Profit and Loss report, the transactions are counted in your Sales of Product Income total:

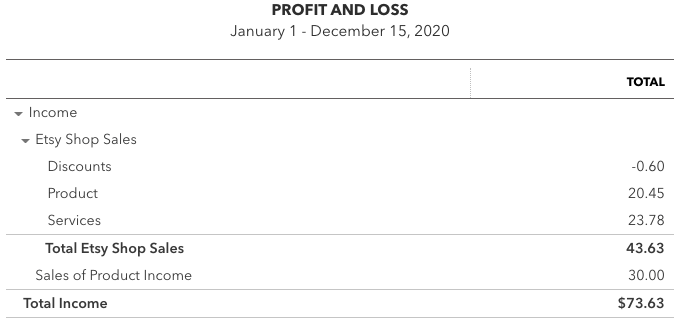

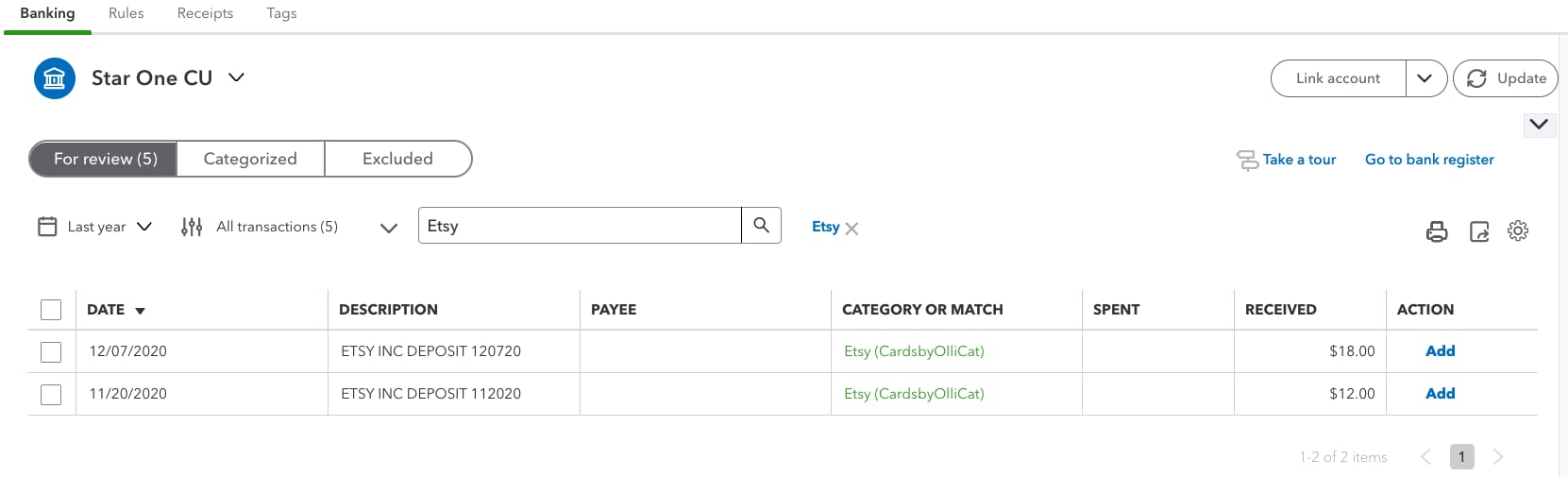

On December 15, you get the Sync with Etsy app and choose to import past transactions going back to January 1. The app enters all sales transactions from that time period to the income account Etsy Shop Sales.

Here’s how your Profit and Loss report appears now:

Total Etsy Shop Sales ($43.63) is from the sales transactions the app imported. It includes income from products you sold, income from services you provided like shipping and gift wrap, and discounts you gave.

Your Total Income ($73.63) is now overstated by $30.00 because the Etsy Shop Sales amounts include the $30.00 of transactions you added from your bank feed to Sales of Product Income.

In this case, here are a couple of ways to adjust your books so these transactions aren’t counted twice.

Option 1: Recategorize the deposits from your bank feed

You can change the category of the bank deposits to the same account used by the Sync with Etsy app so they’re not counted twice.

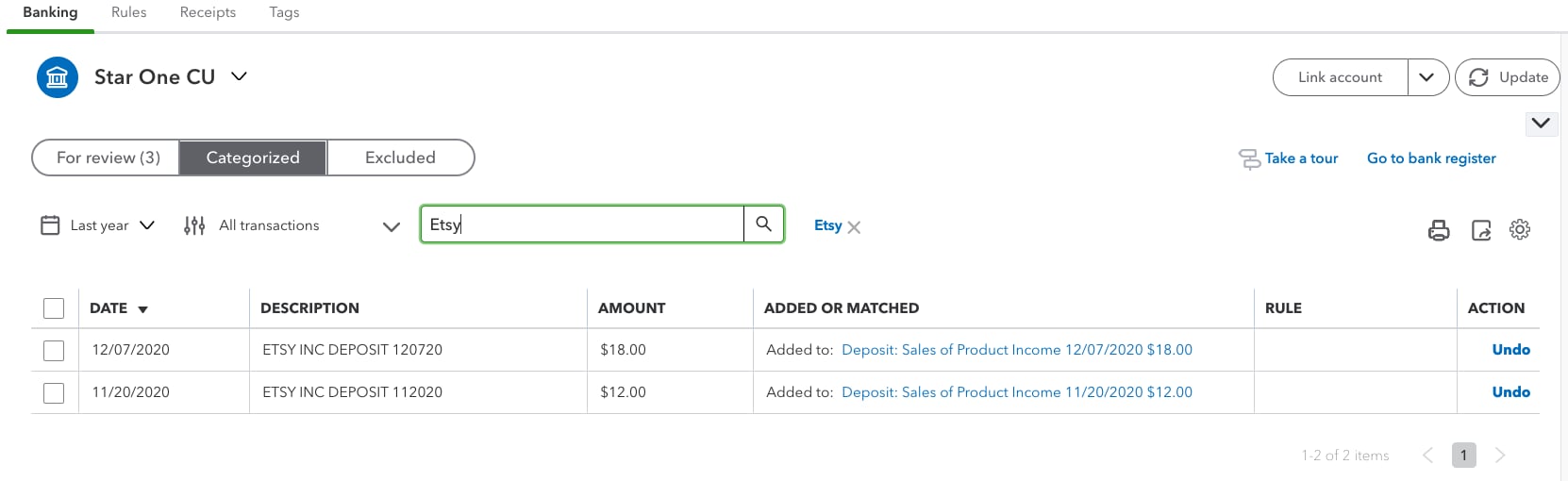

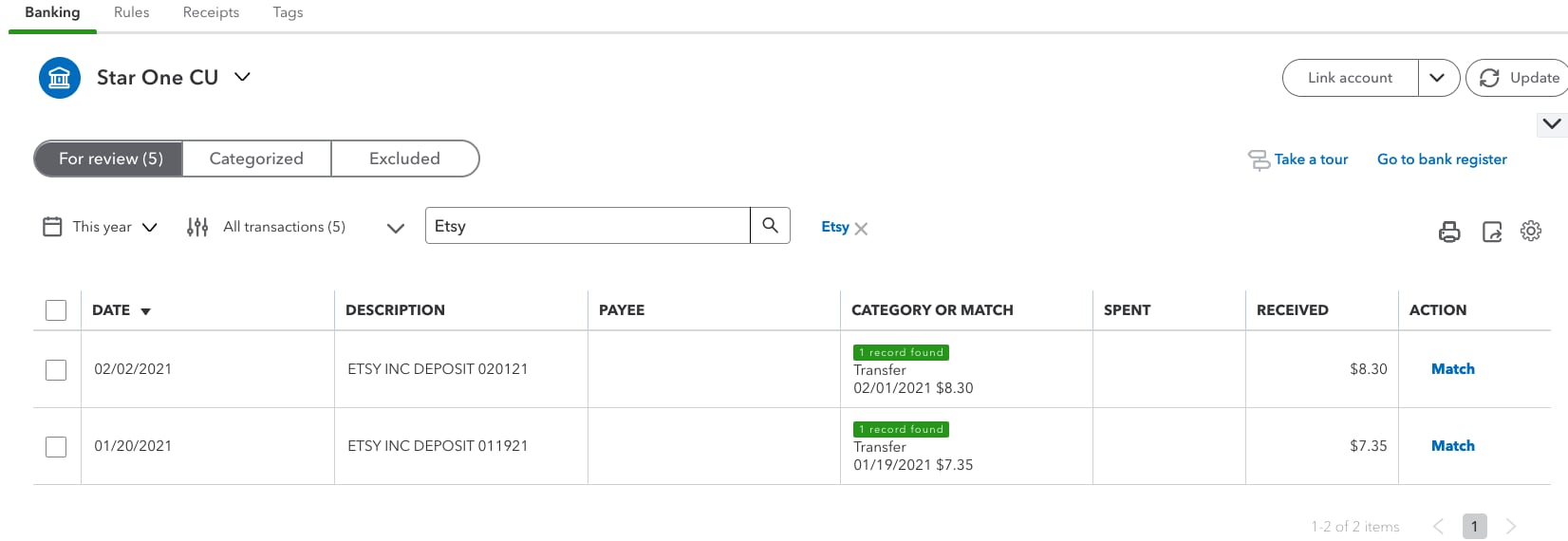

Go to Banking and select the bank feed for your Etsy deposits. Then select the Categorized tab and search for “Etsy” to find the deposits you added to Sales of Product Income. In the Action column, select Undo for each deposit. Then select the For review tab and search for “Etsy” to find them again.

In the Action column, select Undo for each deposit. Then select the For review tab and search for “Etsy” to find them again. For each transaction, select the “Sales of Product Income” category and change it to “Etsy

For each transaction, select the “Sales of Product Income” category and change it to “Etsy

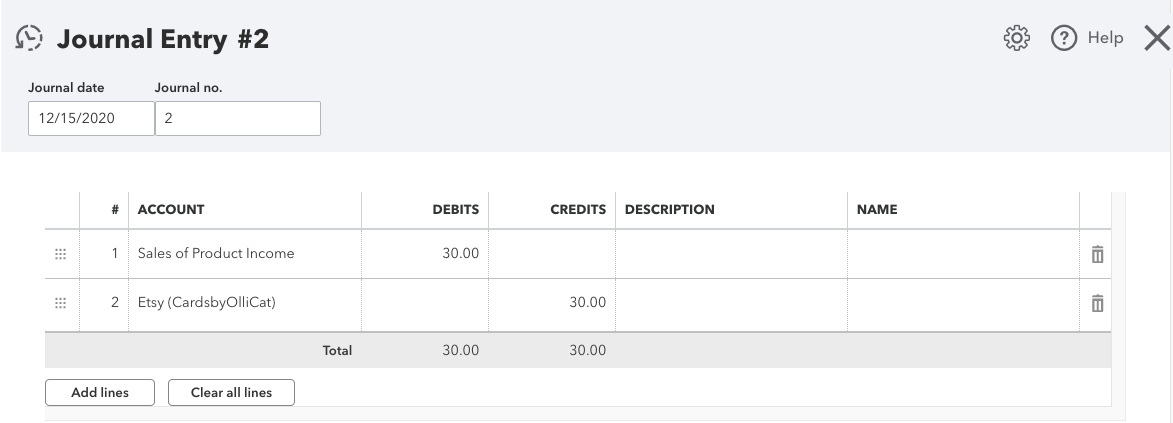

Option 2: Create a journal entry

You can create a journal entry to adjust the income. This will force your books to balance so the same income isn’t counted twice.

If you need help with journal entries, you can work with QuickBooks Live Experts and feel more confident. Find out more about QuickBooks Live Bookkeeping.

If you need help with journal entries, you can work with QuickBooks Live Experts and feel more confident. Find out more about QuickBooks Live Bookkeeping.

In this example, you would debit the income account Sales of Product Income $30.00 and credit the bank account “Etsy (Cardsby OlliCat)” $30.00.

How the app handles new transactions

Remember, you only need to make adjustments if the Sync with Etsy app imports past transactions that are already in your books. When the app imports new transactions, it automatically creates transfers that match to deposits or charges to your bank or credit card account. This helps prevent transactions from being counted twice and your income or expenses from being overstated.

More like this