Record your total daily sales

by Intuit•199• Updated a day ago

Find out how to record your total daily sales in QuickBooks Online using a single sales receipt.

Check out QuickBooks Payments rates and apply. Then, you can automatically process payments, deposit funds and record transactions in your books.

Check out QuickBooks Payments rates and apply. Then, you can automatically process payments, deposit funds and record transactions in your books.

You can enter a single sales receipt to report the total daily sales in QuickBooks if you use a separate point of sale system. Or if you simply don't invoice customers. This saves you time, while still keeping your income reports accurate.

For a better experience, open this article in QuickBooks Online. Launch side-by-side view

Here's a step-by-step guide to help you get you started.

Step 1: Create a customer for daily sales

You'll only use this customer account on your "end of day" sales receipt.

- Go to All apps

, then Customer Hub, then Customers (Take me there).

, then Customer Hub, then Customers (Take me there). - Select New customer.

- Enter "Daily Sales".

- Select Save.

Step 2: Set up accounts for daily sales

Make sure your Daily Sales accounts are set up right. Doing so can help you a lot with accurate income reporting.

To set up daily sales accounts:

- Go to All apps

, then Accounting, then Chart of accounts (Take me there).

, then Accounting, then Chart of accounts (Take me there). - Select New.

- Set up these accounts:

| Name | Category Type / Account Type | Detail Type | Description |

|---|---|---|---|

| Daily Sales Income | Income | Other Primary Income / Sales of Product Income | For tracking daily sales |

| Clearing account | Cash and cash equivalents | Bank / Cash on hand | Zero balance account for daily sales |

| Overage and Underage Expense | Expense | Other Business Expenses | For drawer shortages |

Step 3: Set up items for daily sales

Set up a "Daily Sales" category to keep your items organized:

- Select the Gear icon on the Toolbar.

- Under Lists, choose All lists.

- Select Product Categories.

- Select New Category.

- Name the new category "Daily Sales".

- Select Save.

After setting up the Category, next are the items:

- Go to All apps

, then Sales & Get Paid, then Products & services (Take me there).

, then Sales & Get Paid, then Products & services (Take me there). - Select New.

- Set up these items. Note: Make sure to select Daily Sales as Category for each item.

| Name | Account | Description (will appear on forms) |

| Daily Sales Income | Daily Sales Income | Daily Sales Income |

| Overage/underage | Overage/Underage Expense | Overage/Underage |

| Check | Check | Check |

| Visa/MasterCard | Undeposited Funds | Visa/MasterCard |

| American Express | Undeposited Funds | American Express |

| Cash | Undeposited Funds | Cash |

| Discover | Undeposited Funds | Discover |

Step 4: Create a daily sales template

You'll use this template every time you need to record total daily sales.

- Select the Gear icon on the Toolbar.

- Under List, choose Recurring transactions.

- Select New.

- From the Transaction Type dropdown, choose Sales Receipt.

- Name your template "Daily Sales" and make sure the Type is Unscheduled.

- Select Daily Sales as the Customer.

- Select these items in the Product/Service column:

- Daily Sales: Daily Sales Income

- Daily Sales: Cash

- Daily Sales: Check

- Daily Sales: Visa/Mastercard

- Daily Sales: American Express

- Daily Sales: Overage/Underage

- Daily Sales: Discover

- Select Save template.

Remember

- Mark the "Daily Sales Income" item taxable if you collect sales tax.

- Make sure your sales tax rate is correct. Get help here.

Step 5: Record your total daily sales

Done setting up your sales receipt template? You're now ready to record your "end of day" sales.

- Select the Gear icon on the Toolbar.

- Under Lists, choose Recurring transactions.

- Find your template, then select Use from the Action dropdown.

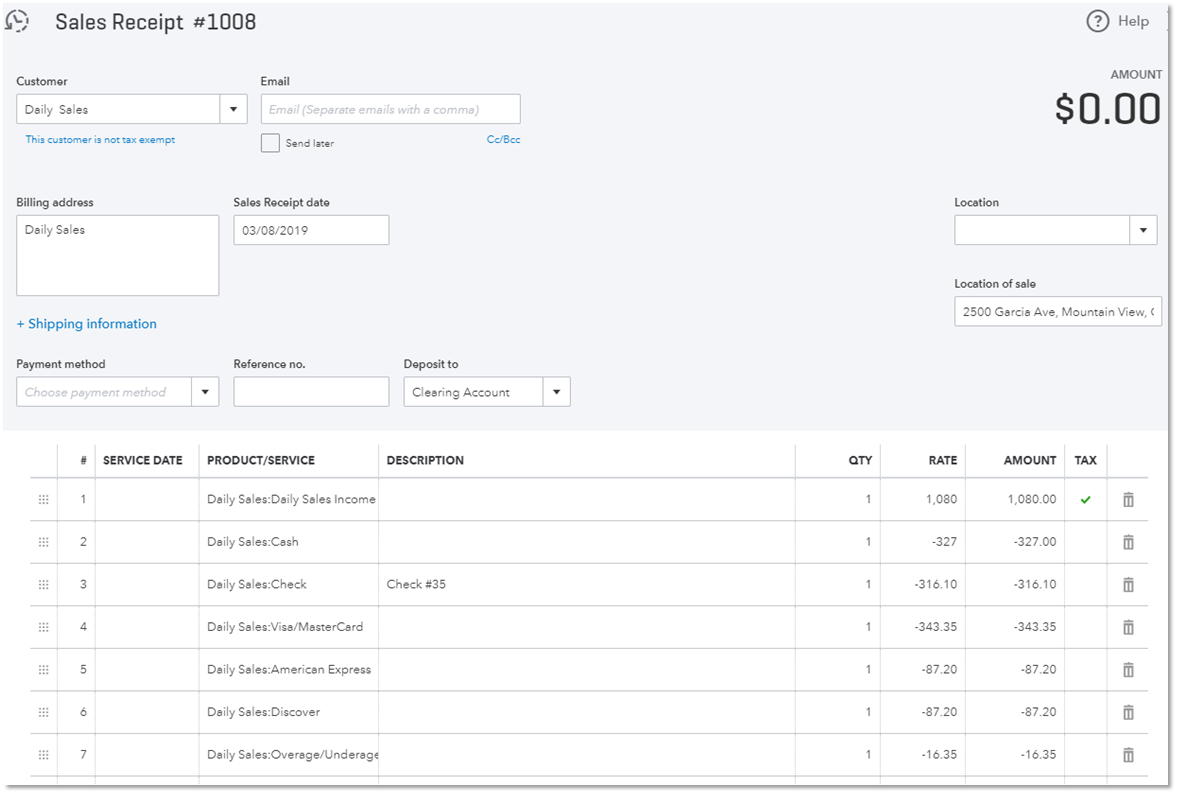

- To better illustrate how your sales receipt should look like, check out a sample breakdown of total daily sales below.

Total end of day sales example:

- You have $1177.20 in total reported sales ($1080 sales income, plus $97.20 sales tax).

- Your cash register count is $327.

- The total of check payments is $316.10.

- Sales through Visa/Mastercard is $343.35.

- Sales through Amex is $87.20.

- You have a cash shortage of $16.35.

- Sales through Discover is $87.20.

How your "end of day" sales receipt should look like:

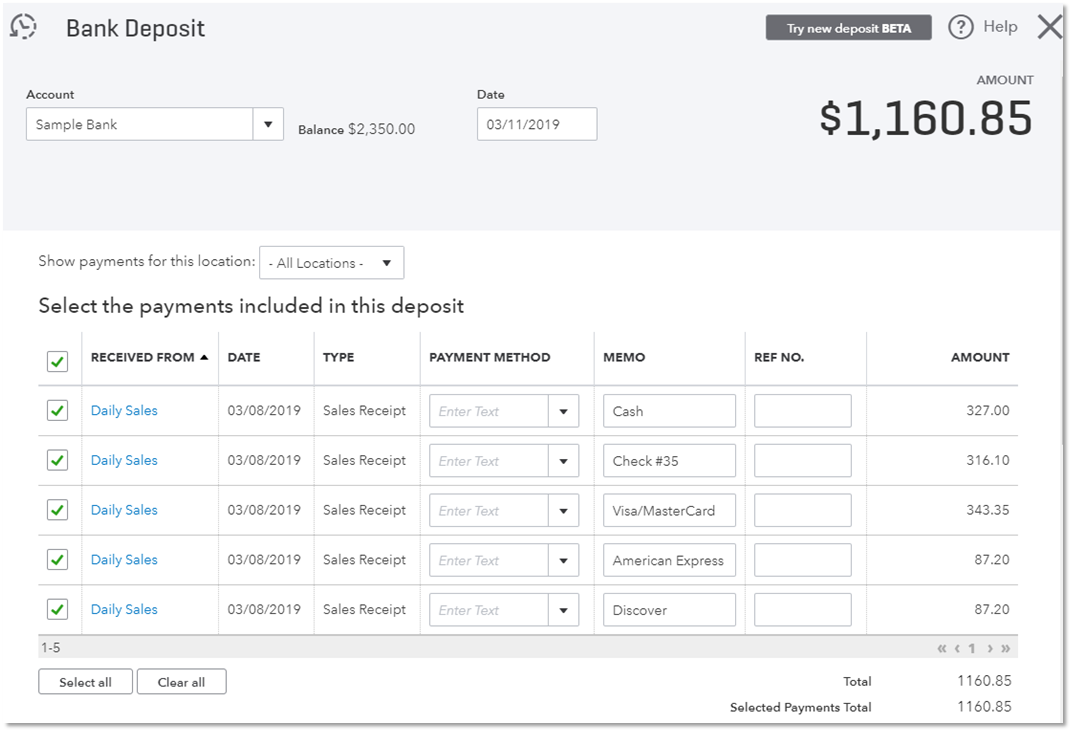

Step 6: Deposit your total daily sales

Record the actual amount of funds deposited to the bank. This step is important for making sure your deposits match what's shown on your bank statement.

Keep in mind

- Record the deposit for Discover, Visa, AMEX, or Mastercard as soon as you receive the funds from your merchant service provider.

- Also, record a bank deposit as soon as you deposit check payments.

To record the deposit:

- Select + Create.

- Under Other, choose Bank deposit.

- Select the bank account from the Account dropdown.

- In the Date field, enter the deposit date.

- Select the group of payments included in the deposit.

- Select Save.

See this sample deposit:

More like this

- Create sales receiptsby QuickBooks

- Create sales receipts in QuickBooks Desktop for Macby QuickBooks

- Track the total sales for each salesperson without Class/Location trackingby QuickBooks

- Find out when QuickBooks Payments deposits customer paymentsby QuickBooks