- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Hello there, @CindyK2,

Choosing the expense account for your wage garnishment item needs the assistance of your accountant. He can determine if you'll need to use the expense account that ADP uses, or there is a need to create a new one. This helps you easily track your payroll liabilities and expenses through a journal entry (JE).

Once verified that you'll have to create a new expense account, proceed with the steps below.

- Go to the Gear (Settings) icon at the upper right.

- Select Chart of Accounts.

- Click New.

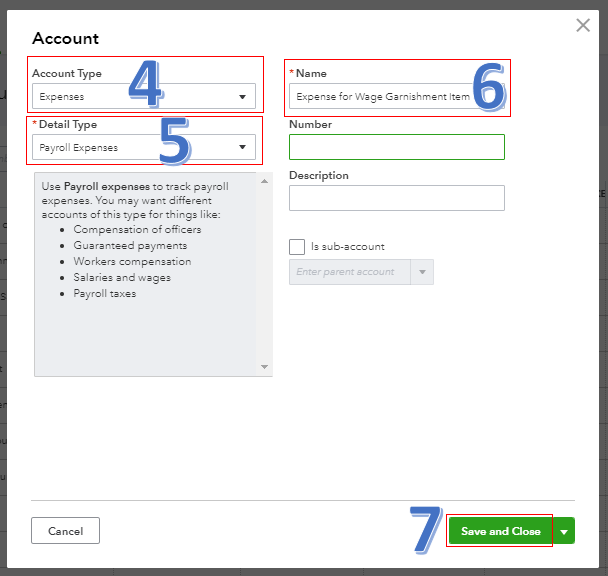

- In the Account Type drop-down, select the appropriate expense account.

- Choose the correct type in the Detail Type drop-down.

- Enter the account name.

- Click Save and Close.

The screenshot below shows you the last four steps. For detailed instructions, go through this article: Create An Account.

Once done, you can reconcile the bank amount to the payroll JE. This ensures the account in QuickBooks matches your bank statement.

You can always run the Journal report to view all your payroll journal entries created within a specific date range. Just go to Reports from the left menu and enter the report name in the Search box. For more details on how to customize and print the report, check out this article: Journal Entry Report.

I'll be right here to help if you need further assistance. Have a great day, @CindyK2.