- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Let's sort it out, @tu_ultimate.

The CA work location may have been set up in the Payroll Settings. That's why QuickBooks Online Payroll (QBOP) showed this prompt as if you need to file the state form.

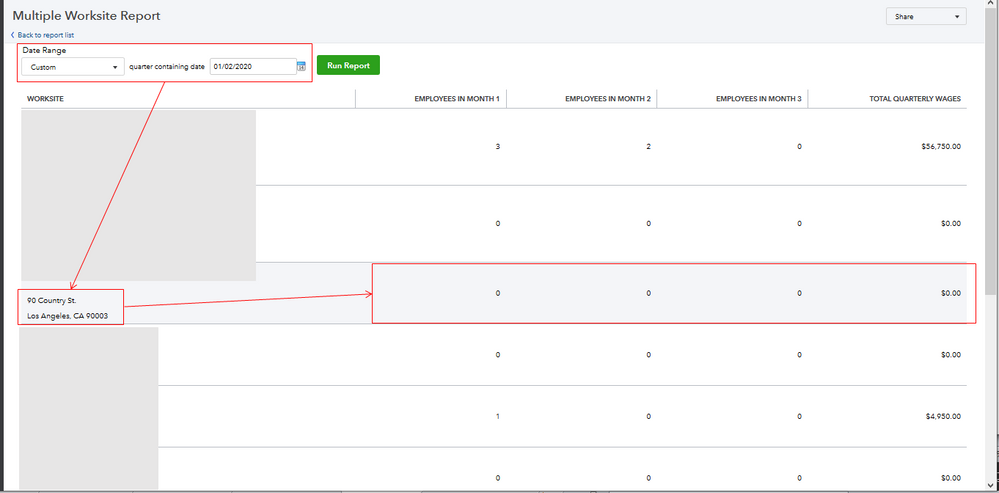

To check this, I'd first recommend running the Multiple Worksite report from the Reports menu. Then, custom the Date Range specific to the period it appears on the forms. This will help you verify if you have an active CA work location and their corresponding employees. I've attached a screenshot below of what the report looks like in QBOP.

One of your employees may be residing in CA, you may need to update their residence location that causes this payroll tax form to appear. You can check the multistate employment payroll situations article for more information. You can change the employees work location if needed.

Second, let's archive the form CA DE 9 to remove the notification in QBOP. I'll guide you how.

- Go to Taxes from the left menu.

- Select Payroll Tax.

- Click Quarterly Forms under Forms.

- Choose CA DE 9.

- Select the liability period.

- Hit Archive.

Lastly, let's make the CA work location inactive from the Payroll Settings. This way, the notification will disappear in the next quarter.

- Go to the Settings (Gear) icon at the upper right.

- Select Payroll Settings under Your Company.

- Click Work Locations under Business Information.

- Click the location that belongs to CA.

- Check the Inactive box.

- Click Save.

These steps will help remove the CA DE9/ 9C. In case you need to file forms, you can reference this article for the process: Filing Quarterly Tax Forms.

Additionally, you can go to the Payroll Tax Center to review the e-filing statuses if you have filed forms.

Get back to me if you have any other questions about federal and state tax forms. I'm always here to help. Have a good day!