Invoice Requirements in Malaysia

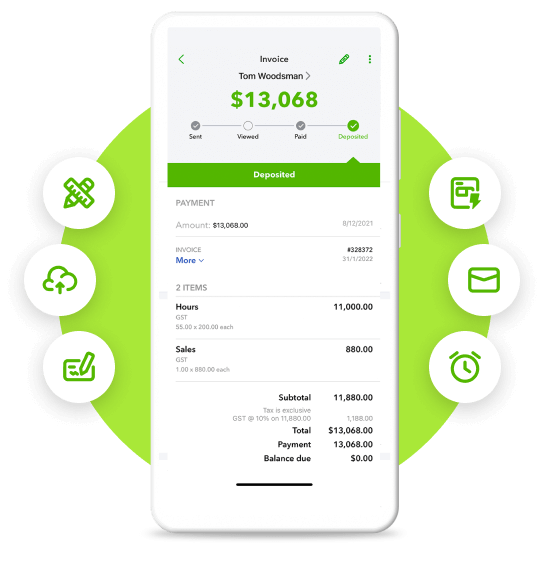

It is key to follow the correct invoicing format for your clients in Malaysia. Before sending an invoice to a client in Malaysia, make sure it includes the information necessary for the recipient to record and pay it.

At a minimum, you’ll need to describe the goods or services provided, the cost in Malaysian ringgit (MYR), dates and times, and any other critical data points that bring transparency to the transaction. Here’s a look at what most invoices will include:

For local currency invoices, simply mention:

- The exact date when the invoice was issued

- The invoice number

- The contents or services supplied

- Address of the company or individual you are billing

- The National Registration Identity Card (NRIC) number (Also used as a tax number by the IRMB)

- The net amount in MYR

- The payable SST in MYR

- The terms of the contract

For clients in foreign countries, you must mention the payable tax in MYR. Make sure the exchange rate applied is the latest issued by Malaysia’s Central Bank on the date of the invoice.

Tax In Malaysia

Value Added Tax (VAT) known as Sales and Service Tax (SST) in Malaysia, was introduced on September 1, 2018, in order to replace GST (Goods and Services Tax). The fixed tax rate in Malaysia is 6%.Some types of goods and services can be exempt from this tax, while others are taxed at different rates.