Invoices Requirements in the European Union

Under the European Union (EU) regulations, an invoice is required in most business-to-business (B2B) transactions and in some business-to-consumer (B2C) transactions.

When selling to customers rather than other businesses, an invoice is generally issued under the following circumstances:

- In distance selling, when another EU country will collect the tax;

- When a new means of transport (some motorized land vehicles, vessels and aircraft as defined in the VAT Directive) is supplied to another EU country.

Member states may impose time limits on the issue of invoices when taxable persons are selling goods or services within their territory.

Here are some important things to include when sending an invoice in Europe:

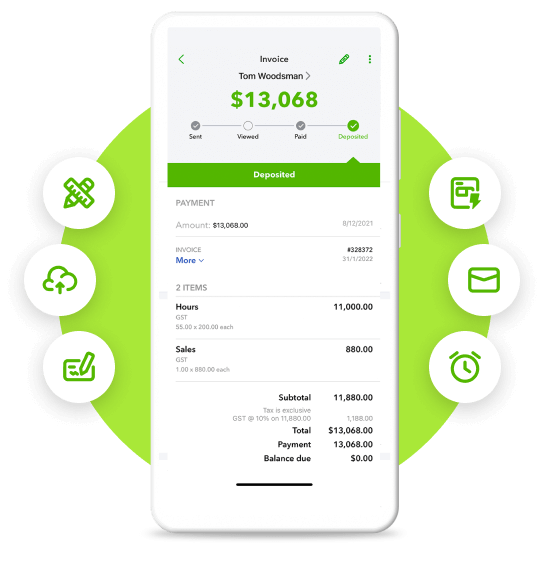

- The date of issue

- A unique sequential number identifying the invoice

- The supplier’s VAT identification number

- The customer’s VAT identification number

- The supplier’s full name and address

- The customer’s full name and address

- A description of the quantity and type of goods supplied OR the type and extent of services rendered

- The unit price of goods or services. This does not include taxes, discounts, or rebates unless these are part of the unit price.

- The transaction and payment dates (if these are different from the invoice date)

- The VAT rate applied

- The VAT amount payable

- A breakdown of VAT amount payable by VAT rate or exemption

- The foreign currency rate (if an alternative to the supplier’s national currency is used)

- The EU VAT Directive refers to sequential numbering, but this number can be based on one or more series.

Additional invoice requirements in some cases

- A VAT-exempt transaction – include a reference to exempting legislation (EU or local)

- If a ‘reverse charge’ is applied to the transaction

- The intra-EU supply of a new means of transport (i.e. some additional information for a car)

- For margin schemes – include a reference to the scheme applied. (A margin scheme is a special VAT scheme available to travel agents and others.)

- If the invoice is “self-billing” (a customer issues the invoice instead of the supplier), those exact words must appear on the invoice.

- If a supplier uses cash accounting, the words “cash accounting” must appear on the invoice.

- For tax representatives: some VAT details may be needed if tax representatives are involved in a business. (Tax representatives are appointed by entities who do business in the EU but don’t have a physical presence there; they still need to settle VAT on their business activity.)