Pro Tax is an online tax software that allows accounting professionals to manage and grow their tax business that lives right in the QuickBooks Online Accountant ecosystem. The software allows users to file T1 (including T2125), T2, T3, and FX tax returns and slips directly to the CRA from any device. The tax calculations are powered by the same tax engine as Intuit’s ProFile product, which ensures accuracy and compliance. You can be assured that your return is done right.

Pro Tax in QuickBooks Online Accountant is a paid subscription service.

Please note that Quebec forms are not currently supported in Pro Tax and the product is English-language only.

Here are answers to some frequently asked questions.

How much does Pro Tax cost?

Pro Tax allows your QuickBooks Online Accountant firm to EFILE unlimited returns. Click here to learn about pricing.

- Create and EFILE unlimited T1, T2, T3, and FX returns

- Access for all members of a QBOA firm

- Export return PDF

- Import and export return to ProFile

- Carry forward your data from ProFile and TaxCycle

- Express notice of Assessment (ENOA) - T1 and T2

- CRA Auto-Fill My Return - T1 and T2

Trial

| Pro Tax T1 | Pro Tax T2 | Pro Tax T3 | Pro Tax FX | |

| Price | Free | Free | Free | Free |

| Duration | Unlimited | Unlimited | Unlimited | Unlimited |

| Includes | Prepare up to 7 T1 returns | Prepare up to 7 T2 returns | Prepare up to 7 T3 returns and slips | Unlimited returns |

| Restrictions | -No EFILE -No export to ProFile -No barcode print | -No EFILE -No export to ProFile -No restrictions on printing | -No EFILE -No export to ProFile -No restrictions on printing | -No EFILE -No export to ProFile -No restrictions on printing |

Pricing

| Pro Tax T1 | Pro Tax T2 | Pro Tax T3 | Pro Tax FX | Pro Tax OnePay | |

| Price | Click here to learn about pricing | Click here to learn about pricing | Click here to learn about pricing | Click here to learn about pricing | Click here to learn about pricing |

| Authorizes | 1 QBOA firm | 1 QBOA firm | 1 QBOA firm | 1 QBOA firm | 1 QBOA firm |

| Includes | -unlimited T1 returns -access to all firm members -Cloud T1 tax preparation -built-in auditor -CRA Auto-Fill My Return -Express Notice of Assessment -FILE to CRA -import and export returns -Intuit Sign | -unlimited T2 returns -access to all firm members -Cloud T2 tax preparation -built-in auditor -CRA Auto-Fill My Return -year-over-year carry forward -GIFI import -EFILE to CRA -import and export returns -Intuit Sign | -file all your returns in one place -comprehensive forms available (EN) -file faster with T3 express -Intuit Sign | -file all your returns in one place -comprehensive forms available (EN) -import your clients’ data from Excel | -Learn more |

How do I subscribe to Pro Tax?

For existing users:

You can subscribe from the Return actions menu in Pro Tax. You will also be provided the option to subscribe before you EFILE a return.

.png)

For new users:

If you are a new Pro Tax user, you can subscribe to Pro Tax by viewing the Your Account page.

- Select the Subscribe to Pro Tax option.

- Complete the sign-up process as prompted.

Can I pay on a month-to month basis?

No, Pro Tax is only offered on an annual subscription basis. Customers will be charged in full when subscribing.

Will my subscription auto-renew?

Yes, unless you choose to disable the renewal. This can be done from the Your Account billing section in your QuickBooks Online Accountant company.

If I opt out of or cancel my Pro Tax subscription, will I get a pro-rated refund?

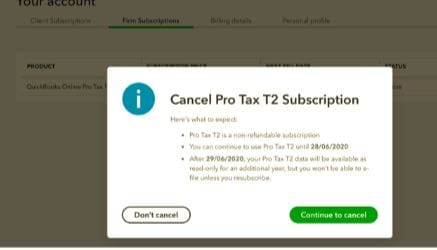

Customers who opt out of their subscriptions are not entitled to a refund. You will have access to a “read-only” data version until the end of your billing period. You will not have access to the EFILE service unless you subscribe again at the full annual pricing.

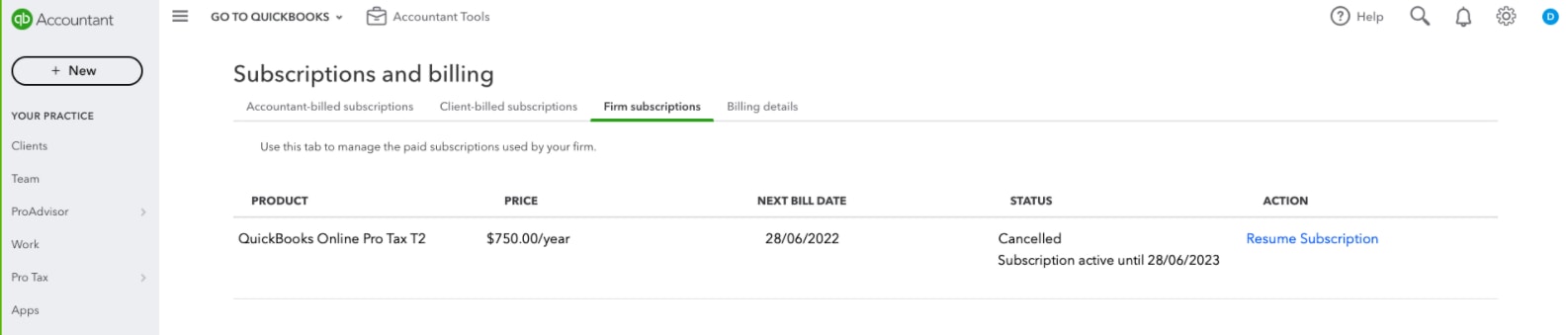

How do I cancel a Pro Tax subscription?

- Navigate to the Your account section in the gear icon of your QuickBooks Online

- Select Firm Subscription from the menu.

- Select the Cancel option. A validation message displays.

- Select the Continue to cancel option.

The Your account status updates to reflect the change.

Refund information

If QuickBooks Online Accountant ProTax does not meet your expectations, you can request a refund within 14 calendar days from the subscription date of the product, if you have not used the EFILE or Print Returns functions. If you have used EFILE/Print Returns during the 14-day refund window, you won't be eligible for a refund.

Click here to learn about the ProTax refund process.