Learn how to turn on tax code notifications in Standard Payroll.

The tax code notification feature in Standard Payroll lets you know about changes and updates made to your employees' tax codes. We'll show you how to set this up in QuickBooks.

Step 1. Check your notification settings

For this feature to work, you need to log into your HMRC PAYE dashboard and make sure that all your notice options are set to Yes. To do so:

- Sign in to the HMRC PAYE dashboard and go to Messages.

- Select Notice Preferences and Notice Options.

- Set notices to Yes. Any new notices will automatically update in QuickBooks.

If the notice option is not set, you'll see a banner in QuickBooks advising you that the PAYE reference in incorrect.

Step 2. Enter your HMRC reference

To receive notifications in QuickBooks, you need to enter your HMRC reference. Here's how:

- Select the gear icon and select Account and settings.

- Select the Payroll tab.

- Select the pencil icon next to HMRC reference.

- Enter your HMRC reference and Accounts Office reference.

- Select Save and Done.

If you are an accountant using payroll on behalf of a client, enter the credentials that allow you to retrieve notifications.

Frequently asked questions

Where and when will tax notifications show in QuickBooks?

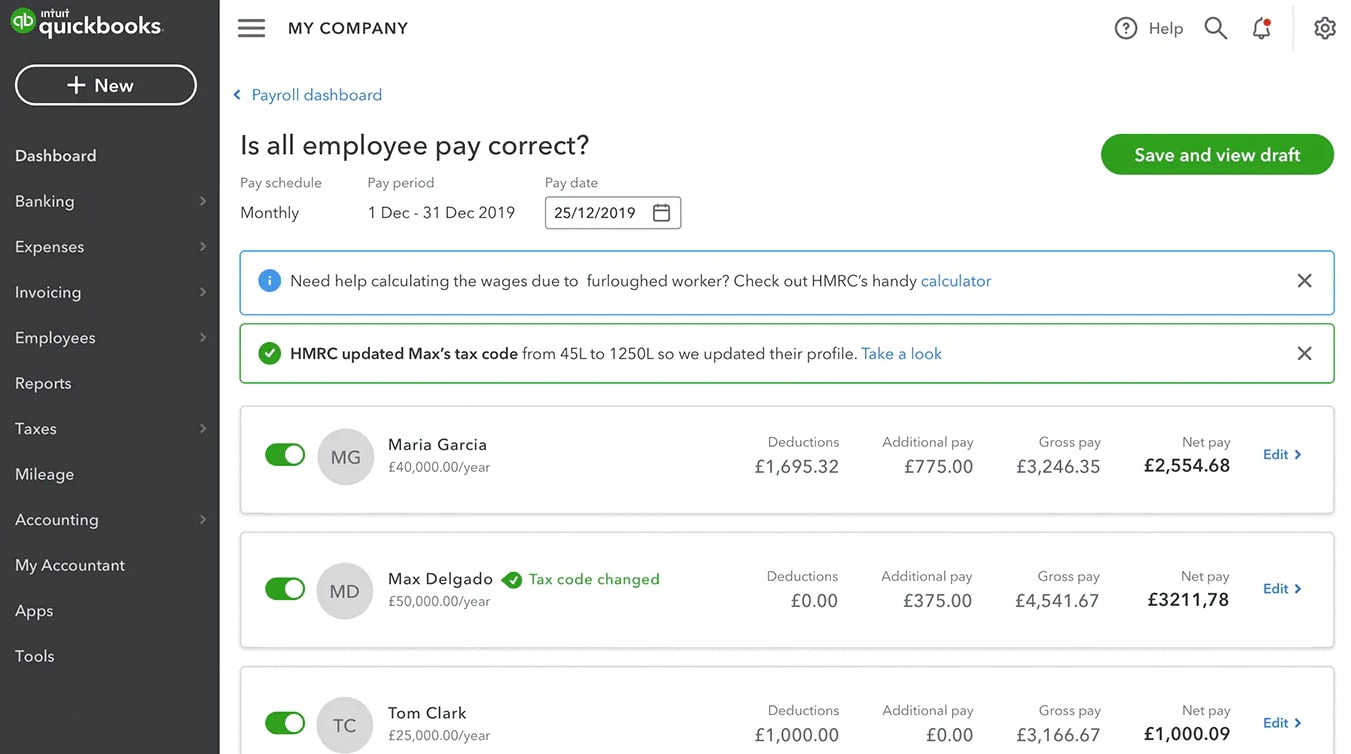

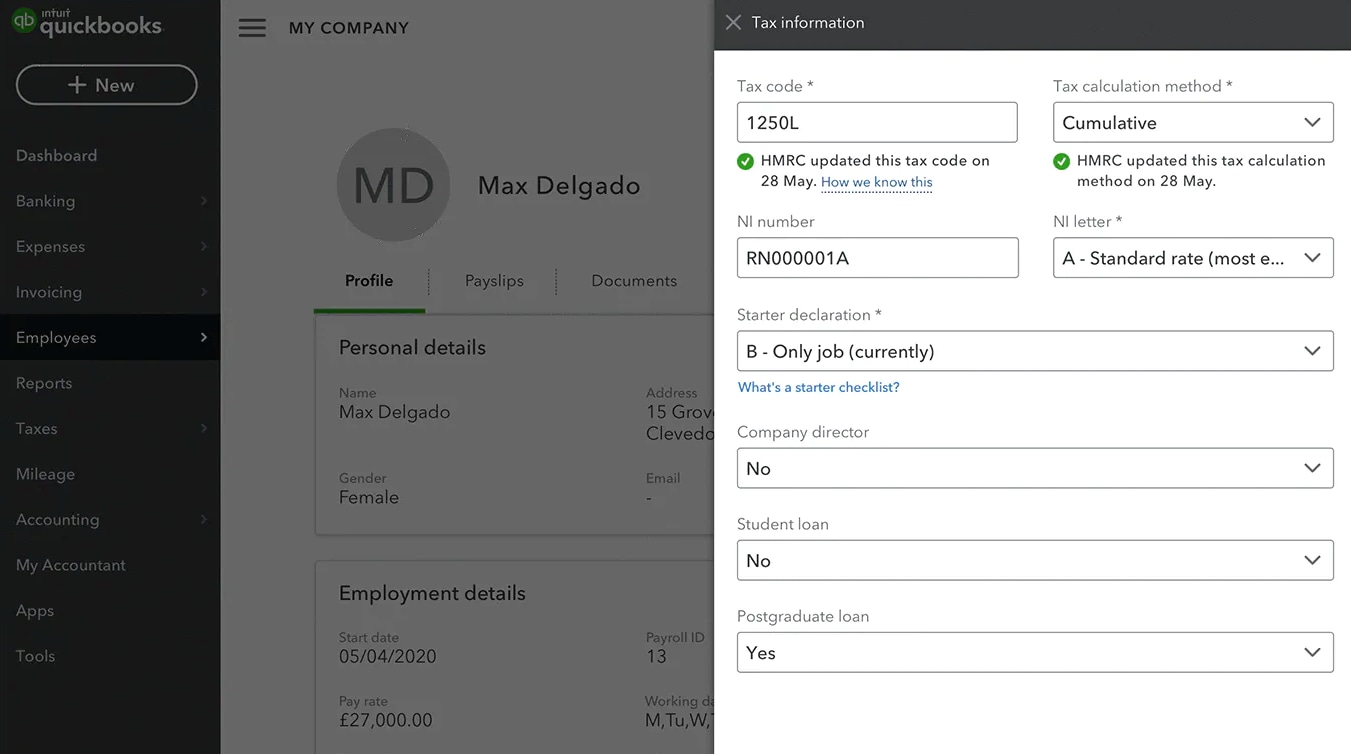

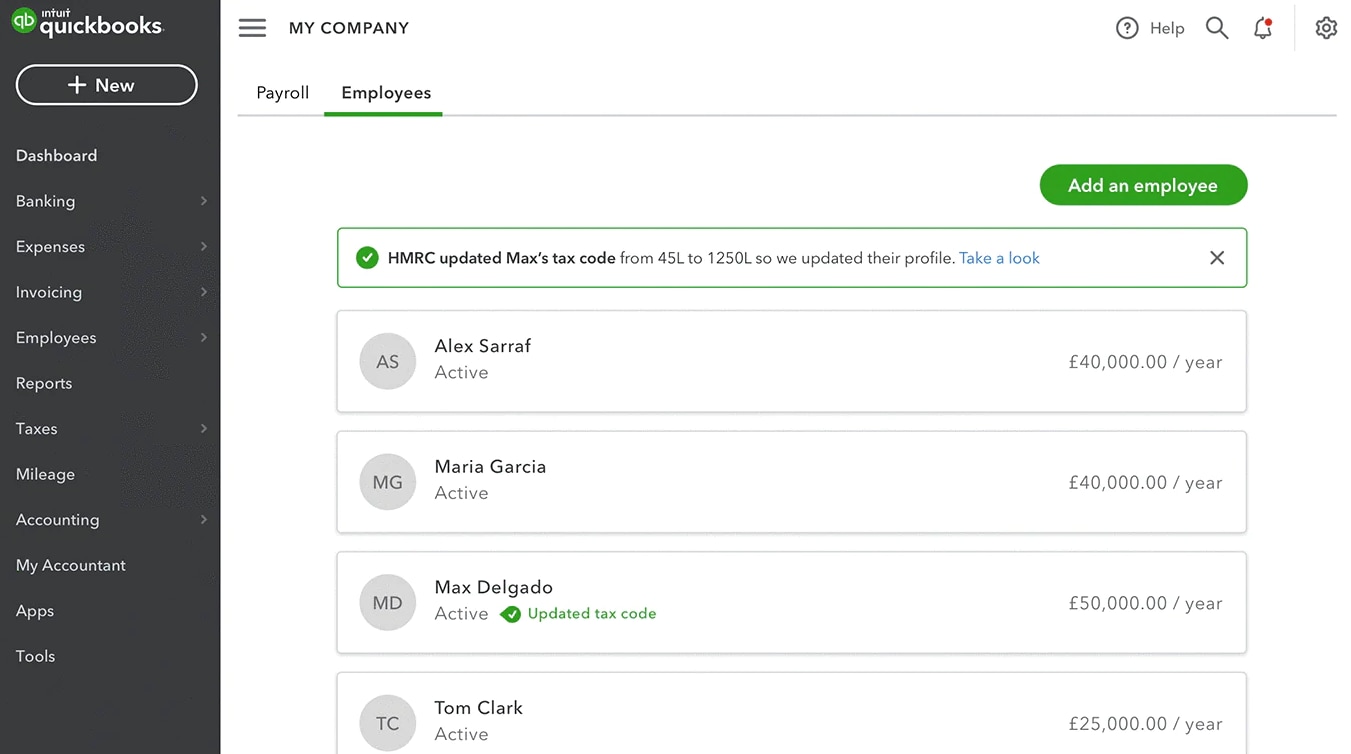

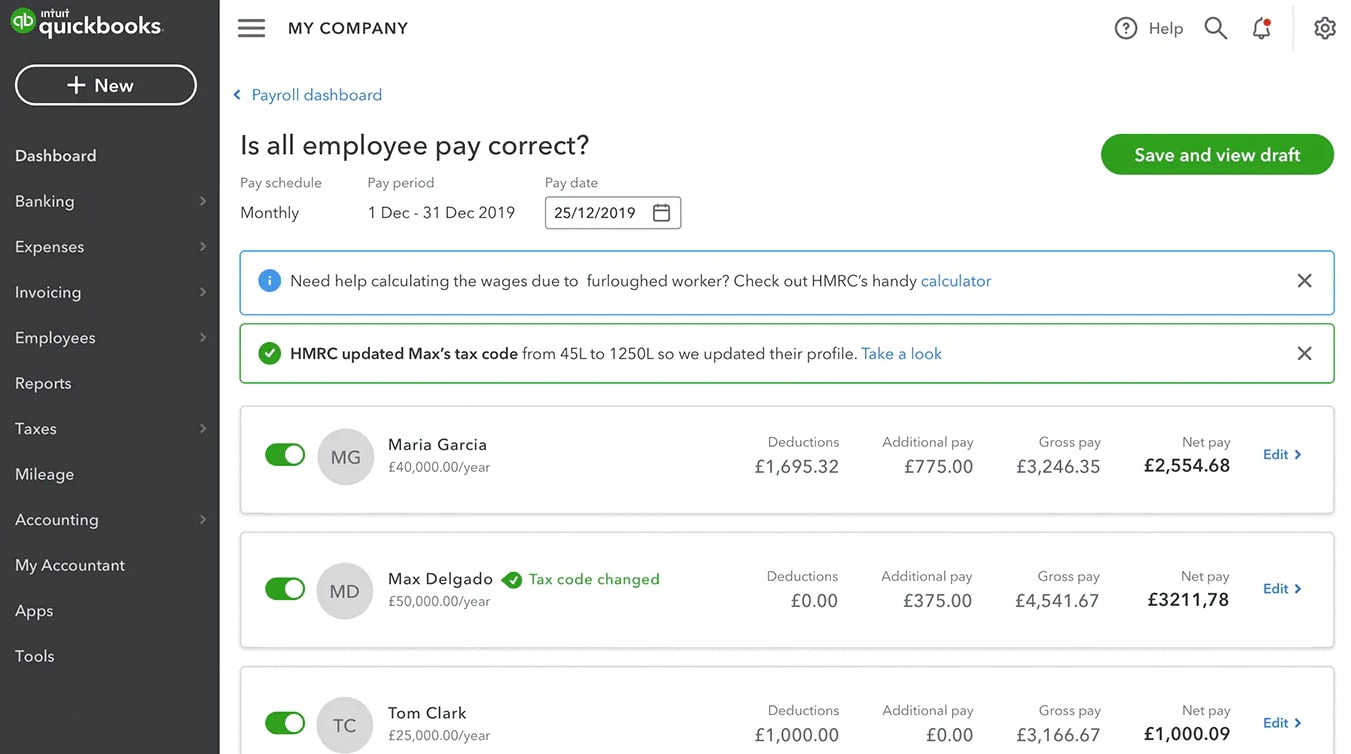

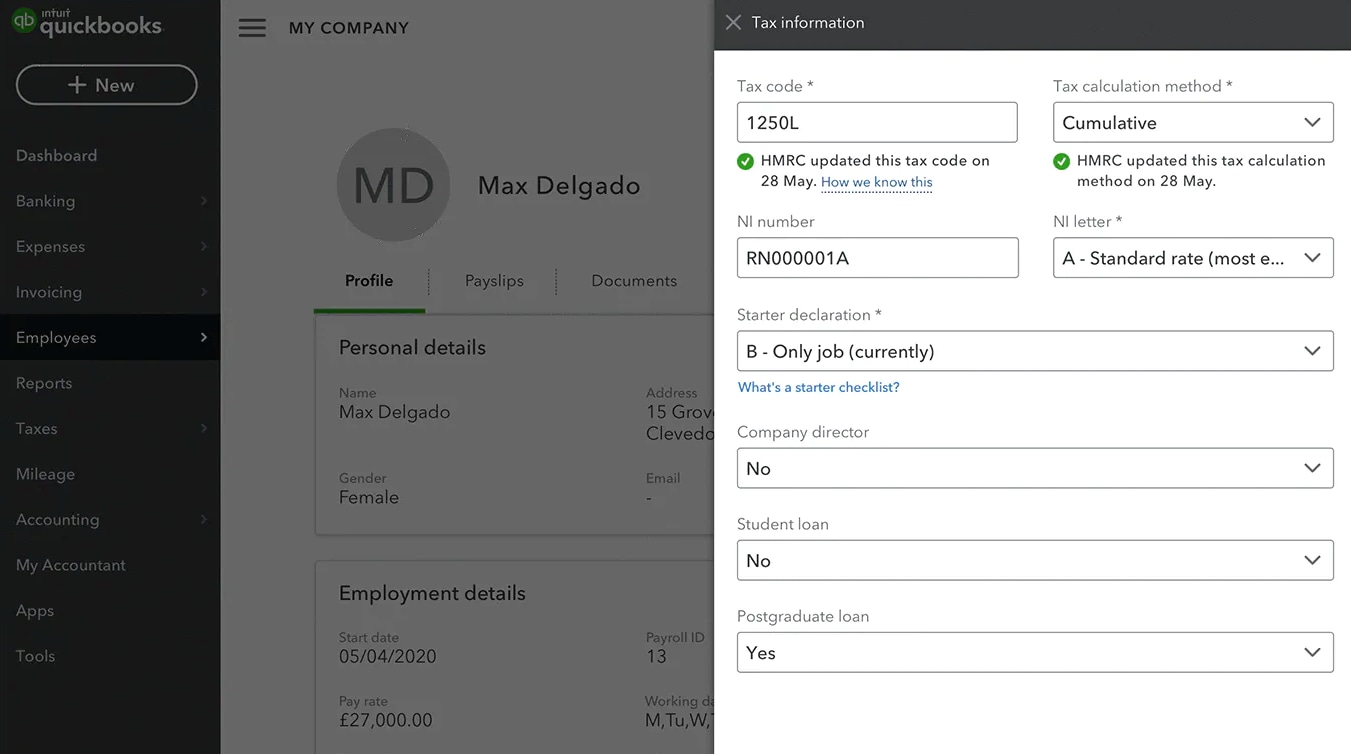

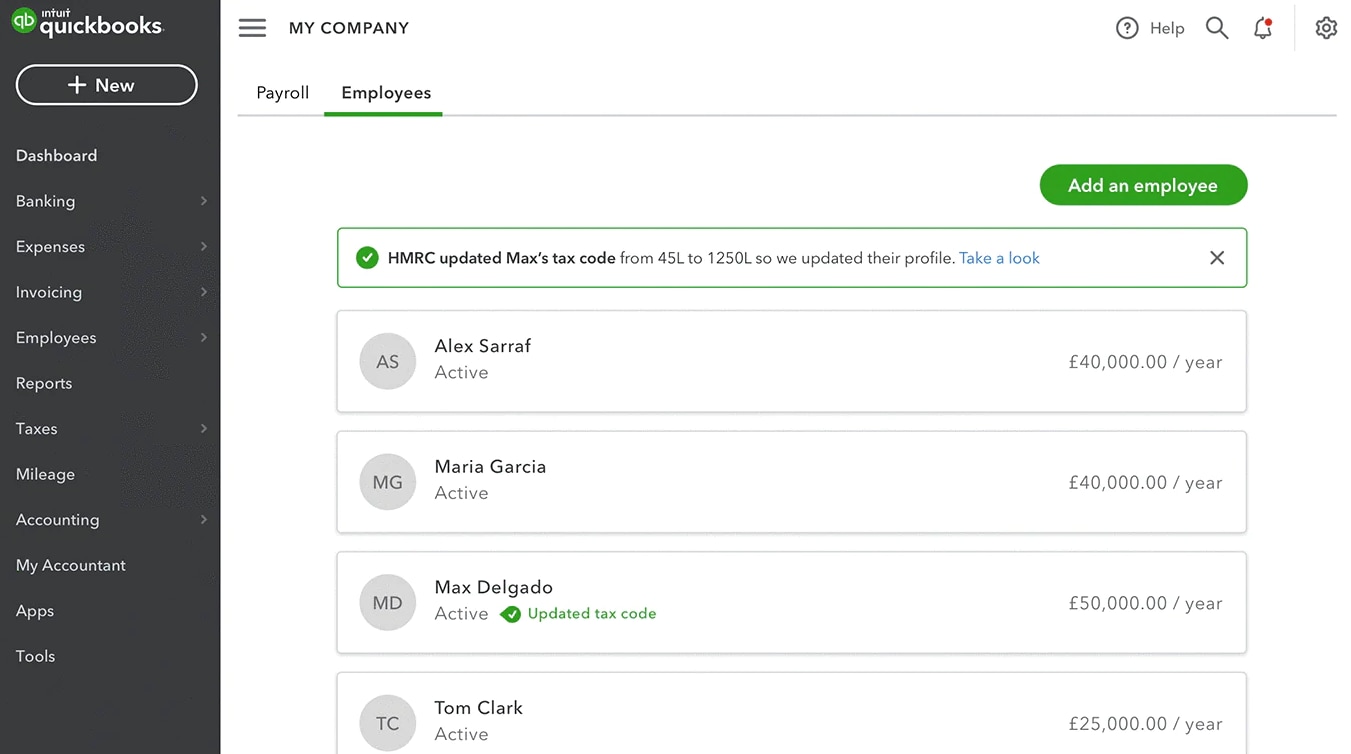

Tax code change notifications will show in your employees list, the employee's tax information and the pay run when running payroll. Tax code notices will apply immediately or during the next pay run.

Here are some examples of what these notifications look like:

Can I manually override tax notices?

Yes, you can. However, if you roll back a pay period and override the tax code or change the calculator method, you'll need to manually change the tax codes back too.

Important: You should only be change tax codes if HMRC tells you. There's a chance that your employees may pay the incorrect amount of tax if their tax code is changes and isn't correct. We suggest reaching out to HMRC directly for any questions.

What kind of tax notices can I expect to see?

There are a number of notices that may pop up in QuickBooks. Here are a few scenarios:

- If there's been automatic updates to employee tax codes – which you can see in your employee list or the affected employee's profile.

- If there's been manual updates to tax codes, both before and after the changes are made.

- If there are upcoming changes to tax codes – these will show in the employee's tax information.

Most tax code change notifications will show on mobile, desktop and most web browsers.

Will I still receive tax code notifications from HMRC?

Yes, you will still get notifications from HMRC. These notifications will come through the portal and it's not currently possible to stop these notifications.

Once you sign up to the automated tax code service through the portal, paper notifications should stop. If you continue to receive the paper notifications, reach out to HMRC.

Is the tax basis updated?

QuickBooks updates the tax basis and tax codes. Although, if a tax basis changes, HMRC will send the tax code too.

For example, if a tax code changes from 1250L to 1250L W1/M1, then 1250L W1/M1 will be sent through from HMRC.

Will student loan notifications update too?

Unfortunately this isn't currently supported in QuickBooks. Student loans, postgraduate loans, NI numbers, previous taxable pay and tax paid may be part of future releases.