Send in your payroll tax notice

by Intuit•80• Updated 1 month ago

Learn what to do if you receive an IRS or state tax notice of discrepancy.

If you have QuickBooks Payroll and received a tax notice of discrepancy, we're here to help. It’s important to take care of it promptly to avoid additional tax penalties, interest, or notices.

Step 1: Make sure your notice is payroll-related

Determine if the tax notice is related to services QuickBooks Payroll provides for you. QuickBooks Payroll handles IRS forms 941/944, 940, W-2, state unemployment insurance, state withholding tax, and local withholding taxes where applicable.

| Unemployment rate notice: If you can update your unemployment rate yourself in your payroll product, you don't need to send your rate notice to us. |

Notices for other business taxes, such as sales tax, corporate income tax, and franchise tax, should be directed to your accountant or tax advisor.

Step 2: Determine if you were on service during the period of the notice

Make sure your notice applies to a time you used QuickBooks Payroll. If the notice timeframe is outside of service, contact the person or company who handled your payroll at that time.

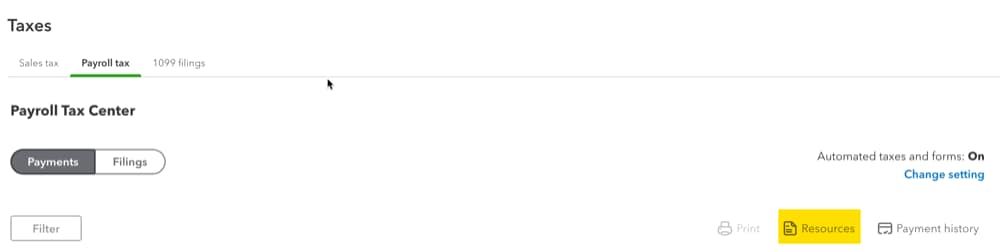

Step 3: Send in your tax notice

Choose your payroll service below to learn how to send us your tax notice.

| Note: Not sure which payroll service you have? Here's how to find your payroll service. |

Frequently asked questions

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Understand the taxes and forms that QuickBooks payroll submits for youby QuickBooks•628•Updated November 03, 2023

- Pay and file payroll taxes and forms electronically in QuickBooks Online Payrollby QuickBooks•910•Updated June 12, 2024

- Invite a contractor to add their own tax infoby QuickBooks•2144•Updated June 25, 2024

- Set up QuickBooks Online Payroll to pay and file your payroll taxes and formsby QuickBooks•1188•Updated July 08, 2024

- View your previously filed tax forms and paymentsby QuickBooks•777•Updated June 11, 2024