Manual invoices vs. invoice software

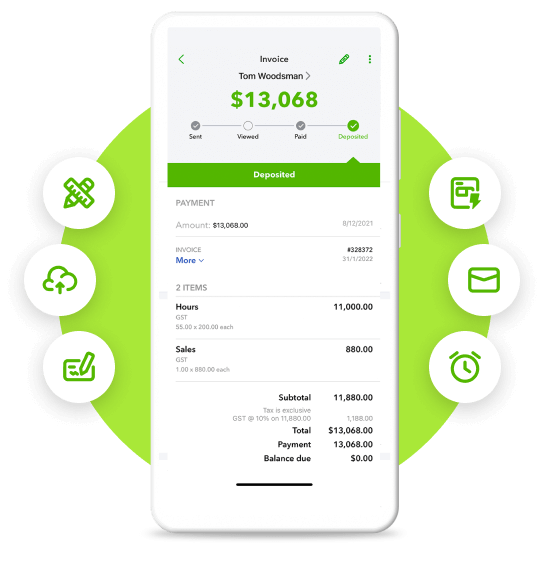

QuickBooks Online Invoicing Software

Get paid fast with payment-enabled invoices. Add an optional “Pay Now” button to invoices, so your customers can pay directly online with a variety of payment methods.

Track outstanding invoices and get alerts when your invoices are viewed and paid.

Send payment reminders to your customers from within QuickBooks Online.

Set up recurring automatic invoices on any schedule you choose.

Customer information is automatically pulled in, making prep simple.

Manual Invoices

May involve more steps to issue, and for customers to complete payments.

Require manual entry and calculation of customer and sale information.

Need to be manually tracked and monitored.

Require manual follow-up for payment reminders and past-due payment notifications.

Late payments may lead to cash flow problems.