Standard payment terms

Before we dive deeper into payment terms, let’s review some of the most common payment terms that small business owners should keep in mind when generating invoices.

- PIA: Payment in advance

- Net 7, 10, 15, 30, 60, or 90: Payment expected within 7, 10, 15, 30, 60, or 90 days after the invoice date

- EOM: End of month

- 21 MFI: 21st of the month following invoice date

- COD: Cash on delivery

- CND: Cash next delivery

- CBS: Cash before shipment

- CIA: Cash in advance

- CWO: Cash with order

- 1MD, 2MD: Monthly credit payment of a full month (or two-month) supply

- Stage payments: Set payments over a period of time, agreed upon by the client and seller

- Forward dating: Invoicing for payment to be made after the customer receives the order

- Accumulation discounts: Discounts on large orders

- Partial payment discount: When a seller offers a partial discount due to low cash flow

- Rebate: Refund sent to the buyer after they’ve made a purchase

- Contra: Payment from the client, offset by the cost of supplies purchased

Why are payment terms important?

Payment terms are important because knowing how much money is going to hit your account, and when, is essential to accurate cash flow projections.

Research by QuickBooks found:

- 80% of small business owners stress about their company’s cash flow.

- More than half of small business owners with cash flow problems say late customer payments are the primary cause.

- 62% of small business owners don’t know exactly how much money they receive each month.

- 58% of small business owners say they’ve made a poor business decision because they were worried about cash flow.

Accurate cash flow projections help you plan for taxes, keep your business running smoothly, and manage its growth. A clear, professional invoice can help you ensure that clients pay in a timely fashion. Clearly communicating terms of payment helps ensure you and your customers are on the same page before work begins.

Example of how payment terms work

To get a better idea of why payment terms are essential to your business’s finances, let’s take a look at an example:

Imagine you’re about to open a new storefront. You need to purchase $5,000 in equipment. You recently received a large order from a customer and submitted an invoice for $7,000. You estimate that the customer will pay the invoice by the end of the month.

But the customer doesn’t pay on time. As a result, you can’t purchase the new equipment you need. Now, you’re paying rent for your storefront, even though you’re not conducting any business out of the location. You begin to lose money as a result of the late payment.

This example demonstrates the need for timely invoice payments. Putting together a concise, easy-to-understand invoice will go a long way toward ensuring you receive payments on time. As a result, you can afford to keep up business operations and meet your growth goals.

How to use payment terms

Payment terms are essential when negotiating a contract. Payment terms should maximize how quickly your clients pay you and minimize inconvenience for your customer. A good set of payment terms should benefit both parties.

As you start to invoice customers, remember that your payment terms should match your business goals. Selecting appropriate payment terms is an important step toward building and maintaining a healthy business. Always include your payment terms on your invoices, but discuss them with your clients first.

Prepayment

You can require customers to pay in advance for services. Advance billing can improve your cash flow and reduce the risk of losing money. If you have a wedding photography business, for instance, you may want to avoid running the risk of cancellation. So you may want your customers to pay in full upfront. Some businesses offer discounts to customers who pay in full upfront.

50% upfront

You may choose to receive a partial payment of 50% of the total cost of a customer’s purchase. Partial payments can provide working capital you may need to complete a customer’s project. They may also benefit your customers by breaking up their costs into smaller payments. Smaller payments for your customers can benefit your business as well, in the form of increased sales and higher order value.

A 50% deposit may also be a compromise between businesses and customers when a customer is unable or unwilling to pay in full upfront. That way, both parties take on an equal risk. If you choose these terms, be sure to define when you’ll receive the remaining 50%.

Installment agreements

You can also choose to accept partial payments through payment plans that break your customer’s payments into smaller installments. As an example, you may choose to divide the customer’s total cost into a series of smaller monthly payments. Installment agreements are similar to line-of-credit payment terms, except they’re cash-based.

Some companies split up big projects into milestones, and the customer pays upon each milestone. You may base installment agreements on time—every three months, for example—or upon delivering a specific part of the project.

Lines of credit

Line-of-credit payment terms offer buyers credit toward the products and services they purchase. Customers can then repay the balance on the agreed payment schedule. Offering credit through your business comes with some risks, as the customer could default. Larger organizations typically use this type of customer financing.

Immediate payment (payment due upon receipt)

Immediate payment refers to a transaction for which payment is due as soon as you deliver goods or services. Examples of immediate payment terms include “cash on delivery” (COD) or “payable upon receipt.” You may negotiate into the contract that you can repossess goods if the customer does not provide immediate payment.

Net 7, 10, 15, 30, 60, or 90

These terms refer to the number of days in which a payment is due. For instance, Net 30 (or N/30) means that a buyer must settle their account within 30 days of the date listed on the invoice. Using Net 30 terms, if you date your invoice March 9, clients are responsible for submitting payment before April 8.

Choosing net payment terms may inconvenience you as a business owner, as you’ll have expensed the entire project without receiving income. However, customers may prefer these terms. Try to find a period that works for both you and your client.

Subscriptions and retainers

Subscription and retainer payment terms require customers to pay regularly, such as monthly or annually. Typically, businesses on retainer agreements issue invoices to clients on a recurring basis. Automating invoicing for recurring payments can help.

Early payment

You can provide customers with an incentive to pay early. For example, consider offering a 5% discount if the customer pays the total balance in full before the due date. Early payments are a win-win. Customers receive a discount on your goods or services, and you’ll have enough capital to complete the project.

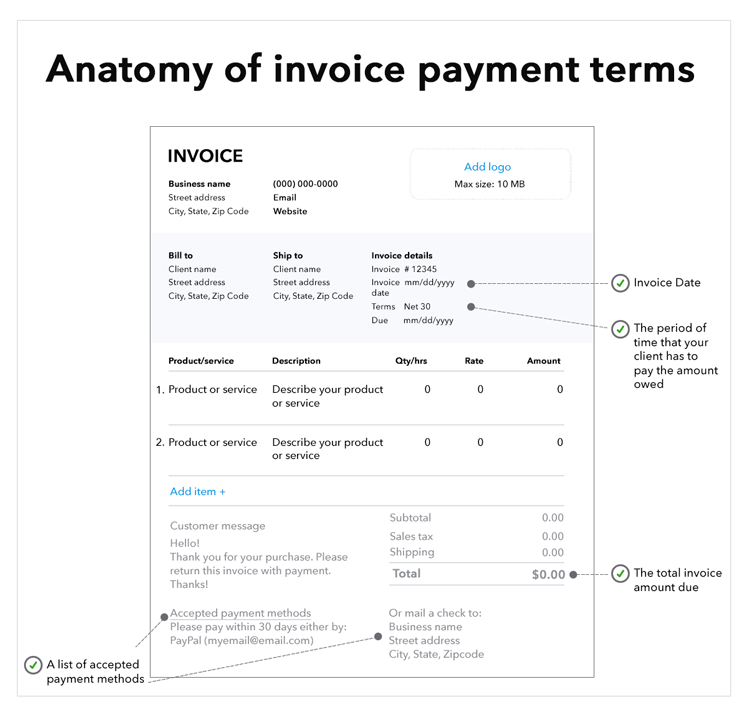

How to control payment methods with payment terms

In addition to controlling the timing of your payment, you also have a say over how customers pay you. Include your payment options in your invoice terms. Setting expectations for your preferred payment methods will help ensure you get paid and avoid confusion later on.

The simplest way to define your payment policies is to make the process as convenient as possible for the customer. For instance, you may be accustomed to receiving paper checks or cash. However, expanding your accepted payment methods will increase the likelihood of on-time payments. Two of the more modern payment methods you’ll want to consider are smart invoices and credit card payments.

Smart invoices

Software like QuickBooks enables customers to pay online anytime with pay-enabled smart invoices. With smart invoices, customers can pay using credit cards, debit cards, and automated clearing house (ACH) bank transfers.

You can also set up automatic and recurring payments, which can reduce the guesswork associated with invoicing. If you don’t set up recurring payments, you can email invoices to the customer directly with a link for payment. These features are useful if you have ongoing contracts.

QuickBooks Payments offers a free email and ACH payment merchant service account, and free instant deposits with a QuickBooks Cash business bank account.

Credit card payments

You might also accept credit card payments. You can request that the client provide you with a credit card number. Or you can accept mobile payments with the QuickBooks GoPayment app, which comes with the hardware necessary to accept all major credit or debit cards using just your mobile device.

There are fees associated with credit card payments. Some business owners choose to pay the fees themselves, while others opt to pass them along to customers. If you choose the latter, you’ll want to indicate this in your contract. The contract should clearly explain that you’ll charge the customer a credit card fee if they elect this payment method.