Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Greetings, MrMiyagi.

If you want to record your payroll wages and taxes automatically, you might want to use a payroll software. In Australia, KeyPay is a cloud-based payroll solution that integrates well with QuickBooks.

For additional information about this software, please refer to this article: https://keypay.com.au/intuitquickbooks

Aside from subscribing to a payroll software, you can also automate employee pay calculations through Journal Entry. You might want to consult your accountant about this process.

We’re just a post away if you need further assistance.

Thanks for providing clarifications, @MrMiyagi.

All money received is usually recorded as income. Since you’re paying yourself a salary, I recommend consulting an accountant to ensure the entry is correct.

Depending on how the business is set up, you need to know the best way to add this type of transaction. Here's a reference for creating one in QuickBooks Online: Record transactions using Create (+).

Keep me updated on how it goes. I want to make sure this gets taken care of. Have a good one!

Thanks!

Im not paying myself a wage - I’m receiving a salary as an employee.

I can do a journal entry that adds the tax paid to tax paid account, and the same amount to the income received account. The difference between the two is added to my bank account.

Is there a way ti automate this journal entry, tied to receiving the salary?

Hello there, MrMiyagi.

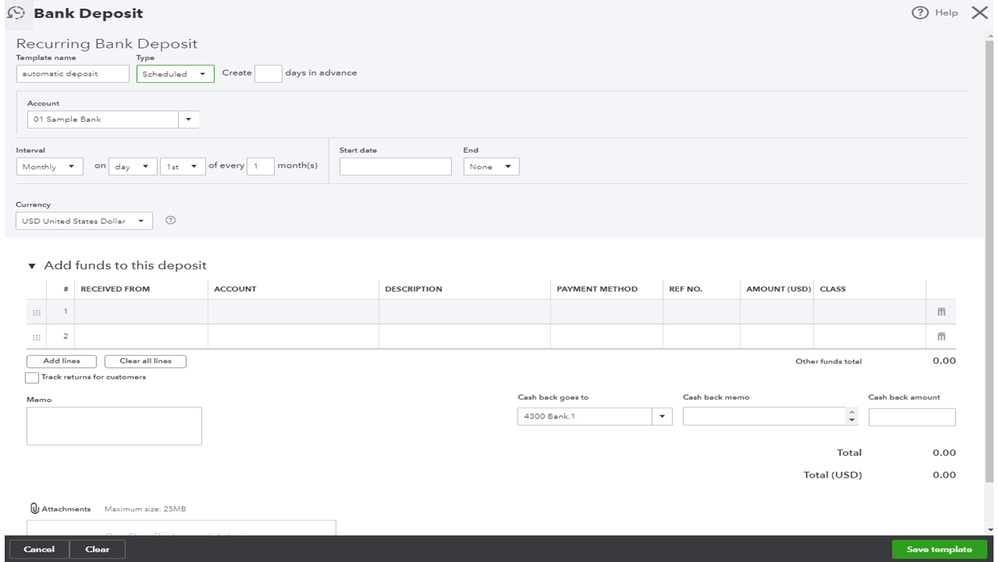

Instead of using a Journal entry, I suggest recording the transaction as Deposit.

Under the Add funds to this deposit section, choose the income account, when entering the wage. In the second line item, select the preferred account where the taxes will be deposited to.

Refer to this article for more information when creating a deposit.

I'll be here if you need more help!

Thanks for your response, MrMiyagi.

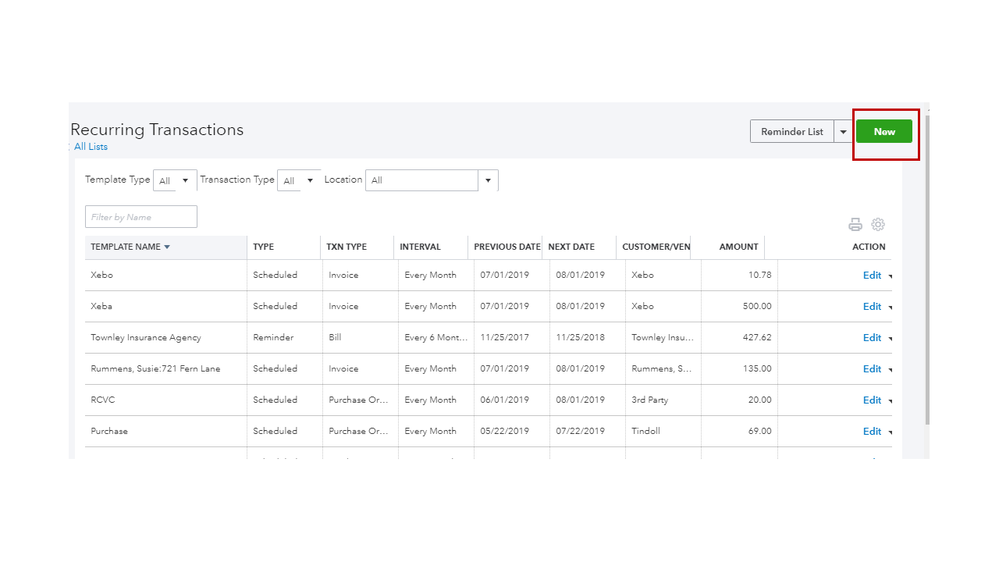

You’re correct, QuickBooks will not allow you to enter a negative amount when setting up a rule. However, the Recurring Transactions feature can help automatically record the entries.

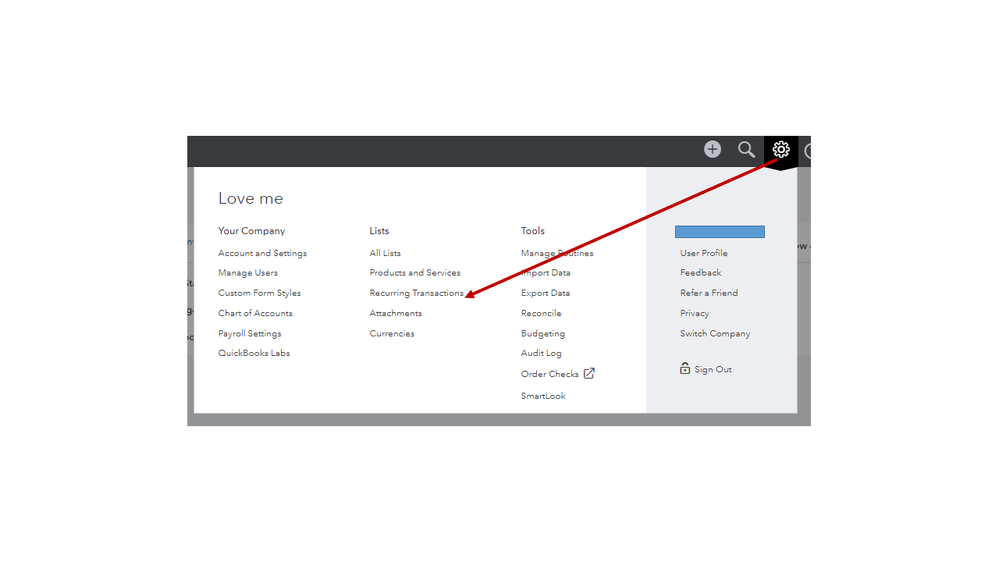

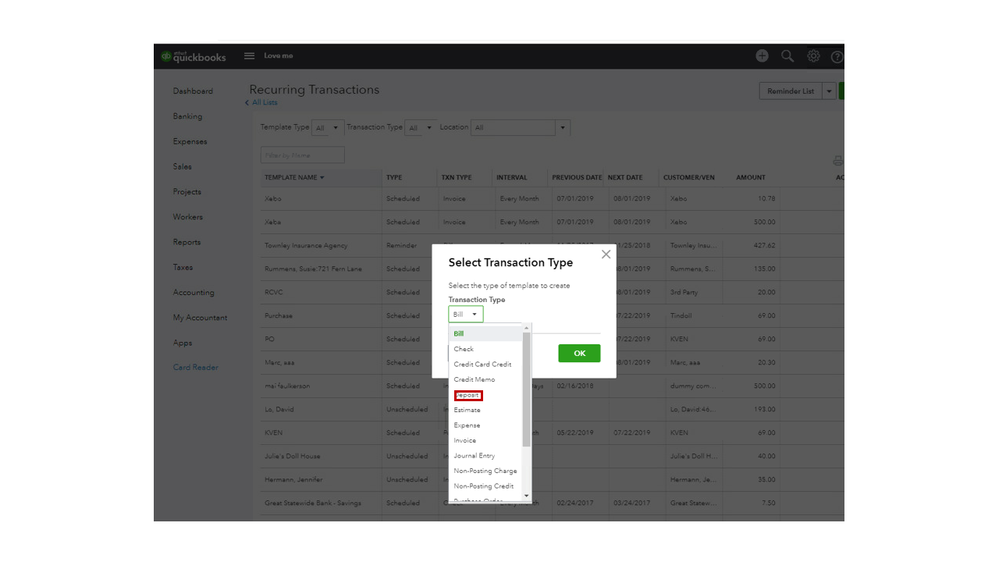

You’ll have to create a template first to input the deposit. Here’s how:

Depending on the Type selected, QuickBooks will automatically record the deposit and post it to the correct bank account . For additional information, check out the following articles:

If there’s anything else I can help you with, leave me a comment below. I’ll be right here to assist further. Have a great rest of your day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here