Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My main goal is to ensure you can match your transactions successfully, angela.

First, I appreciate you sharing details of your concern and the article you've followed to fix this. I've got other solutions we can perform to get around the error encountered.

When you receive payments from third-party merchant services such as PayPal, we can't directly calculate the processing fees. It is because the credit card company deducts bank service fees from the payment. As a result, the payment amount shown on the bank register will not match the deposit amount in QuickBooks Online.

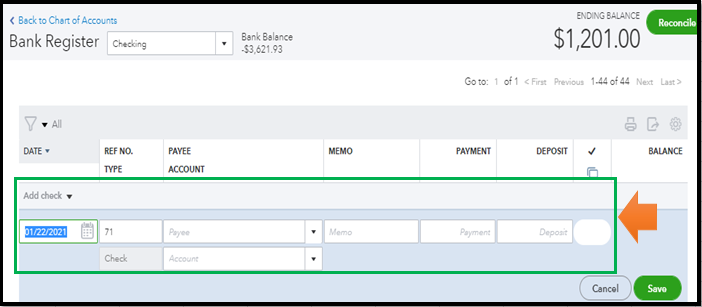

In this case, we can enter the bank service amount into the register. This way, the register balance matches the bank statement balance. I'll show you how.

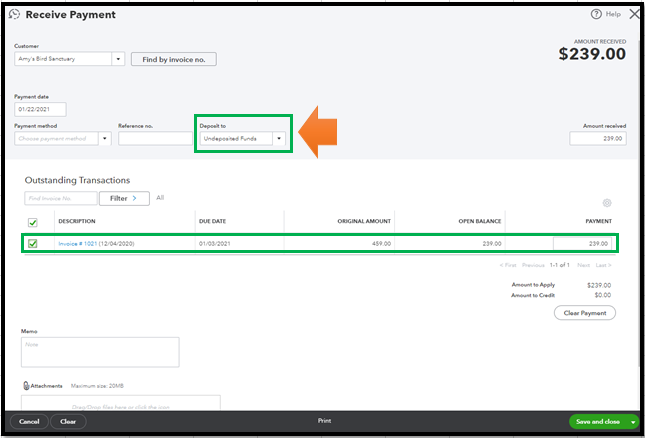

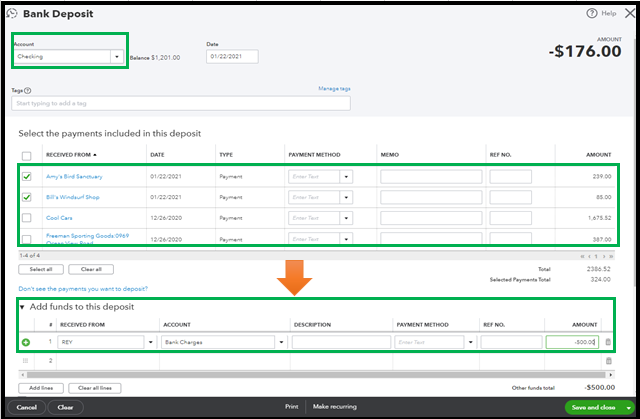

Then, enter the amount as negative when depositing a payment. Beforehand, make sure to deposit the payment in the Undeposited funds account. Here's how:

Next, it's time to create a bank deposit:

For more information, please browse this handy article: Enter a Bank Service Fee while using a Third-party Merchant Service.

After that, start your usual matching process.

In addition, when you use the Resolve Difference feature, an adjustment or journal entry is created. This feature is typically used when you are matching transactions that should have the same amounts, but there is a slight discrepancy.

I'm here to assist you further with any banking insights you may need, angela. Please don't hesitate to reach out if you require any additional assistance. I'm more than happy to lend a helping hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here