Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

When reviewing the accuracy of the transactions entered, I review the transaction listing for each account in both P&L and Bal Sheet. As I work with a lot of overseas vendors, I need to see whether the GST is correct in each account. i can select the GST Code, but not the Tax Amount as it's no longer available.

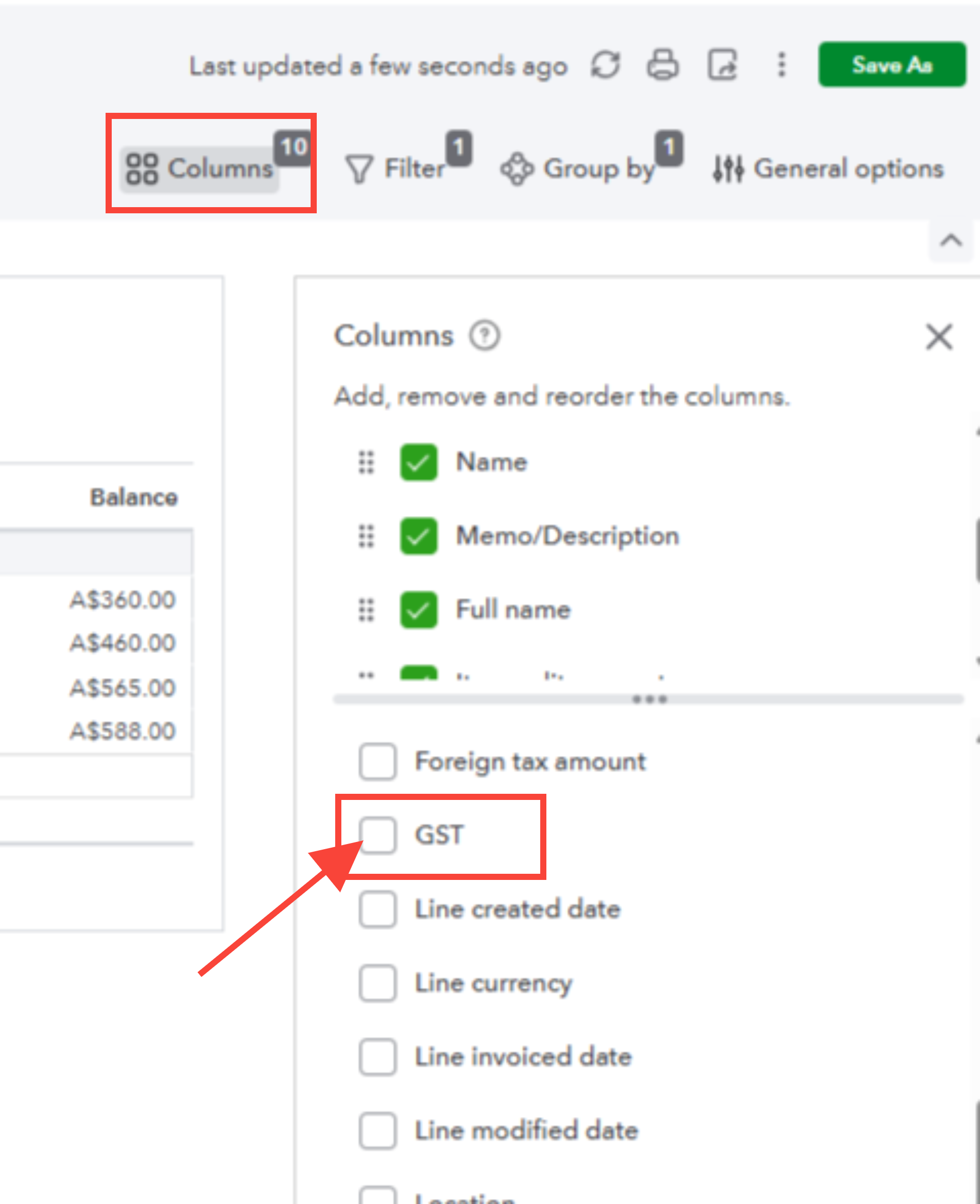

You can add the GST column or the Foreign tax amount column to view the tax amount, Kylie.

Before we begin, could you please confirm if the Multicurrency feature is enabled in your account?

When Multicurrency is turned on, the Tax Amount field will no longer be available and will be replaced by the Foreign Tax Amount column. This occurs because, with the multicurrency feature enabled, all transactions, including foreign transactions, are calculated in their respective currencies to ensure accuracy and consistency across financial data.

To view the Tax amount in the report, you can add the GST column. The GST column displays the tax amount for each specific transaction, allowing you to see the tax amount for individual entries.

To add it to your report, you can follow these steps:

You can also add the Foreign Tax Amount column to your report using the same steps if you want to track transactions in different currencies. This column can also display local transactions.

Once these steps are completed, the report will show the tax details, including the tax amount column you need.

Let us know if you have further questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here