Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hey there, Emi! I'm glad to see the progress you're making with your invoicing. It’s critical to running a smooth operation, and you’re definitely on the right path. Let’s dive into how we can reconcile your QuickBooks Online (QBO) transactions to align everything perfectly.

Follow these steps:

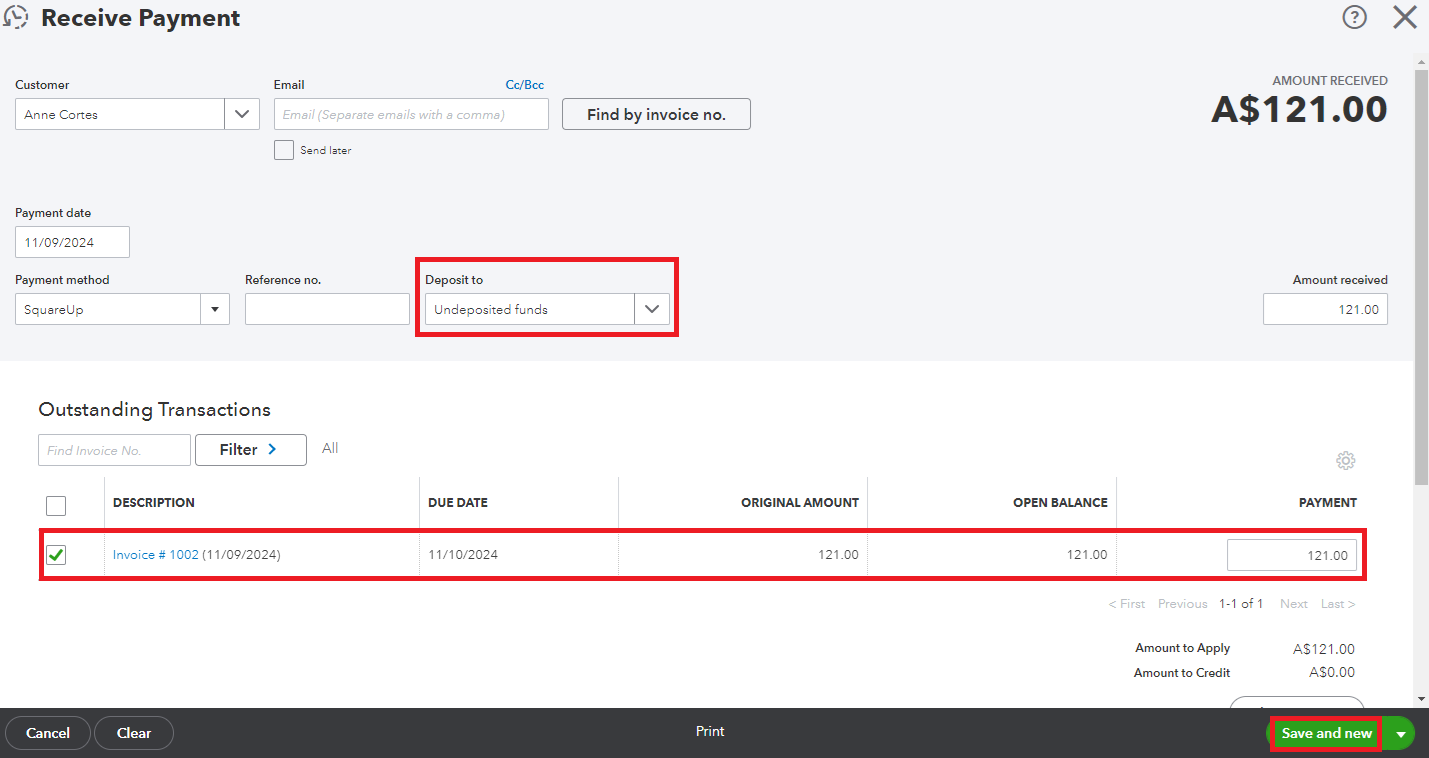

Receive Payment

First, we’ll record the payment and move it to the Undeposited Funds. Here’s how to do it:

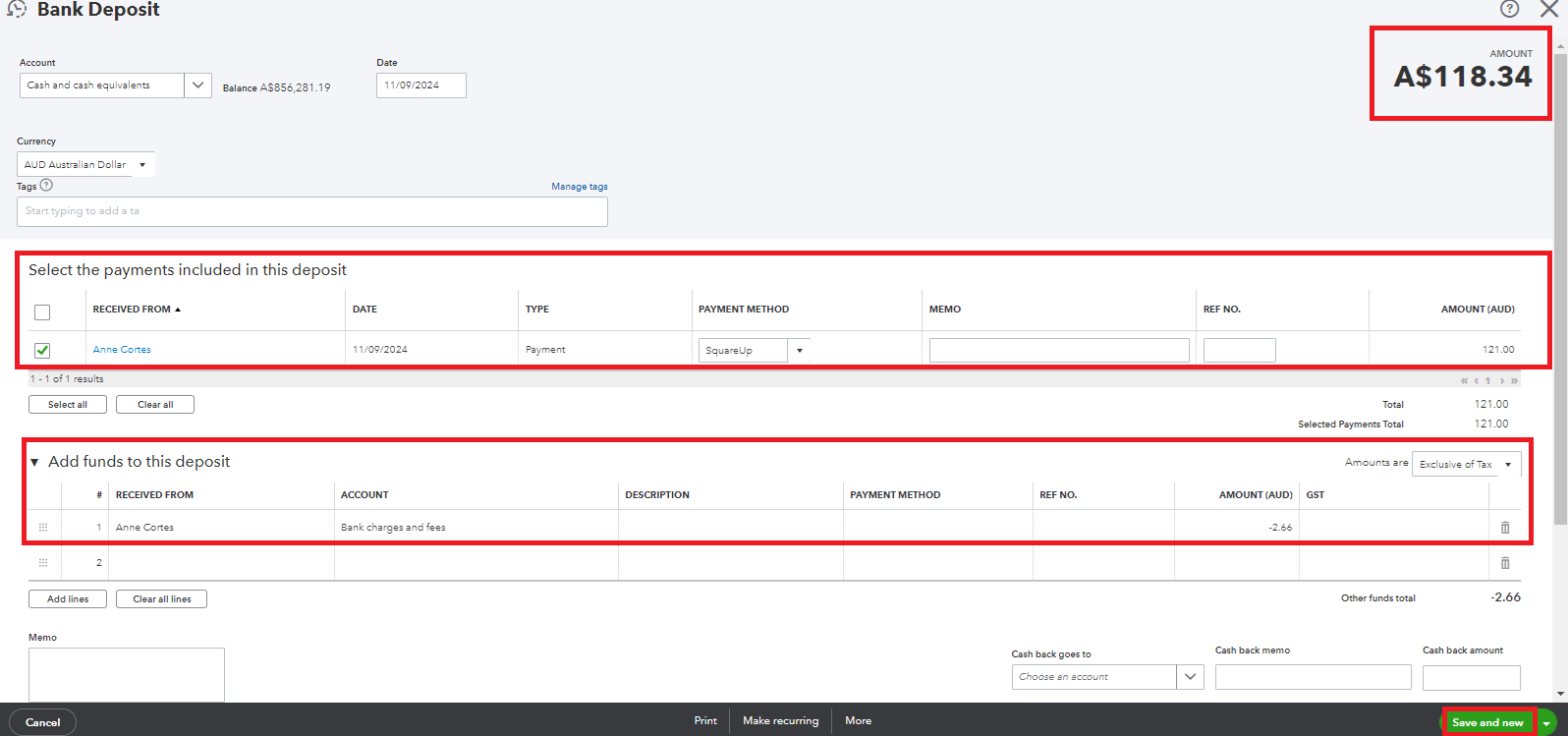

Bank Deposit

Next, we’ll create a deposit reflecting the payment received after deducting the SquareUp bank fee. Here's how:

After you've completed these steps, remember to match the deposit with your bank transactions to ensure accuracy and avoid duplicates.

In case you need more guidance on reconciling your accounts, check out this article: Reconcile an account in QuickBooks Online.

Don't hesitate to circle back if you have any questions or anything else you'd like to discuss. I’m always here to support you. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here