- AU QuickBooks Community

- :

- QuickBooks Q & A

- :

- GST and BAS

- :

- What is the difference between tax exclusive and tax inclusive?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What is the difference between tax exclusive and tax inclusive?

What is the difference between tax exclusive and tax inclusive?

Solved! Go to Solution.

Best answer July 30, 2020

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What is the difference between tax exclusive and tax inclusive?

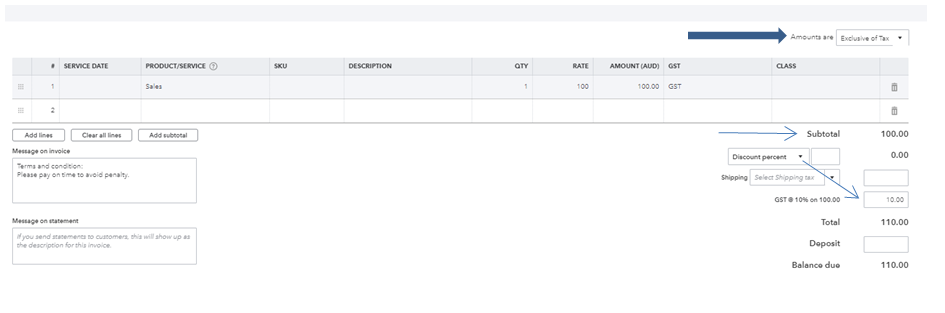

Tax-exclusive

This refers to the amount of tax paid as a proportion of the pretax value of whatever is taxed.

To calculate how much GST to add, multiply by 0.1.

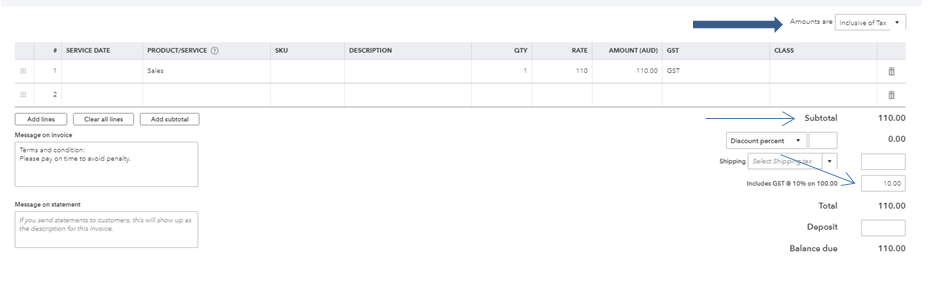

Tax-inclusive

This refers to the amount of tax paid as a proportion of the after-tax value.

To calculate how much GST is included in a price, Divide by 11.

I hope this helps!

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What is the difference between tax exclusive and tax inclusive?

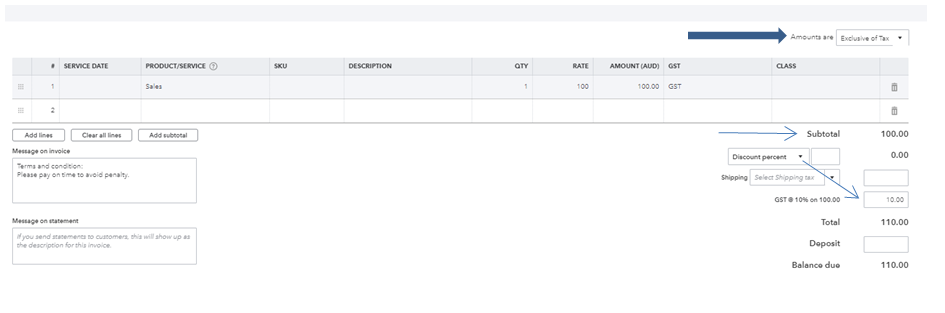

Tax-exclusive

This refers to the amount of tax paid as a proportion of the pretax value of whatever is taxed.

To calculate how much GST to add, multiply by 0.1.

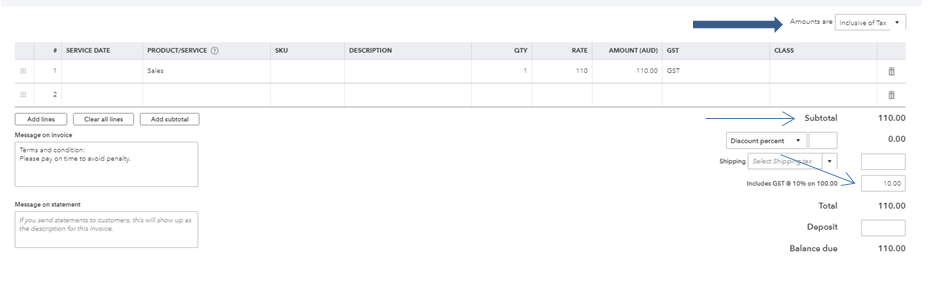

Tax-inclusive

This refers to the amount of tax paid as a proportion of the after-tax value.

To calculate how much GST is included in a price, Divide by 11.

I hope this helps!

Related Q&A