Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi Stephanieluck,

Thanks for posting in the Community!

You'll have to select the Export to Excel or PDF option to be able to download the TPAR report. Here's how:

You can also check this link to learn more about: How to run a Taxable Payment Annual Report (TPAR).

Drop by again in the Community if you have other questions about reports in QBO.

The ATO does not support either PDF or Excel reports when submitting through the ATO file transfer lodgment portal.

You can't lodge scanned images or forms, screen prints, spreadsheets or word processing files (for example, .pdf, .doc, .xls, .jpg, .tif) through file transfer.

How do you get a compliant export report out of Quickbooks for TPAR lodgment

Hi Stephanie,

As o f the moment the TPAR report in QuickBooks Online is for your reference only. E-file format is unavailable in the current features offer. You will have to download the TPAR in QBO and in your downloads change the file type that is supported in ATO before saving it. Then, lodge the TPAR directly to the ATO using the supported file format.

I can understand how important the need to be able to get e-file format for TPAR. I've lodge a product feedback about the option to download supported file and let our engineers know.

If you need help exporting and downloading the TPAR report in QBO, I recommend contacting our Customer Care Team. That way, one of our care agents can help you how to export the report.

Send a reply below if you need more help with QBO.

The efile for TPAR was working last month as I download and lodged the efile for a client on 22/7/24. Are the techs working on fixing this issue as I have several more to do and do not intend to physically type each one in the format required by the portal. A quick and timely reponse for all of us would be appreciated

Hi Sheelagh,

Thanks for joining the thread!

There is an ongoing Product Investigation INV-109753 about No option to download TPAR in QuickBooks Online and our engineers have made aware of this behavior.

I recommend contacting our Customer Care Team. That way, they can add your QBO file to the affected list so that you can get notification via email once a fix has been deployed.

Post again in the Community if you have other QBO concerns.

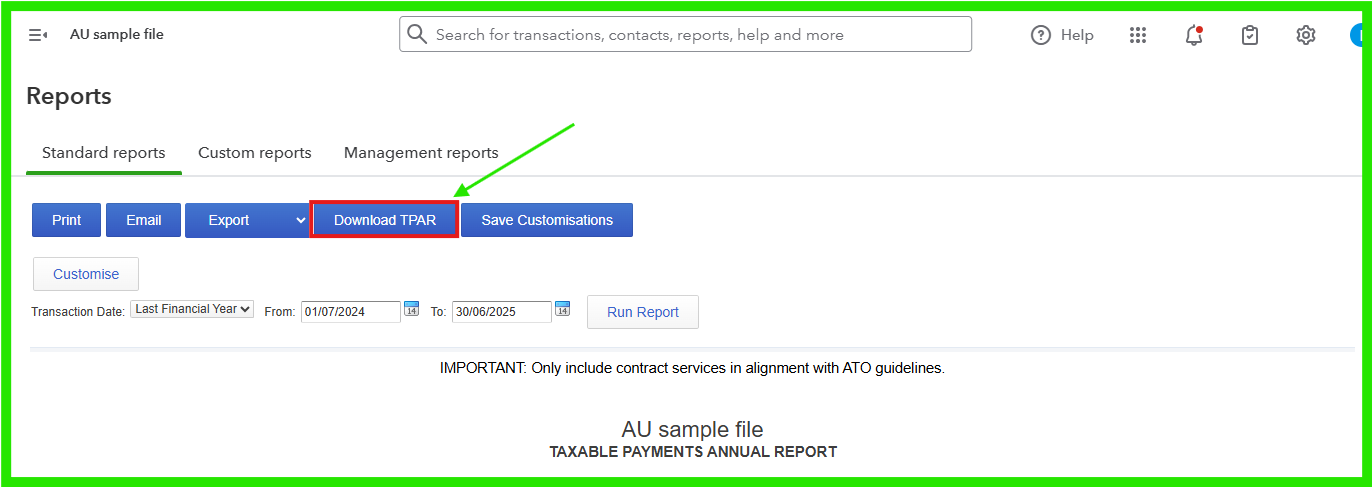

I'd be happy to help you download the Taxable Payments Annual Report (TPAR) in QuickBooks Online (QBO), LiJoo.

In QuickBooks Online (QBO), you can download your TPAR electronic file, which can then be uploaded and lodged via the ATO.

Here's how:

Please ensure all contractor payment data in the report is accurate and complete before downloading. The system will allow you to review the report for any errors before submission. You can check this article for more steps to ensure you can download the report seamlessly: TPAR reporting in QuickBooks Online.

We encourage you to contact the Australian Taxation Office (ATO) for more detailed assistance. You can also visit their official website, which provides comprehensive information and resources to help you with your tax-related questions.

Our Community Space is available for any questions or clarifications regarding QuickBooks. Feel free to reach out by clicking the Reply button below.

I downloaded Tpar report as an excel file for my accountant to lodge digitally. He said the file format is not acceptable and it has to be in WinZip format? Also, he said the company ABN has to be included in the Tpar report. Would appreciate help to do this.

I appreciate your prompt response, LiJoo.

Before we proceed, may I kindly confirm if you’ve completed the steps shared by my colleague earlier? The instructions provided will guide you through the process of downloading the acceptable format, which is the EFILE format for lodging the Taxable Payments Annual Report (TPAR) with the Australian Taxation Office (ATO).

Your accountant is right. Ensure that your business's ABN is correctly entered in the Account and Settings section under the Company tab in QuickBooks Online. This ABN will be displayed in the header of your TPAR (Taxable Payments Annual Report) to identify your business. After you download the report, QuickBooks will convert it into the EFILE format, ensuring that your company's ABN is included in the file for submission.

After you have downloaded the TPAR e-file, you can then compress it into a ZIP file. This is a manual process that you do on your computer, not within QuickBooks.

For more information about the Taxable Payments Annual Report, you can check out this article: To know more about TPAR reporting in QuickBooks.

As always, you can drop a comment below for further questions. We are here to assist you.

Disclaimer: I have updated my response on how to convert the TPAR report into a .winzip format.

Hi there,

I have followed the steps correctly and downloaded an EFILE and done a test file transfer and it has still failed.

Here is what my validation report said.

TEST FAILED FILE FORMAT VALIDATION REPORT

Your File report (1).efile was received by the Australian Taxation Office. File submitted is for test only and is NOT lodged. The file contained errors that prevented processing it further.

The errors found are listed below. Please correct the errors, then re-test the file before lodging.

================================================================================

Validation status: Test failed

Document name: report (1).efile

ATO Reference number: 2515724276846

File type:

Date/Time file received: 12/08/2025 14:10:56

File size (bytes): 78153

File sent by: ########

Reason: Please contact your software developer. The file size is not a correct multiple of the record length.

=================================END OF REPORT=================================

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here