Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

When a pay run is split between two financial years and the super rate has changed does it use both rates?

Yes, the only way that there will be two different super rates for a single pay run is if a pay category's super rate has been overridden, admin380. I'll discuss this in detail.

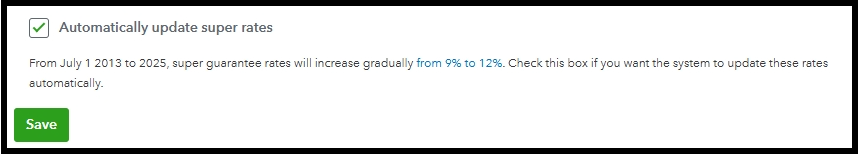

The system calculates the superannuation based on the applicable rate for the portion of the pay period that falls within each financial year. Ensure that the superannuation settings are updated to reflect the new rates for accurate calculations.

To override the Pay Categories super rate please follow these steps:

For more information, kindly visit this article: Superannuation Guarantee changes in QuickBooks Online.

Additionally, you can conveniently pay employee super contributions directly to any registered super fund by utilizing the built-in integration with the Beam super fund clearing house.

We are still here to assist you if you need more help with payroll. We will keep this thread open for your comments.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here