Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

How do i show that money actually went against the debt and pay off last qtrs credit and credit it also to the qtr with the debt?

You have two options for recording your GST payment, @rebecca16.

The first option is to record the refund as a deposit and the GST payment as an expense and the second option is to use a journal entry to offset the debt.

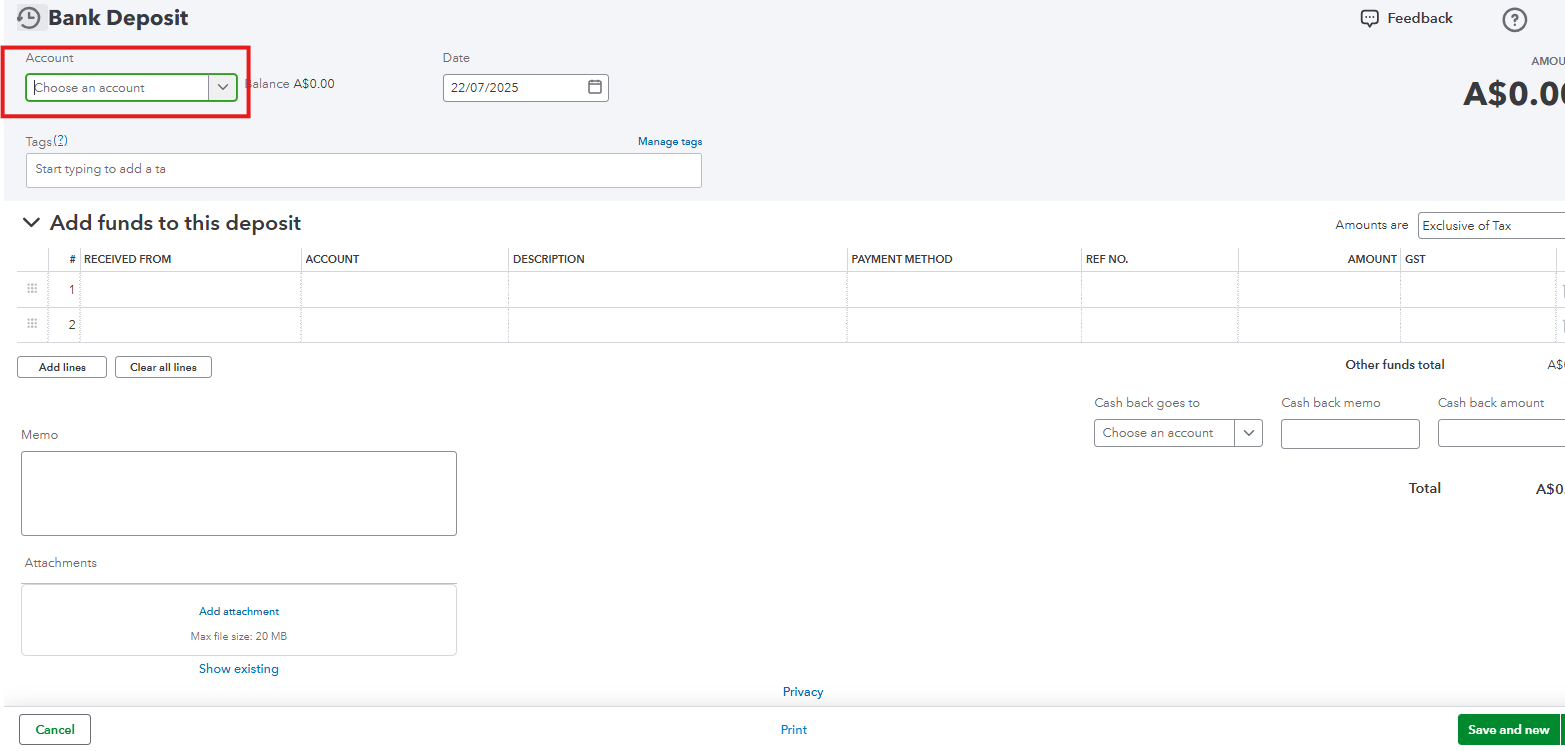

Here's how to record it as deposit.

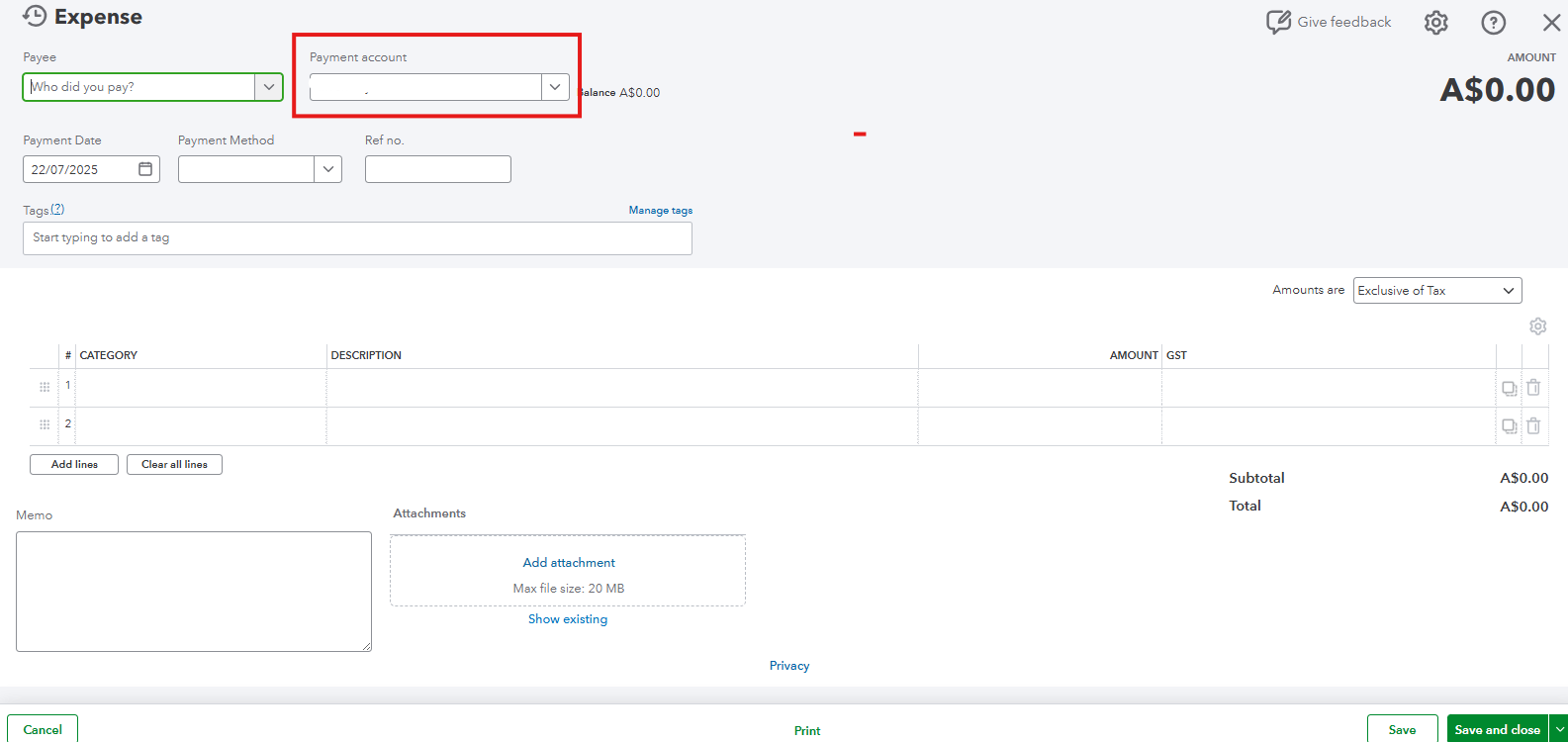

Once the refund is recorded, you can then enter the GST payment as an expense

For recording through journal entries, I recommend consulting your accountant. They can advise on the correct debits and credits to ensure everything is recorded properly.

Please let us know if you have further concerns or clarifications.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here