Thanks for visiting the Community today, faith5.

We’ll have to set up the tax in QBO and make sure to select the Purchases box. Doing so ensures you can claim back for the IRAS.

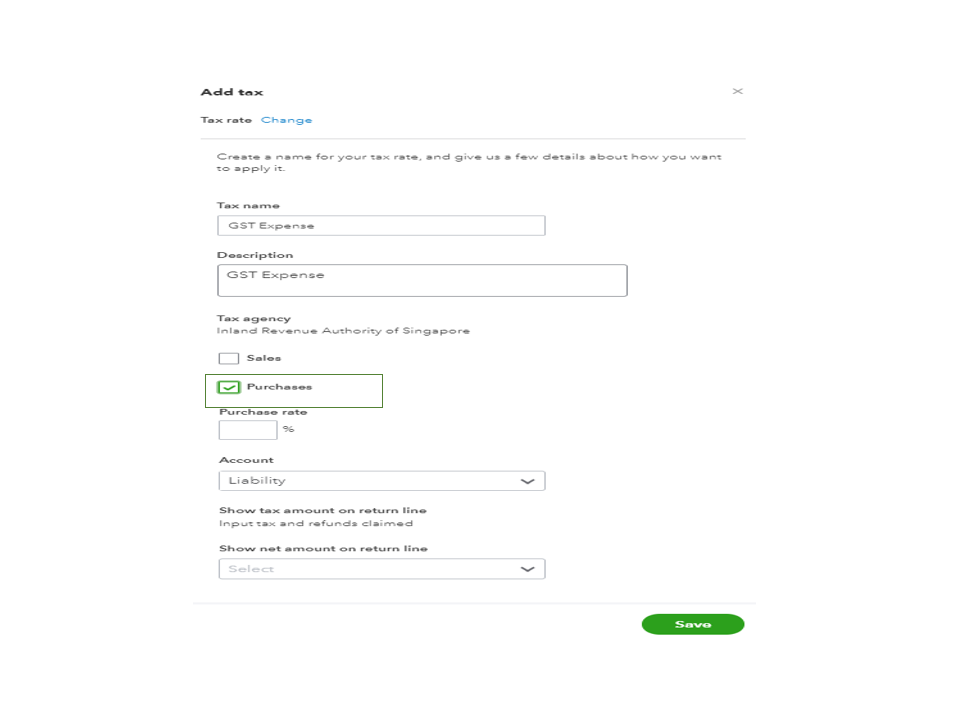

- Tap the Taxes menu on the left panel and hit the Add tax menu.

- Choose the Tax rate option to open the Add tax window.

- Fill in the field boxes with the correct information.

- Tick the box for Purchases and enter the rate in the Purchases rate box.

- Select Liability from the Account drop-down.

- Pick the appropriate option in the Show net amount on the return line drop-down.

- Hit Save to keep the changes.

After setting up, you can create an expense using the newly created tax rate to track the transaction. Let me share these articles to learn more about managing expenses and setting up GST.

If there’s anything else I can help you with, feel free to post a comment below. I’ll get back to assist further. Have a great rest of the day.