Hello there, roslyn.

Here are the steps to set new GST in purchases in QuickBooks Online.

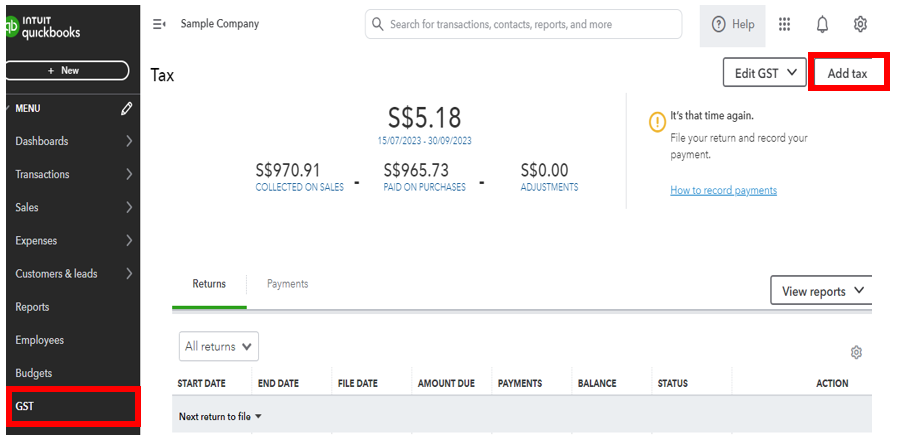

- Go to the GST menu.

- Click the Add tax button in the right corner.

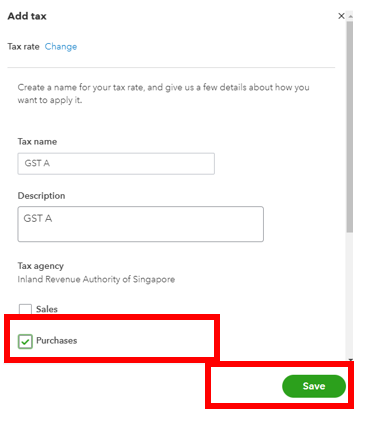

- Select type of tax you want to add. For example, Tax rate.

- Enter tax name and tick the Purchases box.

- Enter purchase rate. Then, make sure to select necessary information.

- Hit Save.

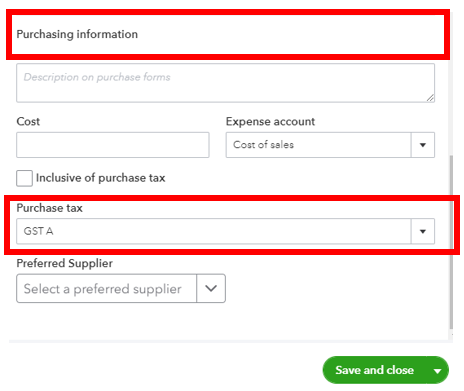

To apply this to your purchases, you can follow these steps:

- Go to the Sales menu and select Product & services.

- Click New. Then, choose product information.

- Enter all information.

- Scroll down in the Purchasing information section, select the Purchase tax drop-down arrow.

- Select the tax rate you created.

- Click Save and close.

Please let me know if you have more concerns about adding tax rate in QuickBooks. I'm here to support you an