- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Paid bills show as unpaid in the Pay Bills window

Hello,

In the A/P Aging Reports, I have one vendor showing an open balance. When I look at detail, there is a Bill and a Bill Payment that match the open balance. When I click transaction history for the bill payment, it shows it was applied to the bill. The bill (which is marked paid) shows the bill payment in its history. Everything agrees. No open balance shows in Vendor Center, only in A/P Aging.

To further investigate, I found the transaction in the A/P register and ran a Quick Report on the Vendor. Sure enough, it shows the Bill, marked paid, followed by the Bill Payment, which is strangely marked "Unpaid," thus showing an open balance. This bill payment check has cleared, and from all I can see in transaction history, was applied to the bill.

To experiment, I selected a check from the vendor in the Pay Bills screen, and sure enough, a credit for the amount in question is displayed.

Something is out of whack - any help?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

"Let's review that a 0 balance on the report means things are not applied to each other.

The request to Zero Out a balance means you Do Not Already have the offset or something that needs to be applied to it. Having a balance means it is waiting for you to Deal with it. Having a Zero Balance, but showing on the report, means things did not get Linked to each other, so the Math of the balance for the name is Zero.

These are two completely different conditions.

If you have an AP balance that you want to Offset, a positive balance or Bill is offset with a Bill Payment or a Vendor Credit. A negative AP balance means you have no Bill entered."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

"any other suggestions to zero out my open balance showing up on A/R report?"

Let's review that a 0 balance on the report means things are not applied to each other.

The request to Zero Out a balance means you Do Not Already have the offset or something that needs to be applied to it. Having a balance means it is waiting for you to Deal with it. Having a Zero Balance, but showing on the report, means things did not get Linked to each other, so the Math of the balance for the name is Zero.

These are two completely different conditions.

If you have an AP balance that you want to Offset, a positive balance or Bill is offset with a Bill Payment or a Vendor Credit. A negative AP balance means you have no Bill entered.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

When bills, which are already paid, show as unpaid in the Pay Bills window, or, in this case, the A/P Aging Report, check if there are available credits (from unapplied bill payments, recorded credits, or journal entries to the Accounts Payable account) that should be applied to those bills. Another possible issue, though less likely occurrence, is transaction damage.

Before proceeding with the recommended solutions below, use Vendor QuickReports to verify if the bill showing as unpaid is actually paid.

- From the Vendors menu, select Vendor Center.

- Right-click the vendor of the bill in question, and select QuickReport.

- Set the date of the report to All.

- Find and double click the bill that shows in the Pay Bills window.

If the bill was paid, select History (or press Ctrl+H) to see the details of how it was paid. If not, proceed with the solutions below.

Check and apply available credits

|

Important: This solution applies if there is available credit balance that came from unapplied bill credit, payment, or a journal entry to Accounts Payable. |

- From the Vendors menu, select Pay Bills.

- Select the bill in question, then select Set Credits.

- Go to the Credits tab and see if there are available credits.

- If a credit exists, select the credit and click Done.

- Select Pay Selected Bills.

If after following the steps in this solution and the bill still appears unpaid in the Pay Bills window or Unpaid Bills Detail Report, the transaction might be damaged.

Troubleshoot damaged bill payment or bill

Solution 1: Edit the transaction

- Create a backup of the company file.

- For reference, take note of the important information of the bill payment check like Date, Amount, and Vendor Name.

- Change the date of the bill payment check.

- Open the bill payment check associated with the bill.

- Change the date to 10 years in the future.

- Select Save & Close.

- Re-open the bill payment check and change the date back to its original date.

- Select Save & Close.

If the bill still shows as unpaid, proceed to solution 2.

Solution 2: Delete and re-enter the bill payment check and bill

- Create a backup of the company file.

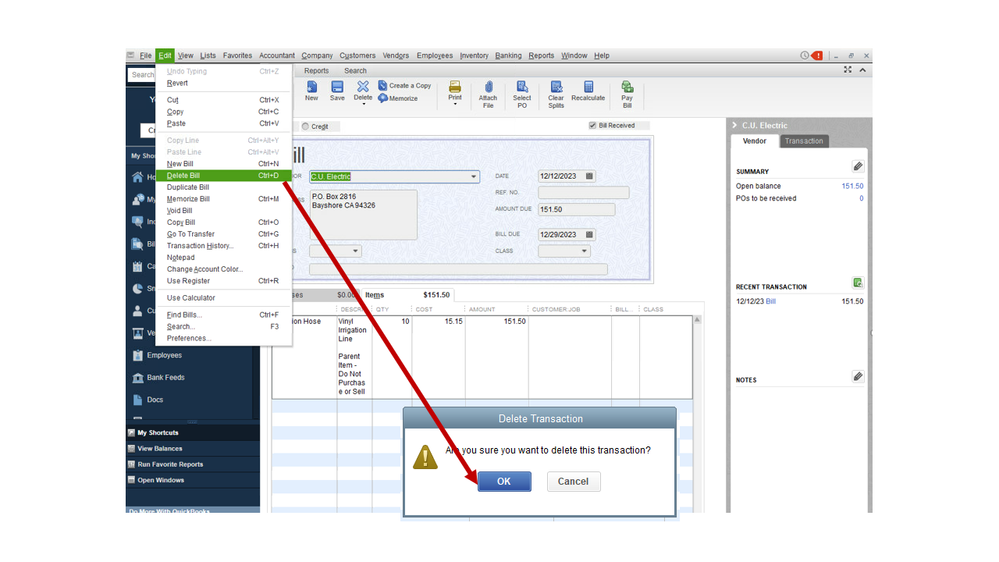

- Delete the bill payment check.

- From the Unpaid Bills Detail report, double-click the payment check.

- Take note of the Date, Check Number and Amount.

- On your keyboard, press Ctrl+D to delete the transaction.

- Select OK to confirm the action.

- Close the currently displayed check.

- Delete the bill.

- From the Unpaid Bills Detail report, double-click the bill.

- Take note of the Date, Reference Number, Accounts, Items and Amount.

- On your keyboard, press Ctrl+D to delete the transaction.

- Select OK to confirm the action.

- Close the currently displayed bill.

- Re-enter the bill and bill payment check using the same information from the original transaction.

Note: If the bill payment check has been cleared, a mini-reconciliation is necessary.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Just to understand this relationship. Why shouldn't we use JE for AP or AR? This should be natural in accounting. Could you explain the relationship between the AP module, the vendor names and the effects on the G/L?

I am trying to clear some small AP vendor balances and I need some help.

I originally created a journal entry and adjusted the balances to $0. But then I noticed that even if the amount was at $0 the bill still appeared as over 90 days on my aging. I reversed the entry as I thought there had to be another way. I also tried a vendor credit but again the amount keeps showing in 90 days and over. As I keep reading I find that I was doing it originally right and all I was needing was to check the credit on the pay bill section but now as I posted and reversed the entry It does not appear on the pay bill section to select the credit.

How can I write off these payables correctly and take them out of my AP Aging?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Hey there, @iankairos,

I see that you've posted the same question twice, and the other one was already answered by my colleague Rasa-LilaM. Just in case you haven't been notified of the new response, here's the link: https://quickbooks.intuit.com/community/Transactions/Clearing-out-old-transactions-from-Accounts-Pay...

In order to keep the conversation streamlined, I'm going to ask that you post any responses there.

Feel free visit the Community for more questions and I'll be happy to answer them for you. I hope you have a great week ahead.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Hi, I've been trying your fixes for this error, and sadly no success. I enter the bill. It appears correctly in the pay bills window. I pay the bill, the vendor now has zero balance. However, the invoice has magically reappeared in the pay bills window. There is no balance owing in the vendor home page, and no balance owing in the AP summary. There are no credits to apply.

If I tick and untick the bill to apply the payment to in the payment screen, the amount owing somehow doubles.

This has not happened to any other payable invoices.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Thanks for reaching out to us here in the Community, @Wray.

Based on the information provided, it looks like the transaction is damaged. To resolve the issue, let’s delete and recreate the bill and bill payment.

Before proceeding, it’s always a good idea to create a backup copy of the company file. Next, open the Unpaid Bills Detail Report and double-click the bill to see the complete details.

Please note of the Date, Check Number and Amount. You'll need the following information when creating the transaction.

Now, let’s go ahead and remove it. Here’s how:

- On the Bill page, choose the Edit menu to select Edit Bill.

- In the Delete Transaction window, hit the OK button to confirm the process.

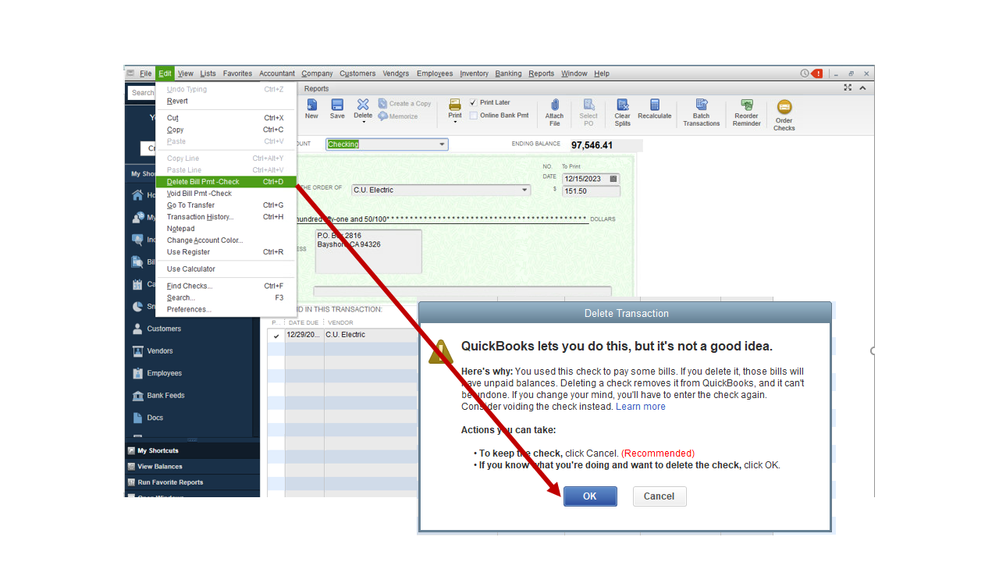

To delete the bill payment check:

- Open the transaction.

- Choose the Edit menu then pick Delete Bill/Bill Pmt-Check.

- Click OK to confirm the action.

The following article provides detailed information when to void or delete a transaction: Bill or bill payment check.

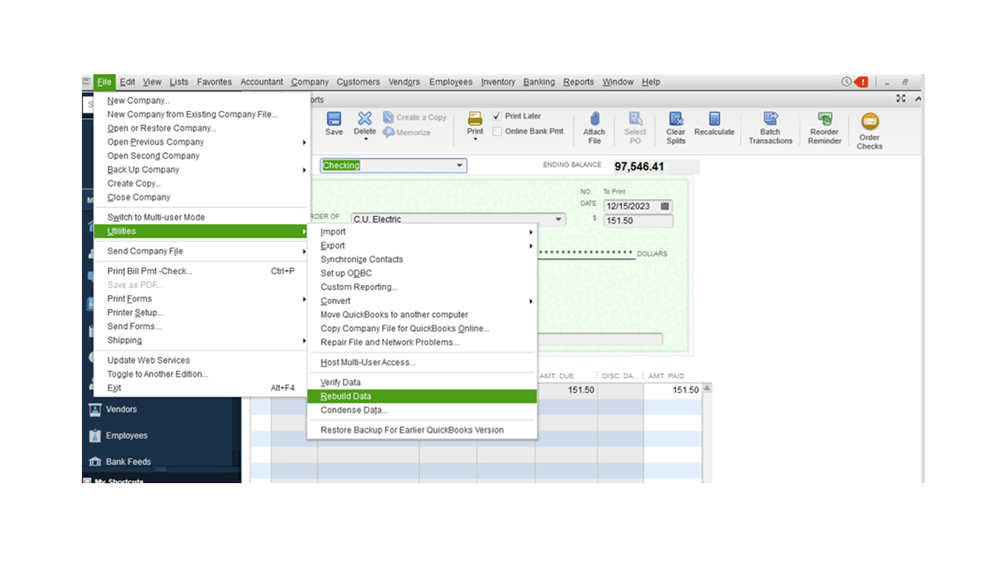

Next, re-enter the bill and bill payment check using the same information from the original transaction. However, if none of these suggestions work, run the Rebuild and Verify Data utility tools to detect any issues in your company file and to correct it.

Here's how to rebuild:

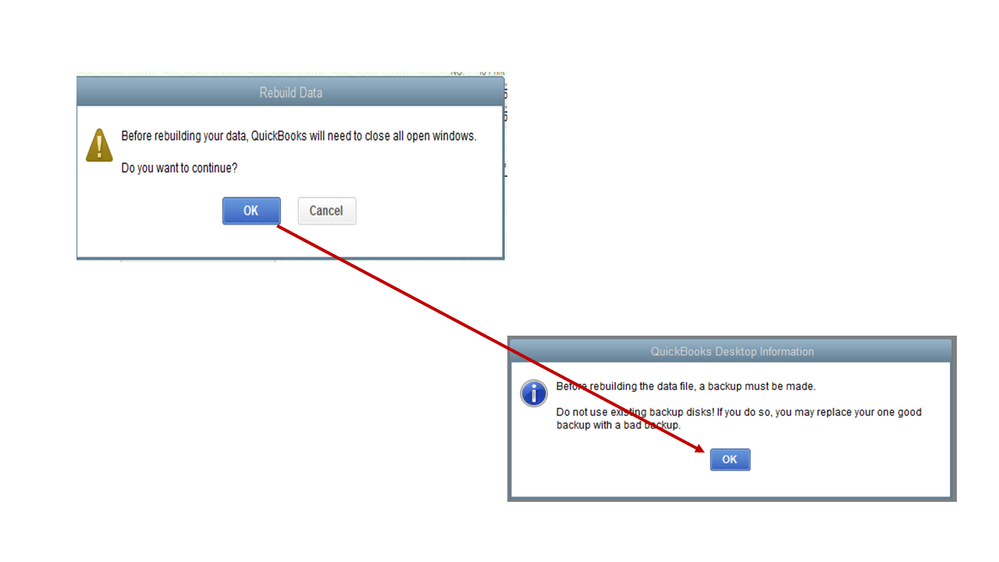

- Go to the File tab to select the Utilities menu, and then choose Rebuild Data.

- When the QuickBooks Desktop Information window opens, hit the OK button.

- Follow the on-screen instructions to create a backup copy.

- Click on OK once you see the following message “Rebuild has completed”.

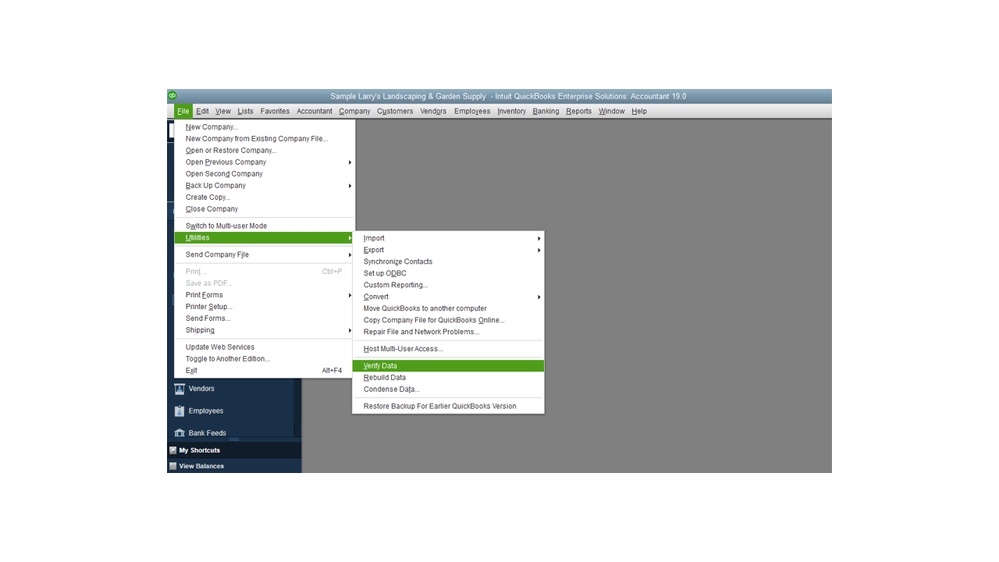

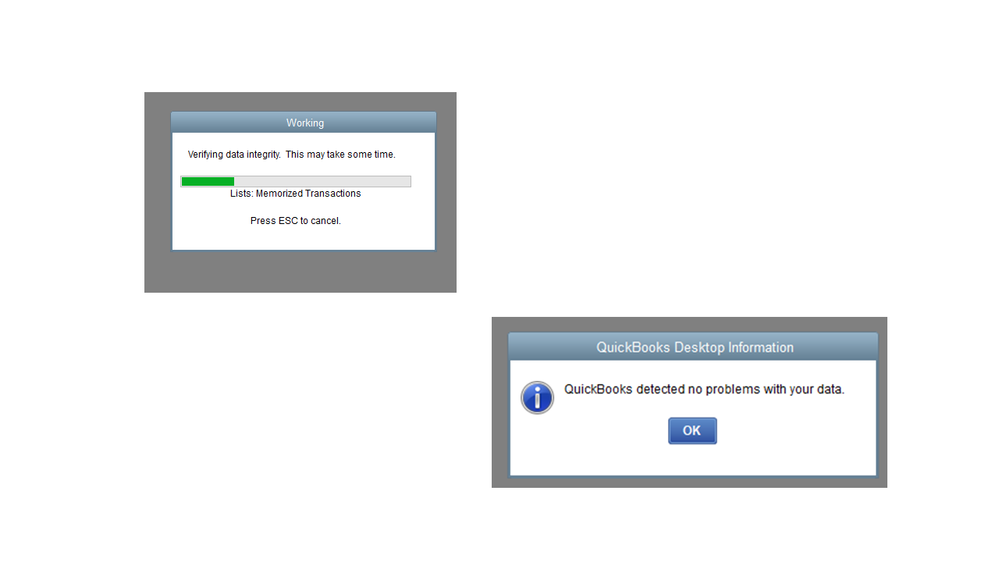

To verify the data:

- Go to the File tab to select the Utilities menu, and then choose Verify Data.

- Once you see receive this message “QuickBooks detected no problems with your data”, click the OK button.

- If the tool finds an issue with your data, you’ll be prompted to Rebuild Now or View errors.

- Hit OK and continue performing the troubleshooting steps.

For detailed instructions, go directly to the Review Last Verify/Rebuild section to continue. Click here to view the steps.

For future reference, check out the following article: A paid bill or invoice shows on report or window of open transactions.

Stay in touch if you have any other concerns or questions. Please know I’m always ready to help you. Have a good one.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Thank you for your suggestions. Unfortunately the rebuild and verify utility showed no errors. I tried changing the transaction date to 20 years ahead, and change it back. That also did not clear the error. Other transactions are not showing any problems at all. I have deleted and re created this item a number of times. I post a partial payment, and the correct balance owing shows in the Pay Bills window. I can post partial payments until only $1 is owing, and the correct outstanding amount shows in the pay bills window. But as soon as I pay the remaining amount, suddenly the entire invoice is showing as payable again. But only in the pay bills window, not in the vendor list or the AP summary. There are no unapplied credits linked to the invoice.

It is very strange.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Hi there, @Wray.

I appreciate you going through the steps provided by my colleague above, Let's try to check if there are Checks or Journal Entry link to that bill. I'm here to guide you how.

A bill that is linked to a check or journal entry will still show as payable in the pay bill window. To check:

- Open the vendor profile of your vendor.

- Click View as a Report under the Run Report drop-down menu.

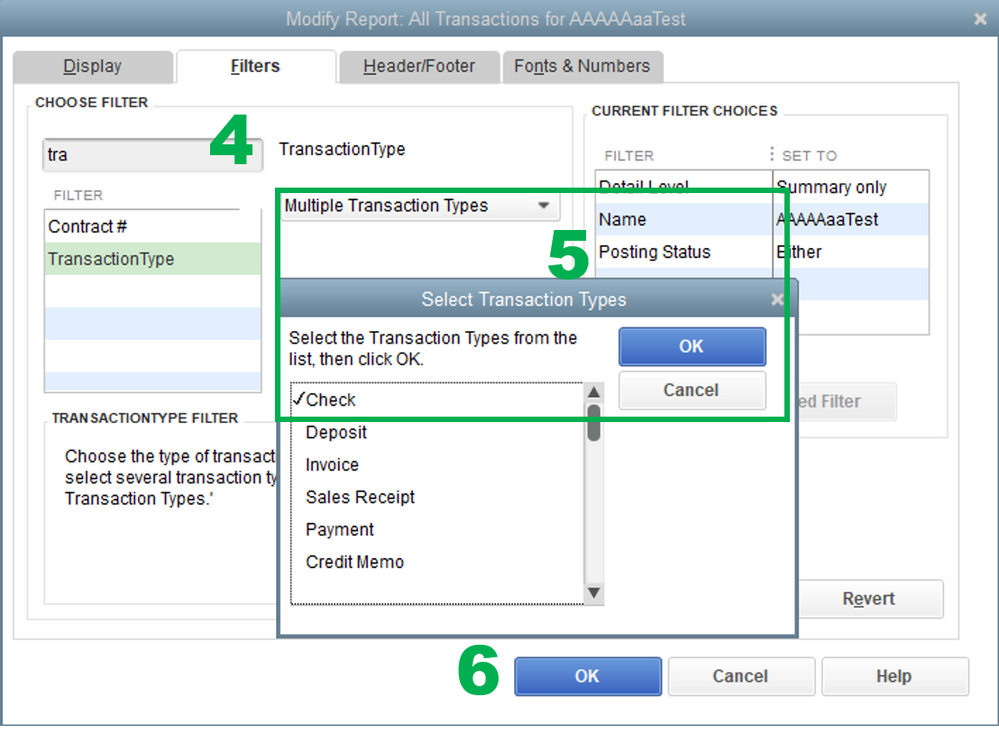

- Click Customize Report.

- In the Filters tab, select Transaction Type.

- Choose Multiple Transaction Types and select Check and Journal then click OK.

- Click OK again to run the report.

If the report shows a journal entry that is linked to that bill, I suggest reaching out to your accountant for further assistance on why the Journal was created.

If there is a check link to that bill, you'll have to remove the check and pay the bill or link the check to the bill. You can refer to this article for the detailed steps: Bill Shows as Unpaid After Writing a Check.

I'm also adding these articles that can help guide you in your future tasks:

- Record vendor prepayments or deposits for prepaid parts or services

- Record a vendor refund in QuickBooks Desktop

If you have other concerns or questions, don't hesitate to reach out to us. We're always here to help.