Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm confused and need some help.

Thanks for posting here, @sgmken,

I want to make sure you're able to record the entries correctly in QuickBooks.

Regarding the transaction for 2/19/21, you can simply create and deposit the sales receipt to the Undeposited Funds account. Make sure to use the exact amounts received that appears in the bank statement fro reconciliation purposes.

Then, create a bank deposit with the credit card fee so you can match it with the bank entry.

Enter a Bank Deposit for the credit care fee to relieve the balance from Undeposited Funds account.

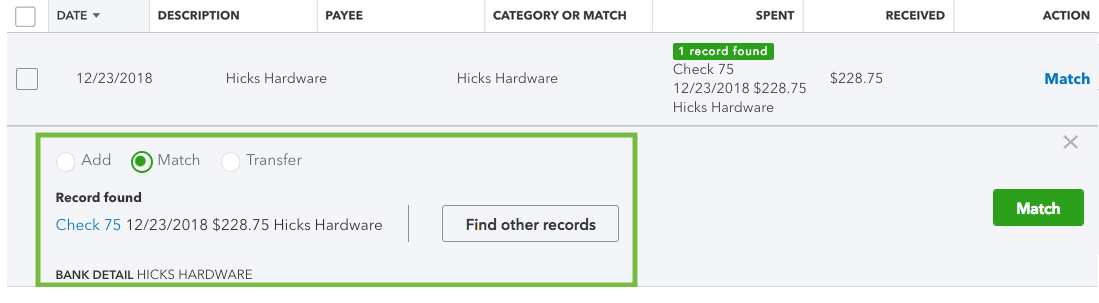

You can now match the transaction to the online banking transaction. Here are the steps with sample screenshot:

See this article to learn more about managing bank transactions in QBO: Categorize and match online bank transactions in QuickBooks Online.

Regarding the refund process, this article will help you record them: Record a customer refund in QuickBooks Online

Let me know if you have any other questions or concerns. I'll be right here should you need further help. Have a good one!

Hi Jen,

Thank you for the reply. I think I understand.

But what about the next deduction that has the refund, plus a few other sales attached to it. Same process?

Thanks for getting back to us here, @sgmken.

Yes, you can follow the same steps that my colleague has provided to record these transactions. That way, you'll be able to match them with your downloaded transactions.

Here are the guides for details:

Additionally, feel free to browse this link here if you need help with other tasks in QBO. It has topics with articles that'll guide you through the process.

Drop a comment anytime if you still have questions or concerns with credit card transactions. I'll be around for you. Stay safe and have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here