Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi Attempte,

I want to ensure that your concern with recording daily sales gets resolved in no time. With that, can you tell me more about it?

I'd also appreciate it if you could add a screenshot of how you record the transaction.

Once I have these details, I'll be sure to get back to you the soonest.

Thanks Adrian

CCD = Credit Card

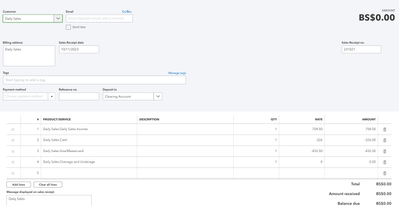

I followed all the information on the Quickbooks entry for how to set up daily sales from a restaurant. I thus ended up with this as my template:

How to enter daily sales from QB.

Why doesn't it then show up AT all when I go to my "bank deposit" as per step 6. I can not batch this at all as it literally doesn't exist?

Help - with many many thanks

Thanks for getting back to the thread and adding a screenshot, @Attempte.

I'd be glad to share additional insights on how to record daily sales in QuickBooks.

Upon checking the screenshot that you've shared and performing the same steps, I was able to see the items in the Bank Deposit window. You can check the sample image below for your reference.

Let's make sure to follow the Income accounts used in tracking these items. For your reference, you can check out this article: Record your total daily sales in QuickBooks Online.

If you've already verified the steps and still getting the same results, I'd suggest running some troubleshooting steps. There are times when too much cache accumulated in a browser can cause unexpected behavior with the product. To isolate the issue, let's open your account in a private window. Simply press the following shortcut keys to access this mode:

If it works, let's clear your browser's cache to delete temporarily stored files and free some space on your browser. You can also use other supported, up-to-date browsers to be thorough.

I've also added this handy article about income and expenses for additional resources.

If you have other questions about recording daily sales, please let me know. I'd be glad to help. Have a good one.

Something is very wrong.

When I enter the way QB seems to want to have it - they do NOT show up in the Bank Deposit. I have triple checked my entries.

Here is a "go around" (9/22 example) which was the only way that I could get it to show up in Bank Deposit.....but it doesn't then show under the income of Daily Sales - it literally goes to Payments to be Deposited.

10/11, which I think I have done everything as per the. QB pages that you also sent through, doesn't, in any way whatsoever show up when I click on Bank Deposit.... I have CASH as being reported to an income account as you can see - maybe I should have it going to the bank account Payments to Deposit instead but that is a straight deposit to deposit scenarios.

Can I hire you for an hour to help

I can help you with recording your daily sales transactions to your undeposited funds account, @Attempte.

Can you try to check the Account that you used when setting up your American Express and Cash from your Products and services.

Refer to the steps below:

Here's more information about your total daily sales using a single sales receipt: Record your total daily sales in QuickBooks Online.

From here, you can now combine transactions in QuickBooks with a bank deposit: Record and make bank deposits in QuickBooks Online. It'll also guide you with managing your bank deposit transactions.

Let me know if you need further help with your daily sales transactions. I'm always here to assist. Have a wonderful day!

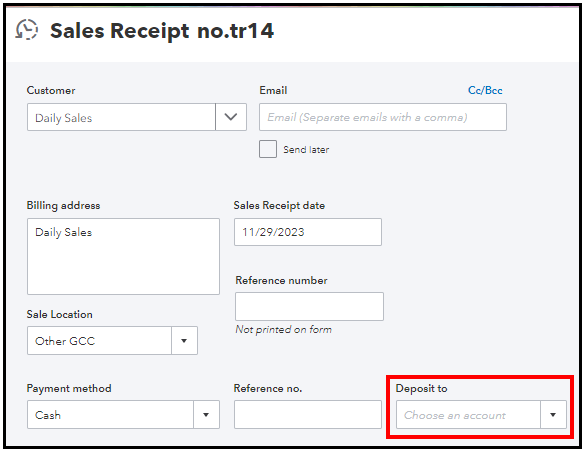

Thank you so much. I don't actually have American Express set up but I do Cash and it is indeed Into an income account called Undeposited Funds as per screen shot provided

Thanks for clarifying things out, @Attempte. Allow me to chime in and help you resolve this.

I’ve reviewed all posts and recommendations in this thread. Based on your screenshot, your sales receipt Deposit to dropdown is set to Payments to deposit.

You’ll want to select either a Clearing account or Undeposited Funds (UF) to ensure all associated daily sales transactions will show up in the report. Just make sure to move the funds from UF to the right account so everything is tracked correctly.

Here's how:

If you get the same results after changing the account, it's best to contact our support team to investigate it further. Our representatives have the necessary tools to diagnose the issue and help find more solutions.

Before that, check out our support hours so you’ll receive responses quickly. Then, follow the steps below to connect with us:

If you want to print your reports, download or export them, check out this article for reference: Run reports in QBO. It includes details of other reports' features to help gain more knowledge about the processes and how they work.

Please feel welcome to send a reply here or create a new thread if you have any other concerns or additional sales-related questions. I’m always here to help, @Attempte.

@MadelynC @MJoy_D

Thank you but I do have them going to Clearing Account for all October receipts. I FORCED the entry from 09/22 to Payments to Deposit because that is all that the Bank Deposit seems to see -

Yet this entry gives me a $0 effect in Clearing Account which, as you also pointed out, isn't pointed to at all in the Bank Deposit....

I feel I am missing something REALLY obvious but I don't know what.

Thank you .. and seriously, thank you for persevering everyone.

Emma

Hello there, Attempte.

Ensuring the correct balance for your daily sales records is of utmost importance for your business. This practice plays a vital role in effectively managing year-end tax processing and form submissions.

Based on the details provided, we'll have to check how the items and accounts are set up in your company. Since this requires special handling, I recommend reaching out to your accountant for further assistance. They can review the mapping of transactions, including the items associated with them. Moreover, they can guide you through the implementation process of the permanent resolution.

If your business has multiple locations or outlets and you want to keep track of expenses and profitability for each one, we've got you covered. Take a look at these valuable resources that provide all the information you need:

Furthermore, these resources cover a wide range of topics, including preparing for year-end filing, ensuring balanced books, and effectively managing your Accounts Receivable (A/R) or Accounts Payable (A/P):

Don't hesitate to leave a comment below if you have other concerns or questions about tracking your daily sales, Attempte. I'm always ready to respond to them. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.