Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, nzi.

We're unable to manage your Assets in QuickBooks Online. You can check out this comparison table that will help you identify the certain feature our QuickBooks Online Essentials plan has. Just click this link: https://quickbooks.intuit.com/global/online-compare/.

Our Product and Services option helps you track your assets. For more details on how to manage your asset accounts in QuickBooks, you can check out this article: Manage default and special accounts in your chart of accounts.

Get back to me if you have other questions. Take care and have a great day!

What kind of asset management do you need?

Purchasing Assets, recording their depreciation, purchasing stores and inventory. Issuing inventory and expensing out items like stores stationary etc

Welcome back to the Community, nzi.

I appreciate adding more details about your concern. This can help me provide a timely solution.

Based on the details shared, I suggest upgrading your current subscription to the Plus version. This is to ensure you can track inventory and other processes mentioned above.

For more information about the product’s features, click on the link provided by @Catherine_B. From there, you’ll be able to try out the trial version or subscribe to the Plus version.

QuickBooks Online doesn't automatically depreciate fixed assets. You'll have to manually track depreciation using journal entries.

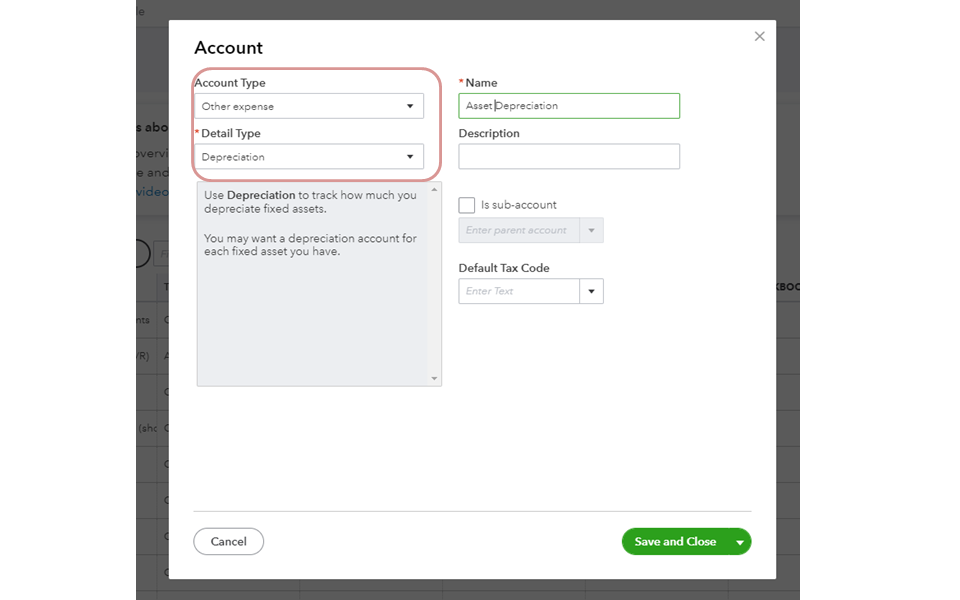

I'm here to guide you through the steps by step process. We'll have to create the account and then enter a journal entry to track the assets and their depreciation.

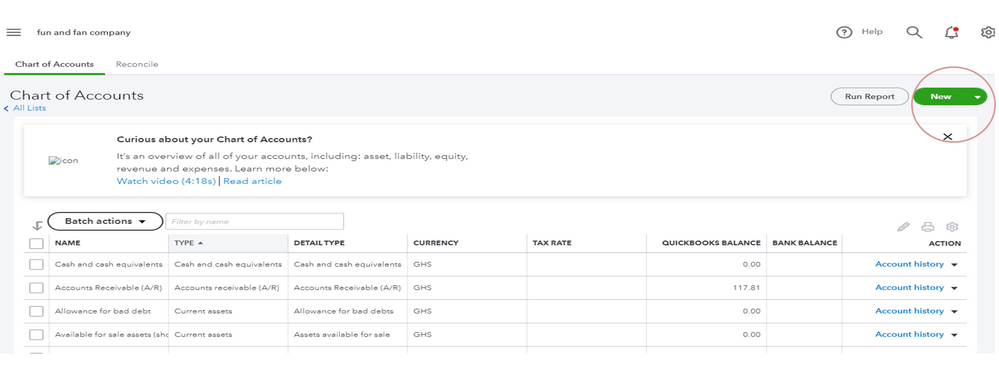

Here’s how:

To enter a journal entry:

I also suggest reaching out to an accountant for further assistance. They can recommend the best methods to use when calculating the asset depreciation.

I'm attaching a screenshot of how the transaction looks like after following these steps.

For future reference, the following links provide an overview of how to turn on the inventory feature, add inventory items, and enter the asset account.

Reach out to me if you have any questions or other concerns. I’ll get back to answer them for you. Have a great rest of the day.

Explore LivePlan to manage your fix assets and integrate it with your QBO.

http://track.paloalto.com/SHRP

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here