Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

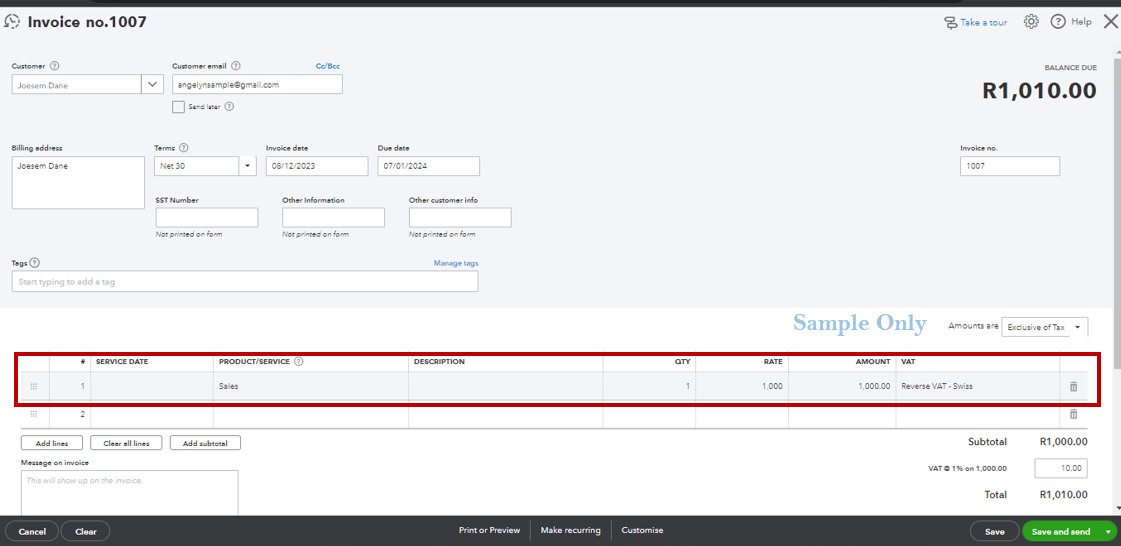

Hi, info. Let's get into the process of recording invoices that require the application of reverse VAT (Swiss) in QuickBooks.

Yes. To record invoices requiring reverse VAT for Swiss transactions in QuickBooks, set up a new tax rate and apply it to the relevant tax agency, applying the specific Swiss requirements.

To start:

I'm adding this material for more hints on setting up new tax rates in our system: Create new tax rates in QuickBooks Online.

You may also consider seeking assistance from a tax expert for further guidance if necessary.

Once done, utilize it when tracking your invoices. It'll ensure that the correct tax treatment is applied to your transactions.

On the other hand, you may run through the details from this article for more hints while tracking your invoices: Create invoices in QuickBooks Online.

When you're ready to process your sales tax payments, use this material as your guide: Manage sales tax payments in QuickBooks Online.

I'm always here to help you record your invoices with the appropriate tax rates. If you have any follow-up questions, rely on me by leaving a comment below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here