Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hey there, @faasconsultant-g.

I'm here to share with you some insights about recording beginning and ending inventory in QuickBooks Online (QBO).

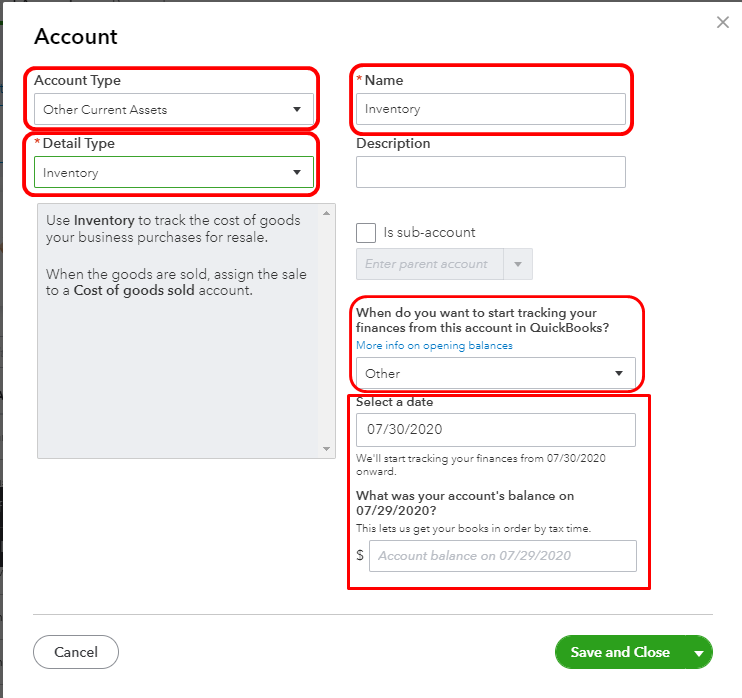

We can create an inventory account to record your opening balance in QBO.

Here's how:

You can check this link for more information: Enter opening balances for accounts.

While the ending inventory formula is Beginning Inventory + Purchases – Sales = Ending Inventory. Beginning inventory plus purchases is referred to as the cost of goods available for sale. The goods are either sold or remain in the ending inventory. When items are sold, the current cost is moved from inventory into the cost of goods sold (COGS) account.

I've also added this link about adding inventory products in QBO: Add inventory products in QuickBooks Online.

Additionally, I'm including this reference that is helpful in checking the best sellers, what’s on hand, the cost of goods, and more among all of your items: Use reports to see your sales and inventory status.

Feel free to drop a comment below if you have other questions. I'm always happy to help. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here