Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

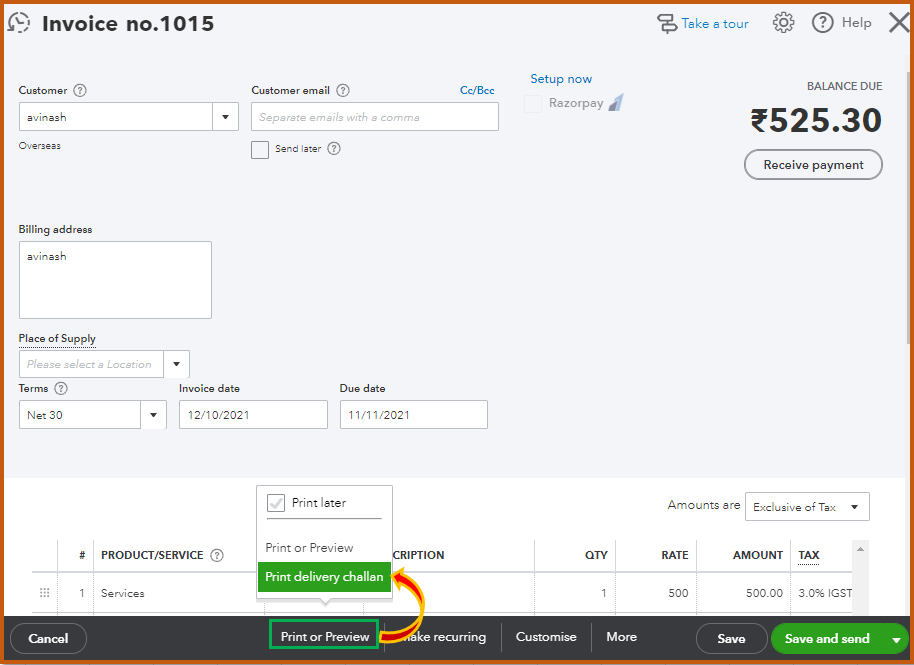

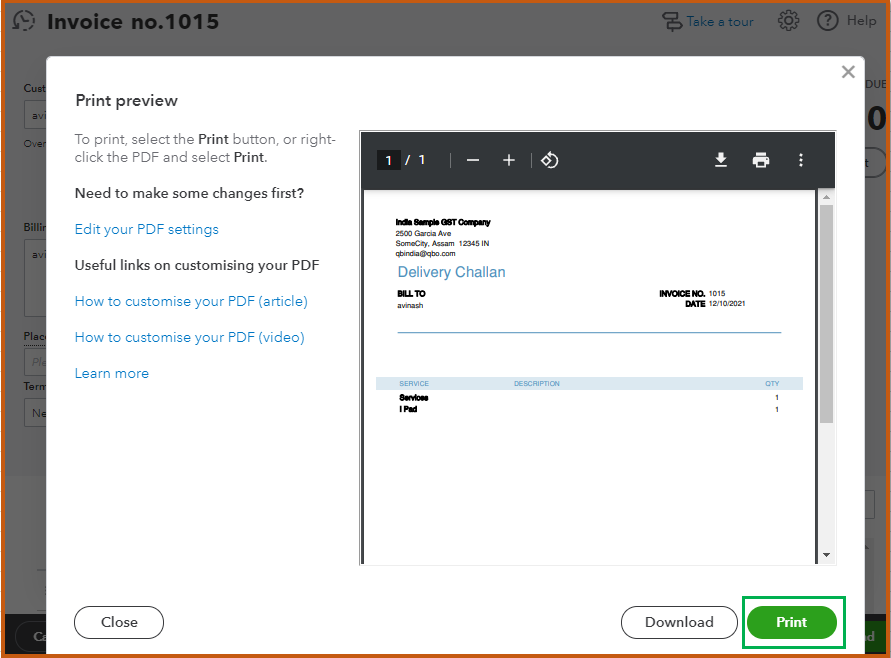

I'm glad to walk you through creating an invoice and print a delivery challan, info1178.

You can follow the steps I've outlined below on how to enter an invoice.

To raise the invoice, you have to edit it. Then, print again the delivery challan.

You can also print delivery challan through the customer's profile. Check out this article for instructions: Can I print a delivery challan?

QuickBooks puts open unpaid invoices into your accounts receivable account. You'll see this account on your Balance Sheet and other financial reports.

If you need to notify customers about upcoming invoice due dates, you can send them a reminder message. Once you receive the payment, you can manually record it in QuickBooks.

Let me know if you have additional questions about creating an invoice. I'm always around here in the Community Forum to help you.

Hi

Thanks for your reply.

I don't want to raise a tax invoice at the same time as the delivery challan.

eg. Challan will be raised on 12/10/2021 and the invoice will be raised on 21/10/2021.

The solution suggested by you I am already aware of the same..

Hope you can help.

I can certainly help you, @info1178.

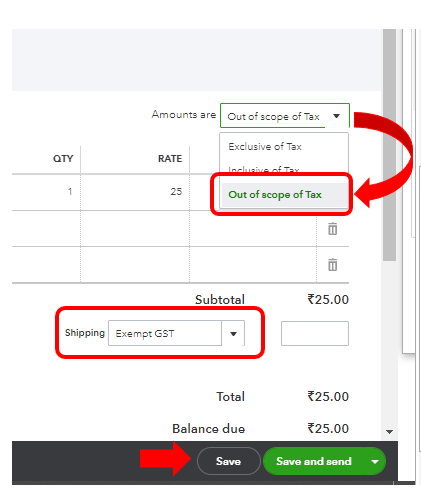

Since you don’t want to raise a tax on these transactions, you can set them to Out of Scope of Tax or an Exempt. This way, they won’t reflect as part of your taxable entries in QuickBooks.

Here’s how:

Also, it would be best to check with your tax agency about this. This way, we can ensure your sales taxes are handled accurately.

I’ve attached this reference in case you need to personalize and add specific information to your sales forms: Customise invoices, estimates, and cash memos in QuickBooks Online.

If you need more help with managing your goods, please don’t hesitate to reach back out. We’re always here to assist you. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here