Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Yes, Menaka. Using the Supplier credit feature will help us to record your advance payment and settlement moving forward.

Here's how:

Once done please, know that the Supplier credit we've will automatically applied to the selected supplier.

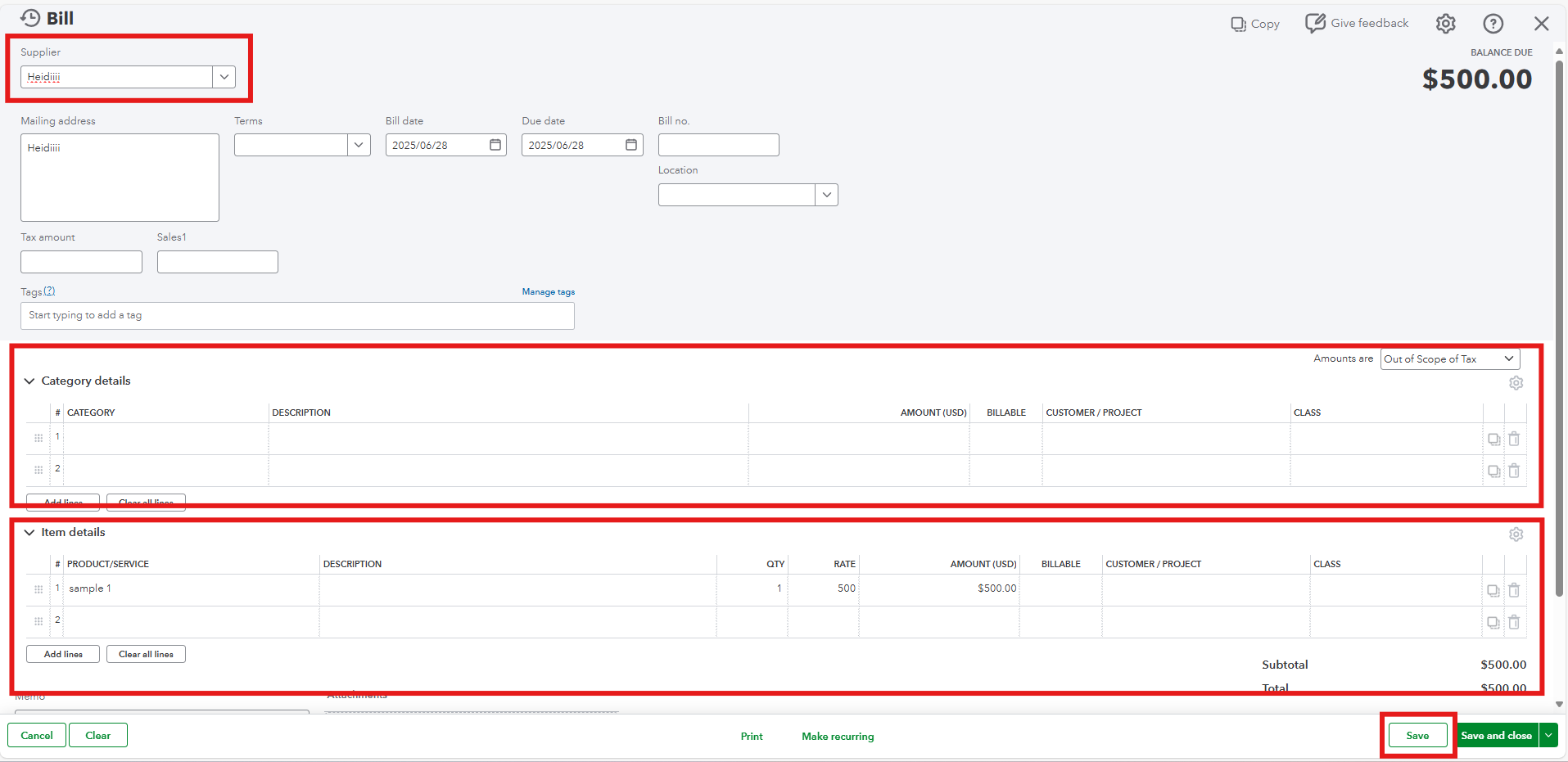

Once you receive the order from the supplier, let's proceed to create a Bill. Here's How:

Lastly, let's record the payment using the Pay bills feature. I'll guide you through the process:

You can run a report with supplier totals in QuickBooks to show all the transactions for each supplier.

Feel free to add your comment below if you need further assistance. We're here to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here