Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I can share some information about how purchase order works, info-hikokistore.

POs are used to tell vendors what items you want to order and track the upcoming expenses. Normally, you'll only need to enter specific items you want to buy and the quantity in the Item details section.

Categories are rarely used in purchase orders, as it defeats the purpose of receiving inventory items by using a purchase order. If you do not use products and services, then you can use this section to select the accounts affected by your purchases. You may consult your accountant in selecting the correct accounts.

Additionally, purchase orders are non-posting transactions. They won't reflect in your Chart of Accounts. report totals, and vendor balance. You're always free to create as many as desired, void, delete, or alter regardless of the date on the form. None of these activities will affect the financial reports of the company.

I recommend reading this article to help manage your purchases in QuickBooks Online:

If I can be of any additional assistance, please don't hesitate to tag me in the comment section. I'll be around to help.

Okay noted. Thank you for your prompt reply.

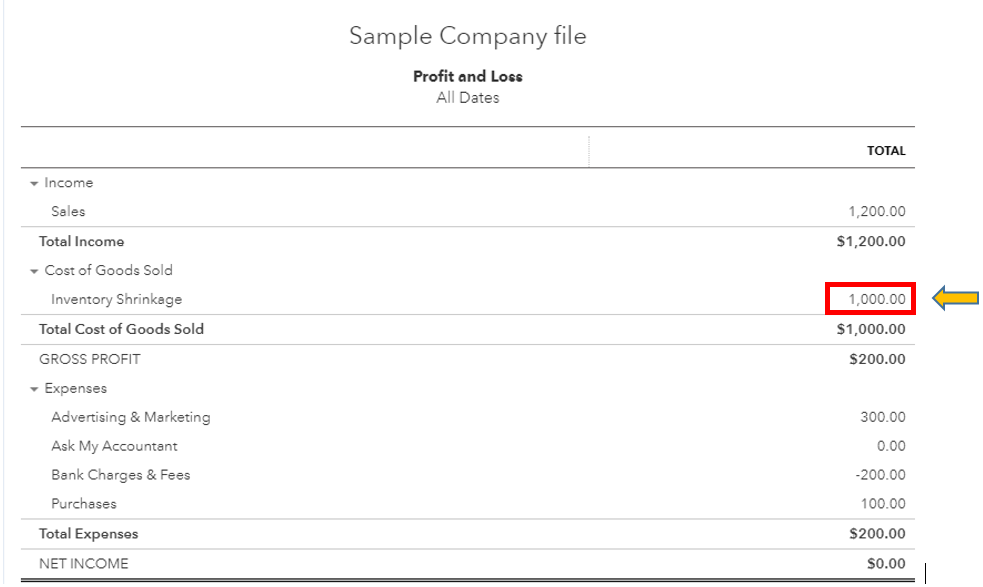

But, after create PO then I make an expenses from current PO. Why, I check at profit and loss report does not appear my transaction for this expenses? On expenses list, also appear no category.

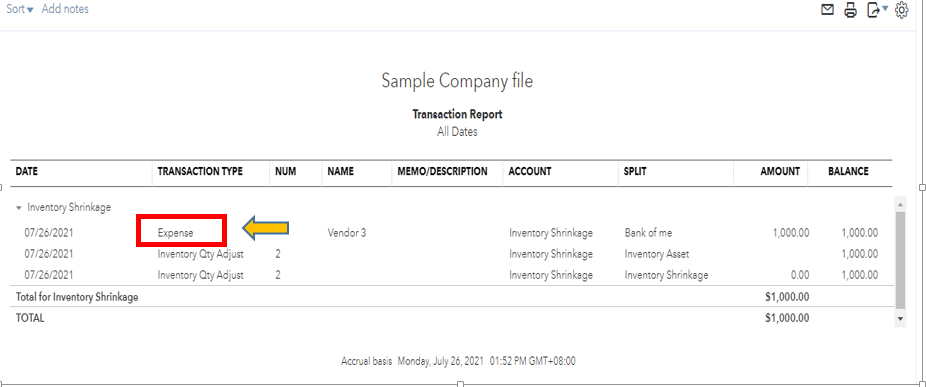

Thanks for providing the screenshot, info-hikokistore.

I'm here to give details about the profit and loss report in QuickBooks Online.

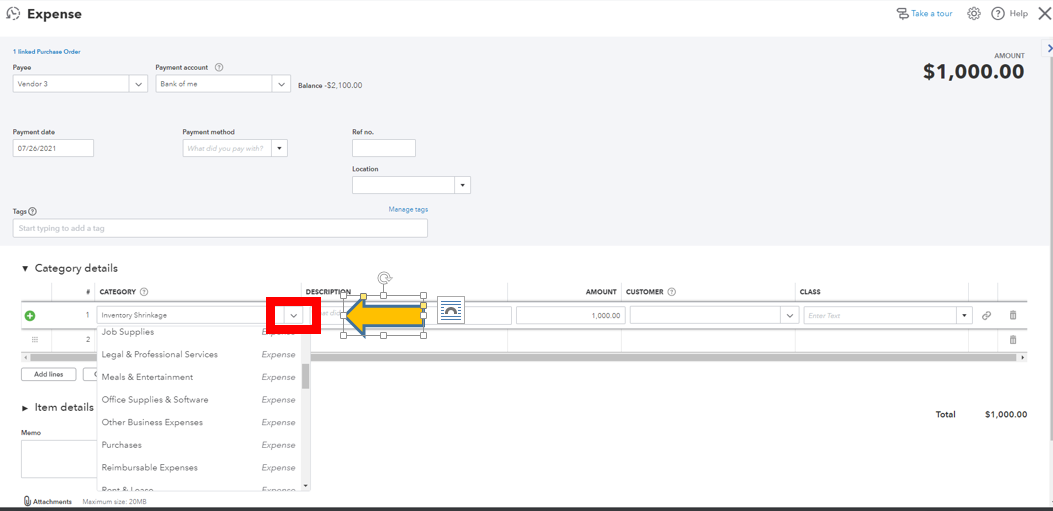

When creating a purchase order in QuickBooks Online, you have the option to choose either the category details or the item details. The category details are used mainly to classify the transaction base on how the account is categorized as expense type or non-expense type. On the other hand, you can use the Item details if you purchase inventory items by quantity and unit price.

As I've checked on your screenshot, you've used the Inventory Shrinkage which is part of the Cost of Goods Sold. This is the reason why there's no transaction appear in the expense area on the profit and loss report. You can change the category if you want this transaction to show in the expense section. If you're not sure on which account to use, I'd suggest reaching out to your accountant for proper selection of expense account. I'll show you how to change the category.

Then, you can run the profit and loss report again to see if the transaction is already on the correct expense account.

In addition, check out this material if you want to use the report outside QuickBooks: Export your reports to Excel from QuickBooks Online.

You can comment below if you need further assistance with the profit and loss report or the purchase order. I'm always here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here