Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, @maitha.

You've got me here to provide some insights about tracking your income and expenses in QuickBooks Online to keep your records accurate.

To track your profit, you can create any sales transactions in the system. It includes invoices and sales receipts. These are the entries that will roll out into your accounts receivables.

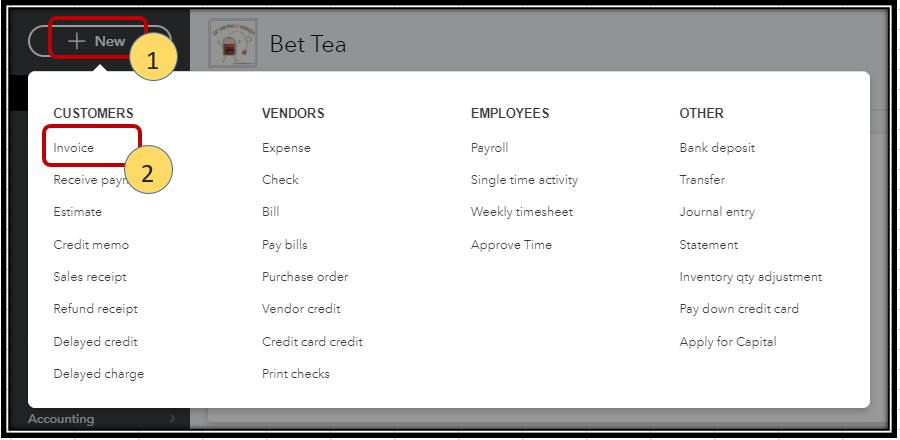

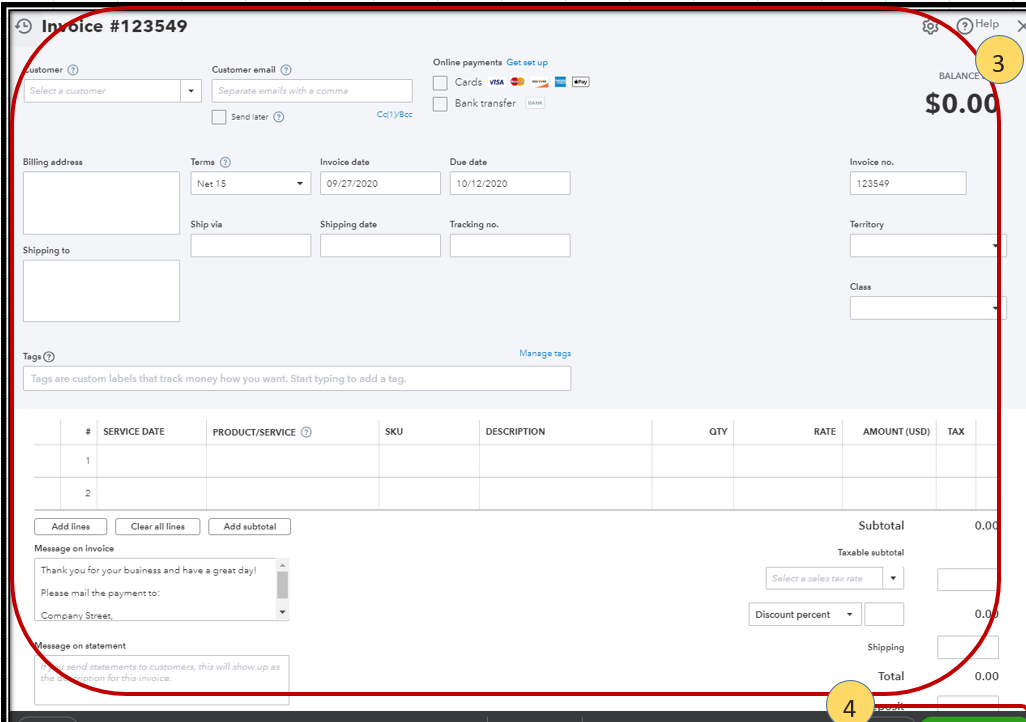

Here's how to create an invoice:

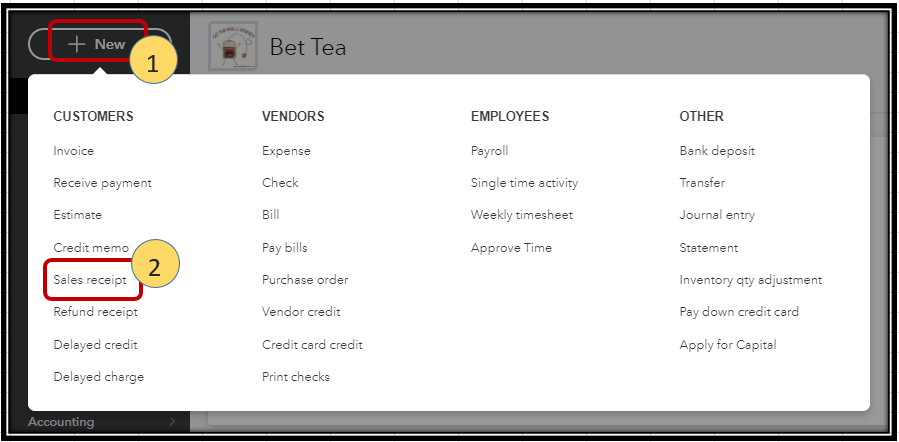

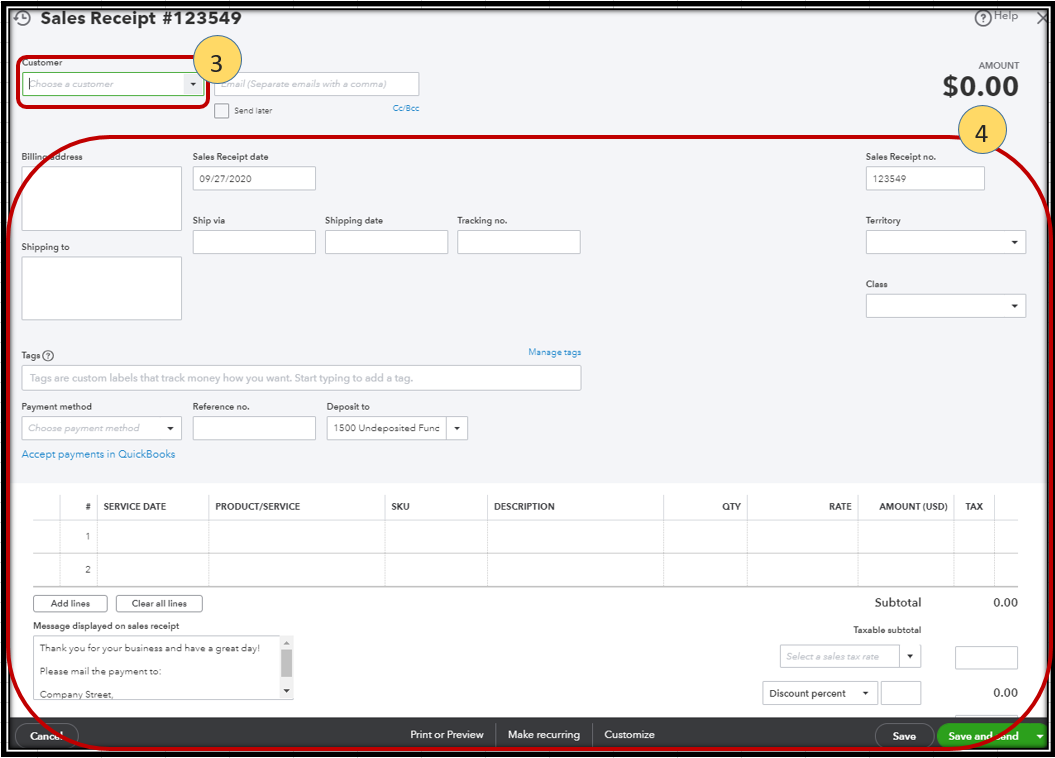

For an immediate payment, use the Sales Receipts. Please follow these steps:

For more details about this procedure, please see this article: Should I use an invoice or a sales receipt?

On the other hand, for your expenses, you can generate expense transactions to keep track of your business's money out. The bills and expenses are the proper entries to make as they'll be sitting on your accounts payable.

Here's a link that contains a video tutorial on how to create an expense transaction in QuickBooks Online: Track your expenses in QBO.

Moreover, to ensure the best course of action for your business, I suggest reaching out to your accountant. They'll be able to provide you the accurate action to be taken in recording the expense for the ingredients and on how to identify the profit for each baked treat.

After tracking your transactions, you can always pull up the Profit & Loss report to see how your finances are going.

Know that you can always visit me here in the Community if there's anything else that you need. I'll be right here to address them for you. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here