Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, @rohit3.

I'd love to share some insights regarding when to add an employee or a contractor in QuickBooks Online.

You can add a contractor if it's a non-employee who you might pay $600 or more in a given year (although electronic payments, such as with a credit card, don't count). However, QuickBooks Online in your region doesn't have an option to set a contractor. You can only add an employee, customer, and supplier.

Adding an employee happens if you have someone who works for you regularly. Since QBO India doesn't have a payroll subscription, you'll need to calculate the amounts for payroll components manually and then post them as a journal entry.

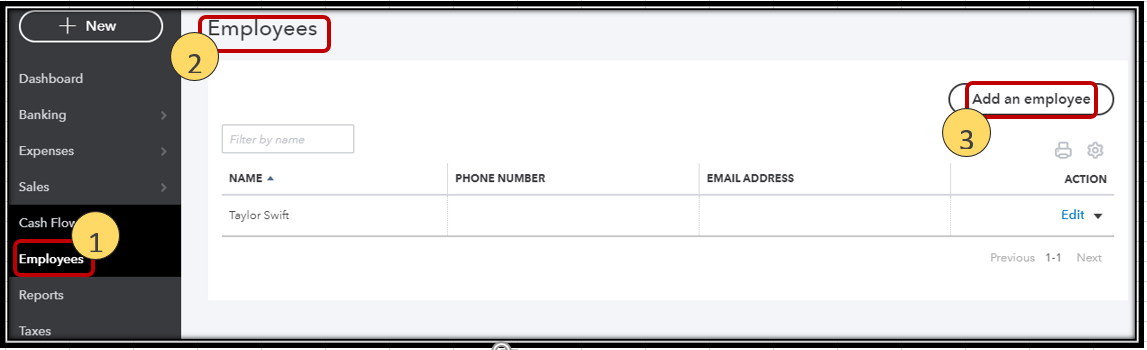

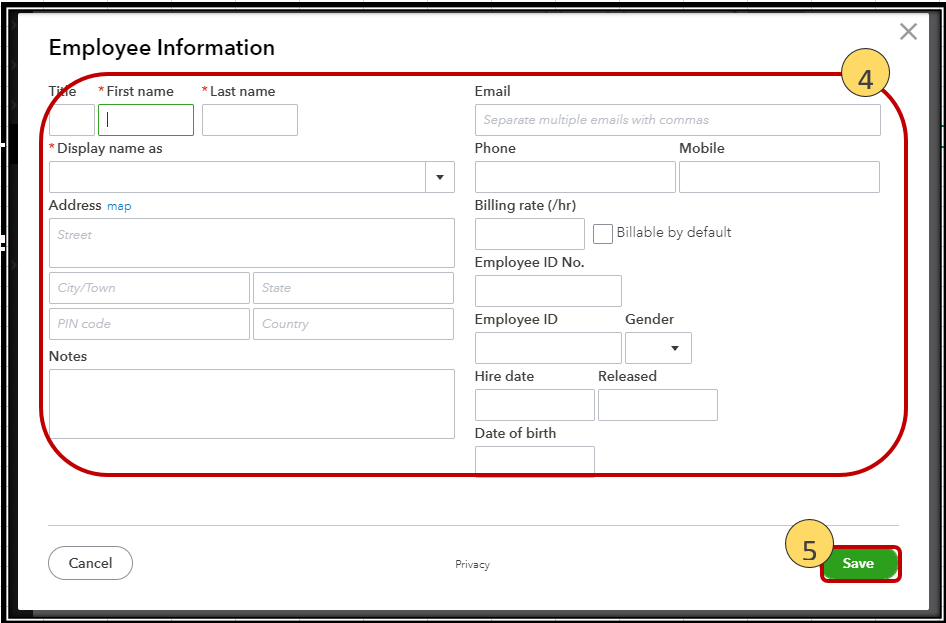

To add an employee:

To learn more about modifying your employee's information in the system, please see this link: Add, edit, or inactivate an employee.

Know that when posting your employee's payroll components through a journal entry, it's recommended to consult your accountant. It is to ensure the right accounts to be affected.

You can always get back to me here if there's anything else that I can assist you with. I'll make sure you're all set. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.