Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I’ve got you covered, shohibuniquellc-.

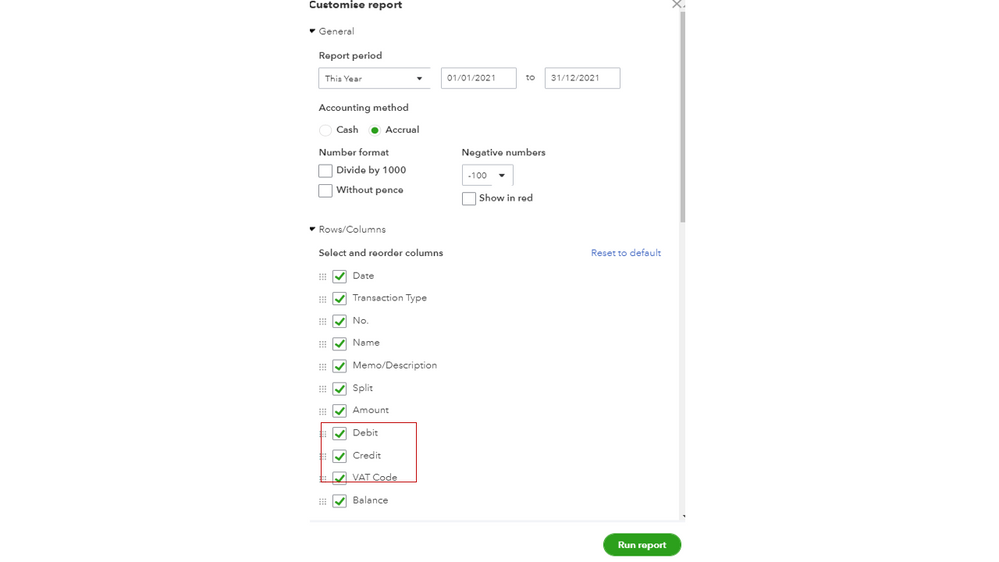

We’ll run the General Ledger Report and customize it to show the VAT code for your journal entry. The process is a breeze, and I’m here to guide you on how to build it.

This is how the report will look like after following these steps.

Let me share this article for more insights into this process: Create a report that shows Debits and Credits for each transaction.

Additionally, the following links provide detailed instructions on how to tailor reports to fit your specific needs. From there, you’ll learn about sharing custom reports and automate one.

Don’t hesitate to post a comment below if you have other VAT concerns. I’ll get back to help you. Have a great rest of the week.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here