Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

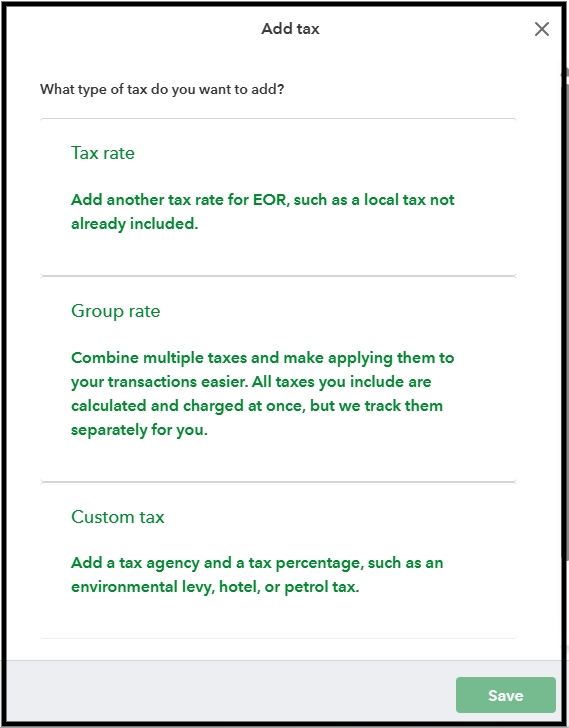

You can manually configure the reverse charge VAT codes in QuickBooks, Laura.

Before doing so, I recommend consulting your accountant to ensure all details are accurate.

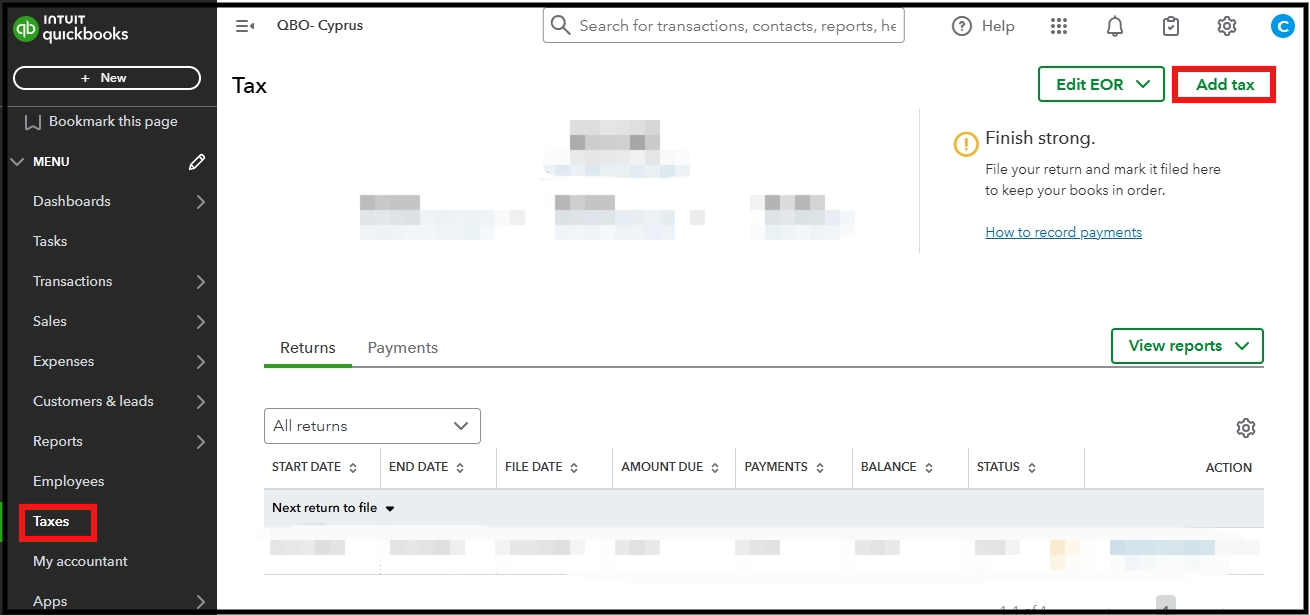

Here's how to set up:

For detailed instructions on applying VAT rates and utilizing them on forms, please refer to this article: How do I set up sales GST/VAT rates and use them on forms?

Please don't hesitate to post again if you have other inquiries. The Community team is here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here