Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for visiting the Community, info1193.

To clarify, are you trying to match a VAT payment to your online banking or you’re working on a specific line on the VAT return. While waiting for your response, I’m adding a link that provides an overview of where the data comes from for each box on the VAT return: FILING VAT RETURNS AND MAKING PAYMENTS.

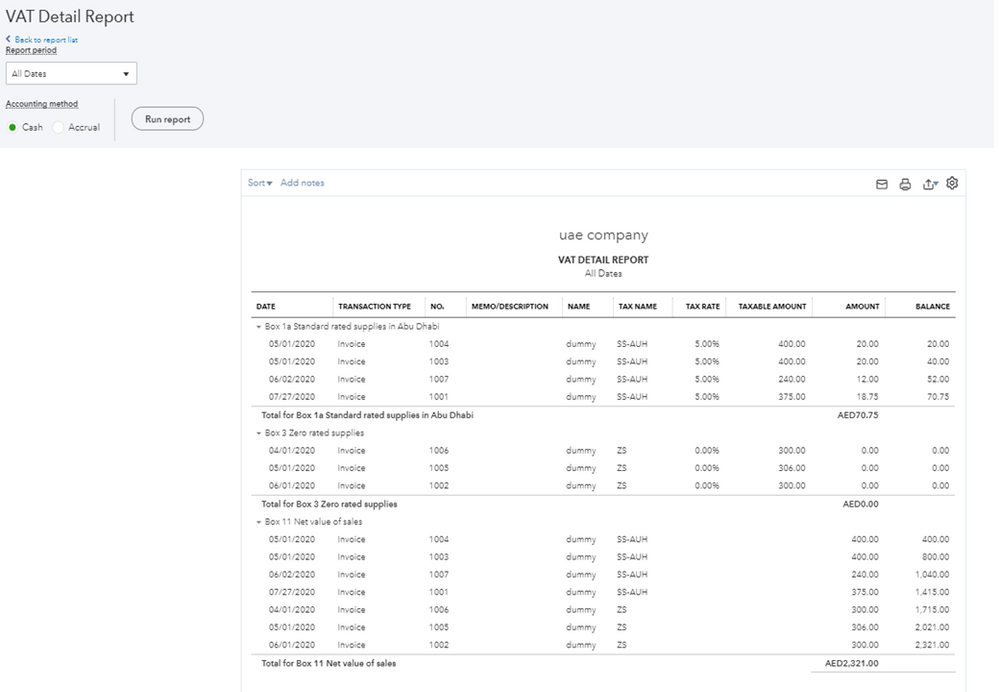

In QBO, you can run the VAT Detail Report to check transactions that are included in each box on the VAT return. Use the data on the report to compare the information on the tax form.

Allow me to help the run report for you. The process is just a breeze.

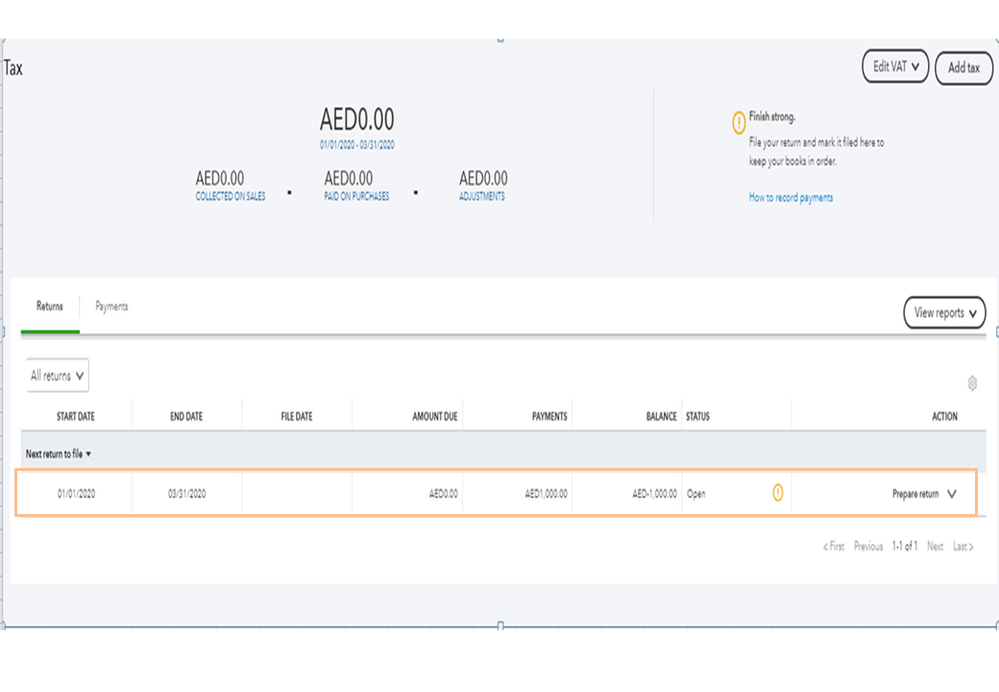

If there’s any discrepancy, create an adjustment to correct the error. Here's how:

Additionally, the following link provides detailed information on how to match downloaded entry to the one entered in QBO. From there, you’ll see instructions on how to classify entries and add a new transaction: Categorise and match online bank transactions in QuickBooks.

If you're referring to something else, I appreciate any additional details and a screenshot you can provide. This can help me get a better overview of what’s happening to the tax form.

I’m looking forward to hearing from you soon. Thanks in advance.

Hi,

I am not Sujan and I can see he didn't came back to you. I'd like to avoid opening another thread with same question.

UAE VAT works for most of the businesses with monthly accrual and payment. This means that each invoice when issued, 5% is accrued (debit) and each purchase within UAE which includes VAT can be reported for returns (credit).

QB permit to report on invoices and it is accumulating VAT.

QB Permits to indicate VAT on Purchases too.

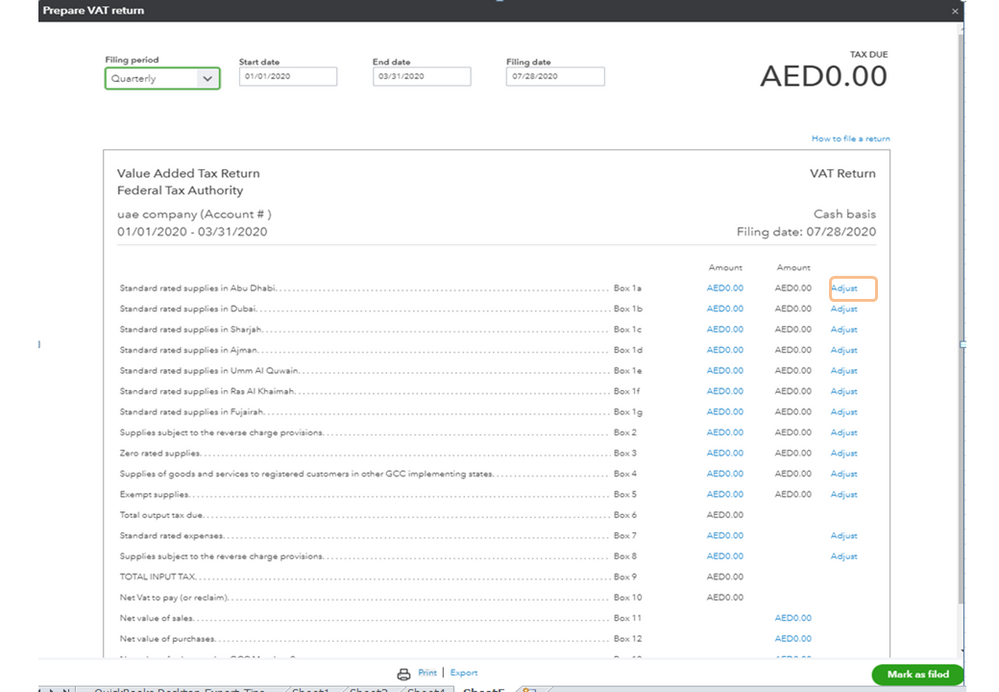

But, instead of doing what it is also explain in all documentation, instead of deducting the VAT from Purchase, it is adding to to dues. See attached.

Recorded only an invoice with VAT (Standard sales) and Purchase with VAT (standard purchase).

Please advise what we are doing wrong?

Hello @Veselin,

Let me help share information about how your taxes are calculated in QuickBooks.

To start with, once you turn on the sales tax feature, QuickBooks automatically create your VAT codes and rates for you. And once you start tracking this tax, it will be calculated base on what is the process mandated by your local tax agency.

With this, I'd recommend contacting them so one of your local tax experts can help you with how your VAT is calculated in every purchase you made.

Additionally, you can also browse for the content of this helpful article for a compilation of commonly asked questions once you start tracking VAT tax: We have recently introduced new features to make VAT filing easier for the customers in UAE.

If there's anything else that I can help you with, please let me know in the comments below. I'll be here to lend a hand.

Hello @JonpriL

Before jumping into discussion and trying to earn kudos or whatever, take a time to think that someone on the other side has spent time with particular problem and described it completely. Do not waste my time with ridiculous and no-solution answers.

If QB is claiming that it is UAE VAT compliant, then what I asked should be out of the box. Your report is wrong, thus, do not give me lectures of accounting or similar.

Please stay away from the post if you will not positively contribute.

actually my friend also faced this issue while she was working with one of the accounting firms in dubai that also deals with tax agent services in dubai,uae .i think her problem was resolved by quickbooks team when she contacted them .

i think the company she worked for is one of the reputed tax consultants in uae

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here