Run your business more efficiently with an automated system like QuickBooks accounting software. QuickBooks accounting software is a powerful business management tool that is surprisingly easy to use. Now you can get 50% of the cost covered by the Productivity Solutions Grant will cover up to 50% of the cost of your QuickBooks setup and installation.

SMALL BUSINESS GRANTS WITH QUICKBOOKS ACCOUNTING SOFTWARE

Get up to 50% reimbursement on accounting software investments

Take advantage of government grants such as InvoiceNow and productivity solutions grant to improve efficiency and boost efficiency with QuickBooks accounting software

Streamline your business with our accounting software today!

What is the Productivity Solutions Grant (PSG)?

The Productivity Solutions Grant (PSG) is a joint initiative by Infocomm Media Development Authority (IMDA) and Enterprise Singapore. The grant is designed to provide financial support to companies that are ready to adopt IT solutions and improve productivity.

Types of PSG high-quality solutions:

|

Sector-specific solutions |

Companies within the respective sectors only. |

|

Generic solutions |

All companies across business sectors and industries |

QuickBooks accounting software is a PSG-approved solution, so there has never been a better time to get started with cloud accounting. The solution will enhance accessibility and cash flow as well as drive impressive productivity improvements.

If you’re ready to realise untapped potential in your business then click here to contact us today.

The benefits of the Productivity Solutions Grant with QuickBooks

Cost of system implementation is covered: Setup and training costs are covered because having the right systems and processes in place will ensure you can take advantage of the benefits that QuickBooks accounting software delivers.

Seamless transition: Professional support during system design and implementation will help to make the transition seamless. It will ensure you can align your new accounting system with your business goals and start realising business potential.

Pro-Advisors accessible: Access to highly trained QuickBooks Pro-Advisors who are pre-approved PSG providers.

Receive up to 50% support via PSG with QuickBooks’s pre-approved PSG vendor.

Apply for the Productivity Solutions Grant in four simple steps

Step 1

Speak to us and we will connect you to a pre-approved QuickBooks Pro-Advisor who will provide a quote for software, system design, training and implementation.

Step 2

Submit your grant application online. Applications are processed within four to six weeks. Once approved you will receive a letter of offer outlining the subsidy amount.

Step 3

Once you have approval contact the Pro-Advisor that supplied the quote and get started. Confirm and sign the quotation so that implementation can begin.

Step 4

You have 6 months to finalise the implementation. Once complete submit the claim and you will receive reimbursement within two months.

Who is eligible to apply for PSG?

Any small business entities can apply for PSG in Singapore if they meet the criteria:

- Registered and operating in Singapore

- Purchase/lease/subscription of the IT solutions/equipment/consultancy service must be used in Singapore

- (For selected solutions only) Have a minimum of 30% local shareholding

- (For consultancy service solutions only) Have at least three local employees at the point of application

Support level update: Between 1 April 2022 and 31 March 2023, the Food Services and Retail sectors may receive an enhanced support level of up to 80% for eligible solution sub-categories. The maximum support level for all sectors during this time is up to 70%.

However, starting from 1 April 2023, the maximum support level will be reduced to up to 50% for all sectors.

Other government grants for small businesses

Market Readiness Assistance (MRA)

Financial support is made available through this MRA to Small and Medium Enterprises (SMEs) seeking to expand their products and services to international markets.

Market Readiness Assistance (MRA) supports up to 70% of funding on eligible costs

Enterprise Development Grant (EDG)

Enterprise Development Grant (EDG) is to assist Singaporean small and medium enterprises in automation and technology. The grant funds projects aimed at enhancing business operations, introducing innovative ideas, or expanding into international markets.

Enterprise Development Grant (EDG) supports up to 70% of the qualified cost for small and medium enterprises

QuickBooks accounting software has a powerful multi-currency function to support your international business, not only can it handle 145+ currencies, it also updates the currency exchange rate every 4 hours automatically for you.

QuickBooks Online delivers the insights you need to run your business more efficiently

Run your business on your terms

View your cash flow, send a custom invoice or track your expenses on the go. QuickBooks holds all the tools you need to meet your goals faster.

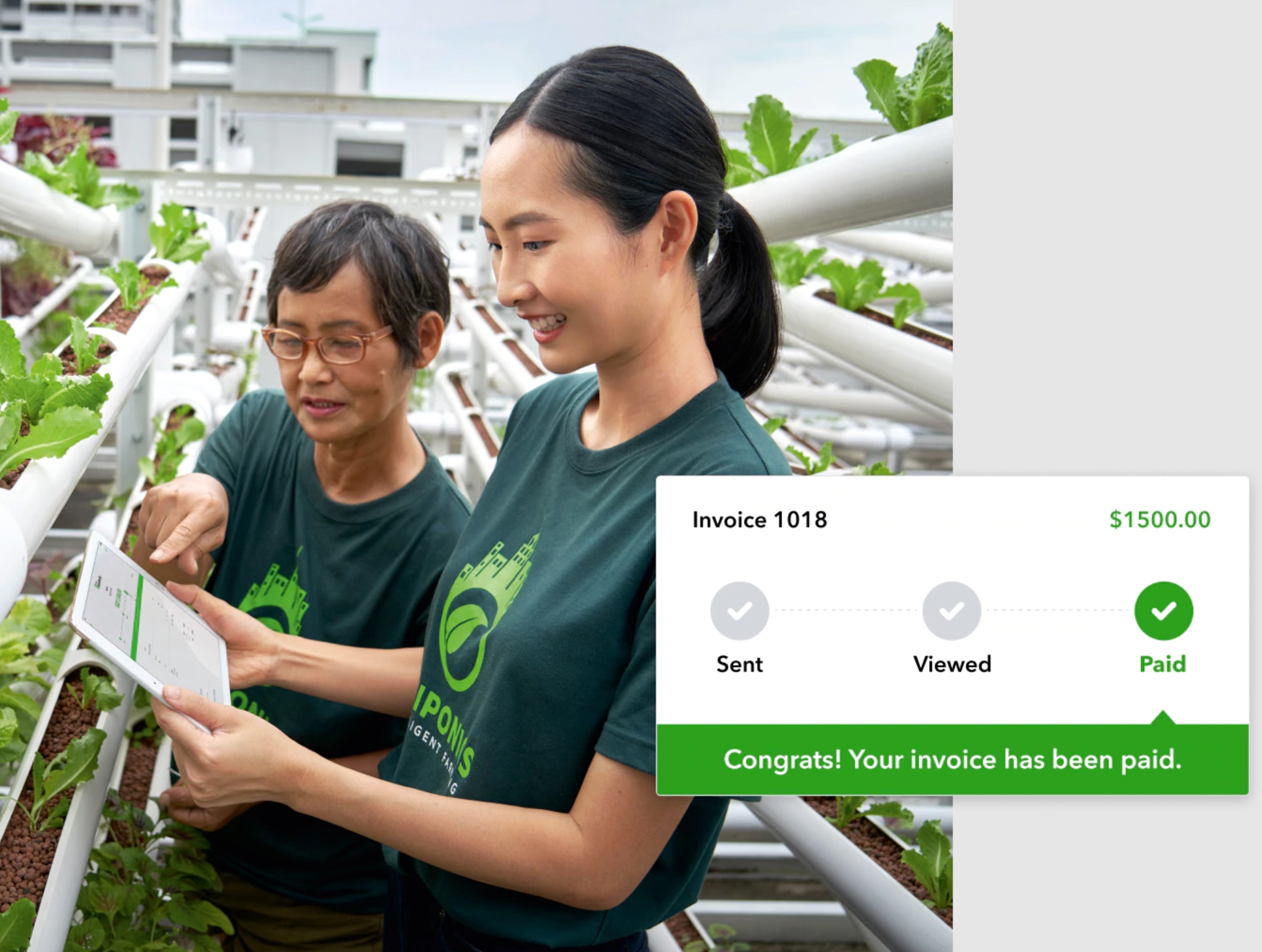

Invoicing

Automated E-Invoicing Generation

Our invoicing lets you create professional e-invoices, sales receipts and estimates. Improve your cash flow and simplify your e-invoicing process by automating your invoicing process with QuickBooks

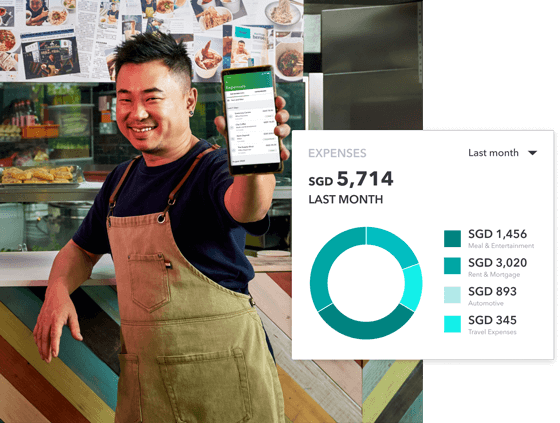

Expenses

Manage your cash flow

Tracking expenses is easier than ever. Photograph and save receipts on the go with the QuickBooks Online mobile app. You’ll always be ready for tax time.

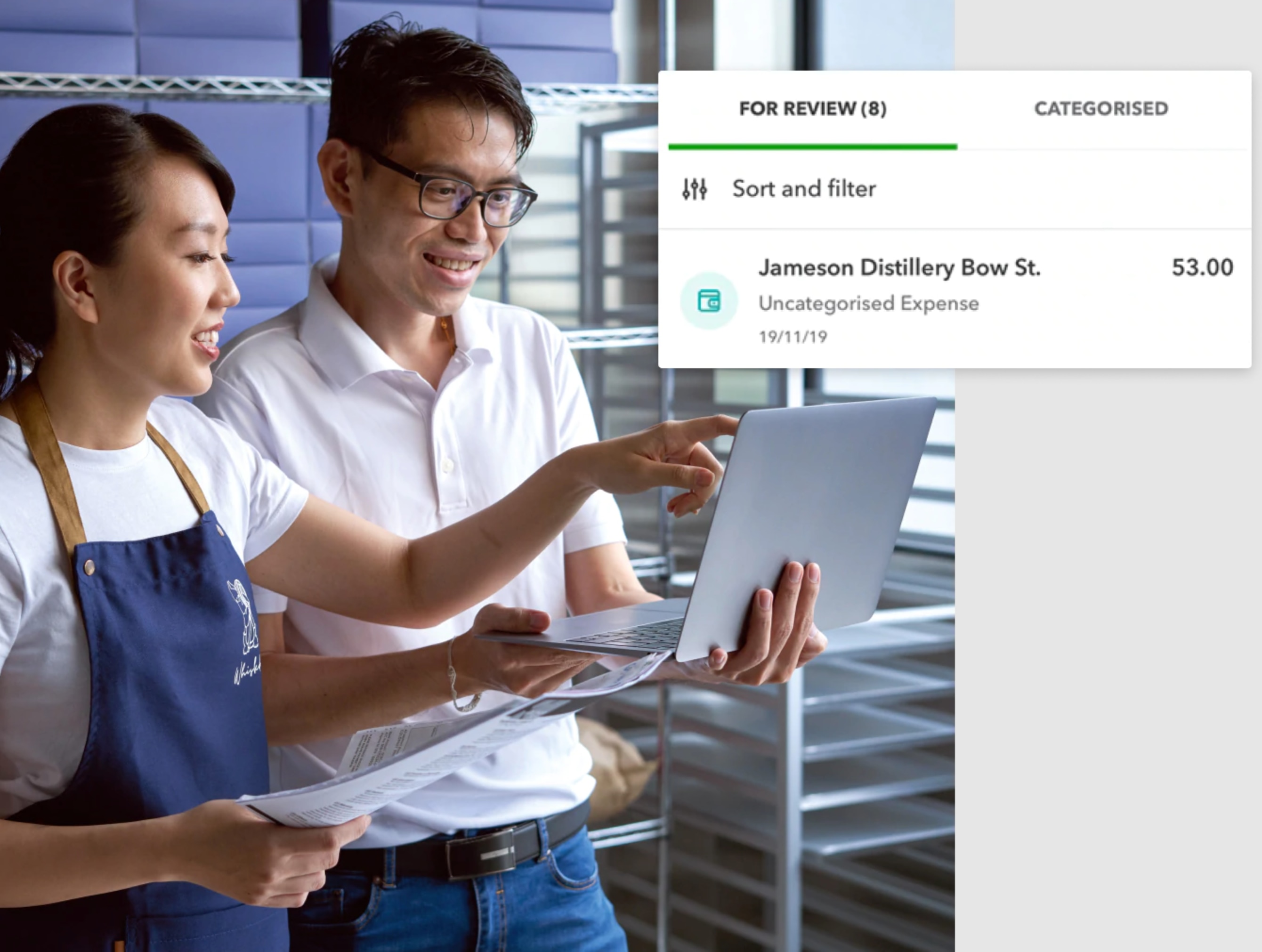

Banking

Connect your bank

Connect seamlessly and securely with your bank, to track your cash flow and see how your business is doing.