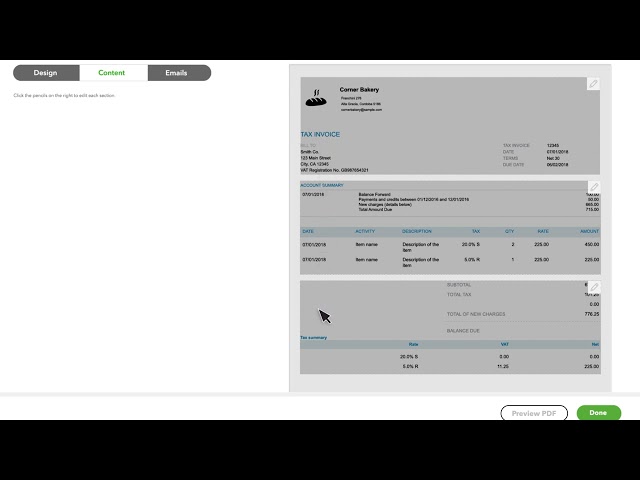

If you’re a freelancer or a small business owner in Singapore, chances are you’ll need to create invoices for your business. Download a free invoice template for your specific needs, and create and send professional invoices. QuickBooks invoice template is compatible with PDF, Excel and Microsoft Word so that you can send invoices as a PDF, in Excel or as Google sheets, or in Microsoft Word or Google docs.

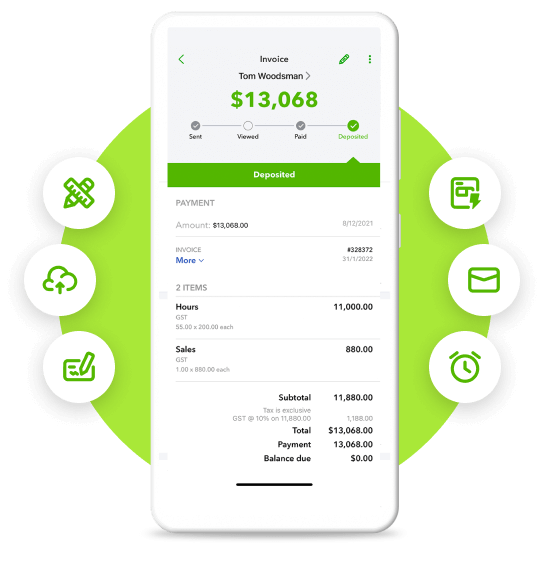

Get tips on what to include in the invoice template according to what you do, and how to use professional Invoicing Software to get paid faster through online payments or credit cards.