Run your books confidently from the get-go

QuickBooks lets you conveniently organize your finances, automate tasks to save time, and send invoices that get you paid fast.

One-stop financial management

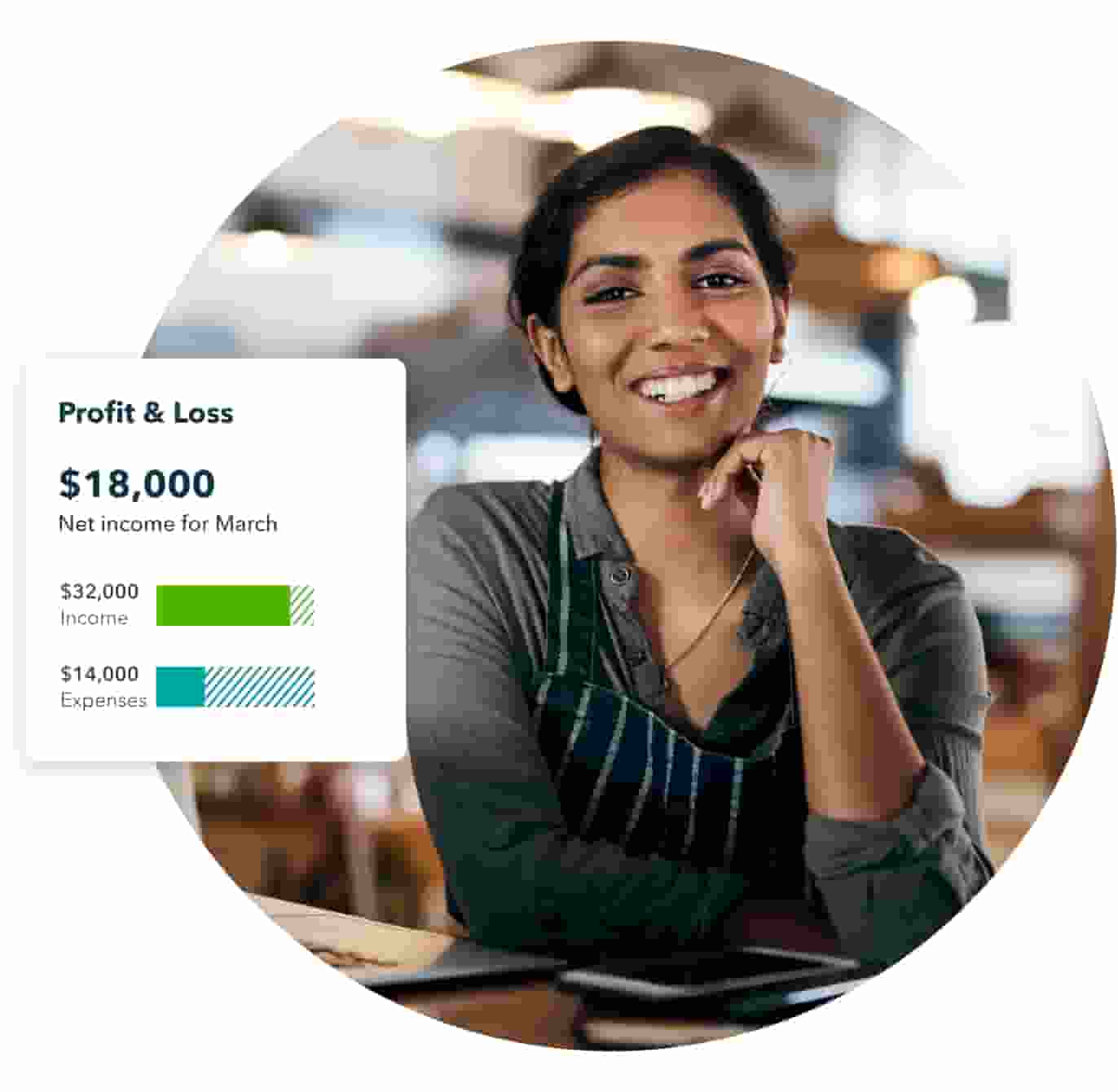

Manage your books

Streamline your accounting, automate workflows, and track income and expenses.

Invoice your customers

Create and send unlimited personalized, professional-looking invoices.

Tax time made easy

Stay ready for tax time with categorized expenses and organized receipts.

Get paid

Your customers can pay you quickly and easily with credit card, Apple Pay, or bank payment.**

Track expenses

Customizable reports help you see where your finances are and make informed business decisions.

Pay your team

Run payroll accurately and automatically with free direct deposit.**

Get 80% off for 6 months

Flexible plans that work for your business.

Need multiple accounts? Call us at 1–888–829–8589

Free guided setup**

Hit the ground running with a QuickBooks expert who can help you:

- Connect your banks

- Set up the features you need for your business

- Learn best practices to use QuickBooks with confidence

Not included with QuickBooks Self-Employed.

Stay connected, stay informed

Work on the go

Run your business from wherever your day takes you. The QuickBooks mobile app syncs with your desktop account for on-the-go expense tracking, receipt capture, and more.**

Expert guidance from a pro

QuickBooks certified accounting professionals (ProAdvisors) offer smart advice and help grow your business.