Invoices Requirements in Hong Kong

It is essential to follow the right invoice format for your clients in Hong Kong. As per the law, the Inland Revenue Ordinance (IRO) requires you to keep sufficient records either in English or Chinese to enable your assessable profits to be readily ascertained. It is important to note that all records must be retained for seven years from the transaction date. Otherwise, the freelancer or service provider could face massive fines. .

To avoid any inconvenience, you must format your invoice according to the instructions issued by the Inland Revenue Department in Hong Kong.

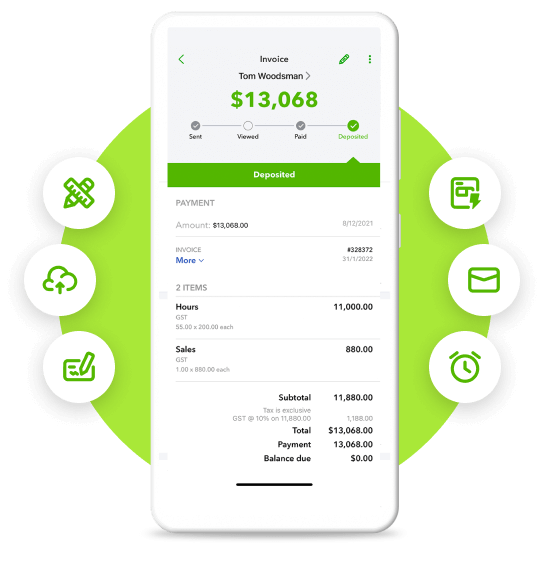

For local currency invoices, simply mention:

- The exact date of the invoice

- The invoice number

- Name and address of the individual

- The contents or services supplied, including quantities and prices

- Address of the company

- Hong Kong Identity Card (HKID) number

- Complete banking details, including bank name, Bank code, Branch code, Swift Code, and account number