Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi ricardo7,

We would need more details on the end goal in order to assist. Is this $78.59 and expense or income? You mentioned you are looking to create this transaction as a fix for a mistake, but cannot find the origin of the mistake. Are you trying to reduce or increase the overall balance of your account? Is this amount currently showing as a difference on your reconciliation?

If you prefer a walk-through, please get in touch with one of our friendly support team members by clicking here.

Thanks,

-Steven

Hi Steven,

Thanks for the reply.

$78.58 is a balance difference between my banking account and quickbooks.

How did I get this difference I dont know....but I'm happy to create an entry to make this difference disappear (it will take more time to find where the mistake is rather thank make it disappear creating an invoice or credit in order to match QB with my banking account). Please see the attach

Question: how do I create a dummy invoice/credit/journal in order to bring QB to the balance of $73080.40

The first tier support (phone) didnt work for me. I spent hours and didnt get to any conclusion.

Cheers

Ricardo

Thanks for coming back, @ricardo7.

Here are the possible causes for the reconciliation difference ($78.58) between the bank and QuickBooks Online (QBO):

I'll provide the details on each transaction you'll use to help fix this.

First, creating a dummy invoice affects your report totals, customer's balance, and the accounts receivable figures immediately. It's because this is still a posting transaction. It creates income, and you'll have to receive payment, which will affect bank balances.

Second, there are two types of credits. The adjustment note can affect sales reports, while delayed credit won't.

Third, a journal entry is the last resort for entering a transaction in QBO. It helps you enter debits and credits manually and transfer money between accounts.

You can go to the + New menu to locate any of the three transactions above.

I know how important it is to match the account in QBO to your bank statement's balance ($73,080.40). But I'd suggest consulting your accountant for this. They can help determine which method you'll need to use to remove the difference of $78.58. This way, we can ensure your books are accurate for that reconciliation period.

You can also perform the seven suggested steps in finding and fixing issues when reconciling an account in QBO. Please know that this process will take more time for you. Here's the link for your reference: What To Do.

Additionally, I recommend visiting this link to learn more about the proper workflow from starting to completing the reconciliation process: Help Guide.

The Community and I will be around to help if you need anything else. Keep safe.

Best regards,

Raymond Jay

Hi Raymond,

Appreciated your time on writing some advices.

To be honest with you, QB is not user friendly when a mistake happen.

I only have success when all transactions are matching perfectly with the bank.

When it doesnt happen, that is exactly when my nightmare starts.

The tier 1 QB (phone call) support doesnt know how to solve (I spent 6 hours on the phone with them and I would rate 0 stars, If I have the opportunity.

My accountant is not familiar with QB, so I'm not having too much support from him.

I'm on my own to solve this problem, so my question: How do I make the $78.58 disappear, and make the QB balance matches the bank from now on?

I need a solution for this type of human error, when I don't have all the knowledge upfront (I'm not an accountant).

Cheers

Ricardo

Hello there, ricardo7.

I'd like to provide a few details about matching your bank balance to QuickBooks.

The bank balance doesn't match to QuickBooks when there are manually created transactions, duplicate transactions, edited or deleted transactions. If this happens, we recommend checking the lists of transactions on your bank statement with what's in QuickBooks. This is to check if there are any changes made from previous reconciliation or any transaction that shows in QuickBooks but not in the bank.

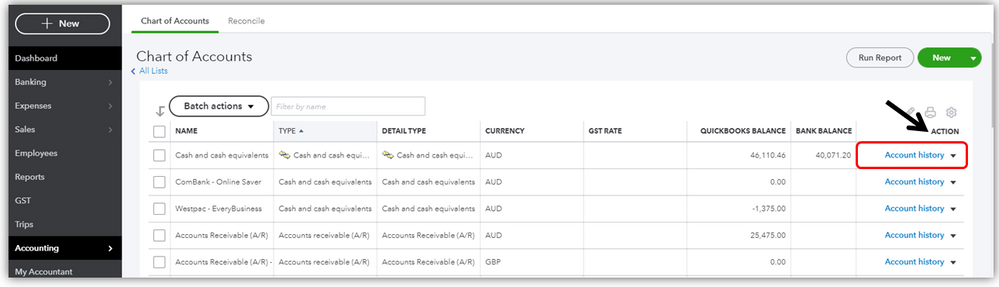

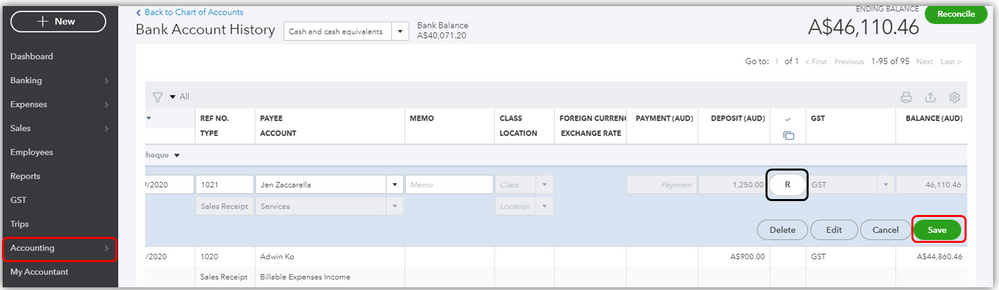

We can manually reconcile in the register to correct the previous reconciliation that may cause why the balance is not matching. Here's how:

On the other hand, if it's your first time to reconcile your account, we'll need to review the opening balance if it's correct. This article provides complete steps on how to correct the opening balance to start with your first reconciliation. Then, make sure that the bank register in QB is the same as your actual bank account statement.

Lastly, you may need these articles for additional reference in fixing reconciliation in the Online product:

I'd like to know how you get on after trying the steps. If you still need a hand with this, please don't hesitate to let me know by commenting below. Take care and stay safe.

Sorry guys,

We are going anywhere here.

There is no perfect transaction stating $78.58....

The $78.58 is probably a cumulative mistake caused for those who doesnt know how to use the tool Quickbooks. (not a user friendly by the way). Every mistake in QB becomes a snowball effect.

All my transactions are reconciled and still a difference of $78.58 between QB and my bank account.

What I want is just to create a transaction (whitout matching the bank) and bring the balance to what I have in the bank.

I dont care if the reports will be short by this amount ($78.58). I just need to re-start fresh from now on.

Anyone can help me here?

My situation at the moment

All transactions cleared and reconciled up to 10/9/20

Hi there, ricardo7.

I'm joining this thread so I can share additional details on how we can resolve the $78.58 difference.

It's best to check first the cause of the discrepancy. It could be that there is a transaction that was deleted after you reconciled it. If this is the reason, the system will prompt you about a discrepancy in your account.

You can follow these steps:

From there, you'll see the transaction, when it was deleted or changed, and who did it. For deleted transactions, you'll need to manually re-enter it and do a mini-reconciliation to fix it. Just follow the steps shared by SarahannC above.

You can also create a sales receipt worth $78.58, then we can manually reconciled it. Before doing so, make sure that there's no duplicate transaction.

Here are some of the articles you'll want to check for more details:

I'll be here if you need anything else. Stay safe!

Hi,

The idea of creating a sales receipt worked very well for me.

I know this band-aid solution is not the right one, but I've created an item that wont impact my inventory (service created), and at least I can keep the ball rolling and dont accumulate things.

I issue invoices everyday and dont have an accountant/bookkeeper dedicated, so mistakes like this happens from time to time.

Now I can tell the accountant more about the $78.58 and he will tell me how the reports can be fixed.

I have one final question that will impact my reports as well, and I need a shed of light from you:

My last BAS payment is showing $11580, but trully I got some money back from government due to incentive during COVID-19.

How do I "retire" the $11580 on my JAN to MAR BAS payment since there will be no banking transaction to match? The money I got from government was a type of discount (not cash in my banking account). How do I make QB understand there will be no transaction to match without creating any kind of duplication?

Regards

Ricardo

Hi ricardo7,

Just to double check the 'discount' you mentioned from the ATO will or won't appear on your bank feed in anyway? You mentioned a concern of a duplication of the transaction.

If you prefer, you can always contact us by clicking here so one of our friendly support staff can go through steps with you to resolve this. Bare in mind we are not trained accountants and can only show you work around's we would not be able to advise what is correct or incorrect for you books. I'd encourage you to reach out to an accountant if you feel the work around does not suit your business.

-Steven

Yes, you are right Steven.

The discount applied was given in the background by the ATO and it will never appear in my banking account.

If I record the full payment ($11580_, the balance will be subtracted in QB, but not in the banking account, and then I will drag this mistake forever.

How do I "archive" the $11580 and keep the QB balance and banking account matching?

Regards

Ricardo

There is always the option to record the GST Payment to another account other than the Bank account. When you go to Record Payment you could select an alternative account instead and leave a note explaining the reason for recording purposes. This would make sure that the GST Payment is closed within the GST centre and the Tax accounts reflecting the changes.

Whilst we cannot advise which account to use or how to then categorize the payment, as a potential work around you could record the GST payment as an expense to a different account. Alternatively, if you wish not to use the Record Payment option within the GST Centre you can always create a Journal Entry to record the payment, you can select here for the steps.

It may be best you consult with a bookkeeper or accountant in regards to how to best 'archive' the payment with regards to balancing your books. We can provide potential work arounds but we are not trained accountants and cannot guide the outcome of the books or make judgment on the right or wrong way.

Thanks,

-Steven

Hi guys,

Any tips on how to start my invoices with the payment options box unchecked?

I prefer majority of my customers to pay via banking transfer rather then paypal or credit card

The app version is limited, so I would like to start a new invoice without the box checked.

Any ideas?

Thanks

You can sign up for a payment account, then turn on the online payment option in QuickBooks Online (QBO), @ricardo7. With this, you'll be able to create your invoices with the box unchecked and let your customers pay via bank transfer.

There are features in QBO that you need to activate using the web version. Once you have a payment account, you'll have to turn on the online payment options so you'll get to choose the method you want your customers to pay your invoices. Here's how:

After that, you can create an invoice and email it to your customers. Just make sure to select only the bank transfer option as your customer's way of paying the invoice. Once received, they can select the Pay now button in the email and pay it using the method specified.

To effectively monitor the payments you’ve received and the invoices that go with them, you can pull up the Invoices and Received Payments report. Just go to the Who owes you section in the Report menu's Standard tab.

You can use the QuickBooks mobile app to receive an invoice payment from your devices. Fro the step-by-step guide, just select the kind of mobile device you have in this article: Receive an invoice payment using the QuickBooks Online app.

Additionally, the QBO app has the flexibility and features to help you stay on top of your business. For the complete details on what you can do using it, I'd recommend checking out this article: Features of the QuickBooks Online app.

Please let me know if you have other concerns. I'm just around to help. Take care always.

Hi ,

Even following the steps, once I create the invoice, the online payment box is still checked.

If I have to do manually its ok, I can control, but the problem is the android version of the app. (it doesnt give me the option).

In summary, all invoices are starting with the box checked.

Any other idea?

Thanks

Hi,

If I chose "Plain Text" or "Online invoice", the result is the same when I create a new invoice. The payment online box is checked by default.

I need exactly the other way around. The default = box not checked

Cheers

Hi ricardo7,

If you have enabled Accept Payments with Paypal on your file, this 'online payment' box will be checked by default when creating an invoice; this is by design to give your customers the convenience of multiple payment methods (Paypal, credit card etc). You would need to uncheck it prior to sending the individual invoice if you do not wish the option to display. As you have identified, the app does have limitations when compared to the browser and one of these is the inability to uncheck the 'online payment' option when creating an invoice.

I would be happy to pass this along as feedback and would encourage you to do the same (select the main menu, then Feedback) as all customer insight is valuable and will be considered for potential inclusion in future product enhancements. In the meantime, if you are creating invoices on the go you can still log in to QBO on a mobile browser to have the option of unticking 'online payment' (see screenshot below of what this looks like). Alternatively, if you rarely use Paypal as a payment option, you can disconnect the Paypal app altogether and only connect it when you require it.

-Kass

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here